After setting up Single Touch Payroll (STP), there are some business and contact details you can update yourself.

Other details, like your ABN and Software ID, were recorded when you set up Single Touch Payroll. To update these details you'll need to go through the STP setup steps again.

Let's look at the details:

To update your business details (business name, ABN, ABN branch or address)

Go to the Payroll menu and choose Single Touch Payroll reporting.

Click the ATO settings tab.

Enter your updated details.

Click Update business details.

To update your business contact details (name, email or phone)

Go to the Payroll menu and choose Single Touch Payroll reporting.

Click the ATO settings tab.

Enter your updated details.

Click Update contact details.

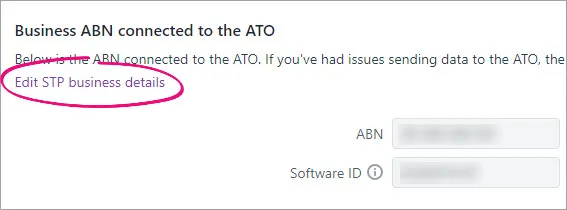

To update your business details connected to the ATO (Software ID, ABN, Agent ABN or Registered Agent Number)

Go to the Payroll menu and choose Single Touch Payroll reporting.

Click the ATO settings tab.

Click the Edit STP business details link.

At the confirmation, click Edit STP business details.

Follow the prompts to set up Single Touch Payroll again.

FAQs

What if I make a mistake in a pay run?

Mistakes happen and in MYOB they're easy to fix. Depending on what needs fixing, you might be able to adjust the employee's next pay or undo the pay and record it again.

With STP, your employees' year to date (YTD) figures are sent to the ATO after each pay run. So if changing an employee's pay affects their YTD figures, the updated figures will be sent to the ATO the next time you do a pay run.

If a pay has been accepted by the ATO and you need to undo it, you'll need to reverse the pay and report the reversal to the ATO.

For all the details on fixing pays, see Fixing a pay.

If the pay you need to change is in a payroll year that's been finalised with the ATO, see Changing a pay after finalising with Single Touch Payroll.