If you've previously used eInvoicing, you'll need to cancel your existing eInvoicing agreement with your current provider. Then follow the steps below to register again to keep sending eInvoices from MYOB.

Electronic invoicing, or eInvoicing, is a business improvement initiative to enable businesses to exchange invoices directly between their accounting software.

This means:

improved security

less manual data entry

reduced risk of human error

businesses will get paid faster.

Currently, eInvoicing is mainly for businesses whose customers include government agencies and some large businesses, but the network of businesses is growing.

eInvoicing is supported by the Australian and New Zealand governments due to its business and economic benefits. To learn more about what's behind the eInvoicing initiative, check these government websites: Australia | New Zealand

MYOB Business is recognised by the government as an eInvoicing-ready product: Australia | New Zealand

As well as sending eInvoices from MYOB to customers who are able to receive eInvoices, you are now able to receive supplier eInvoices yourself straight into MYOB.

How does eInvoicing work?

Different accounting software systems don't typically talk to each other, so eInvoicing is made possible via a standardised protocol. This means both you and your customer need to be registered to send and receive eInvoices. Once you're registered, you can send the customer an eInvoice straight from MYOB and it'll be delivered into their accounting software, regardless of the solution they are using. No paper, no emails—just sent straight from your software into theirs.

You'll also be able to track the status of the eInvoices you've sent so you'll know when they've been received, approved for payment, or if anything went wrong.

Who can use eInvoicing

If you use MYOB Business or you access your online AccountRight company file in a web browser, you can register to use eInvoicing.

If you're an AccountRight desktop user, you need to have an online company file to be able to use eInvoicing. You can then register for eInvoicing when you access your company file in a web browser.

Any MYOB user can set up eInvoicing. Once you're set up, anyone who can currently create invoices in MYOB will be able to send eInvoices from MYOB and track their statuses

If you've previously used eInvoicing, you'll need to cancel your existing eInvoicing agreement with your current provider. Then follow the steps below to register again to keep sending eInvoices from MYOB.

Register for eInvoicing

In MYOB, click your business name and choose Sales settings.

Click the E-invoicing tab.

Read the displayed information, or watch the video, about e-invoicing. When you're ready, click Get started.

Enter your business details.

Agree to the terms and conditions.

Click Register for eInvoicing

After you're registered

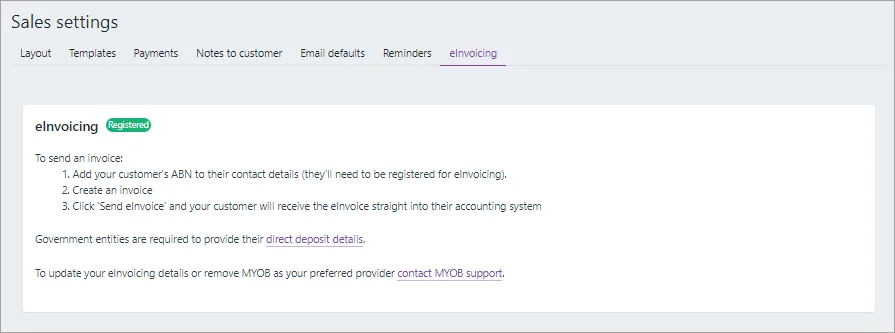

Once you've completed your registration, you'll see this indicated in your MYOB sales settings (business name > Sales settings > eInvoicing tab).

If you are a government entity, click the direct deposit details link on the Sales settings > eInvoicing tab and complete your direct deposit details.

Send an eInvoice

Before sending an eInvoice, contact your customer to check if they're able to receive eInvoices into their software. You can also visit the Peppol Directory and search for them. If they have a registration date, they're registered to receive eInvoices.

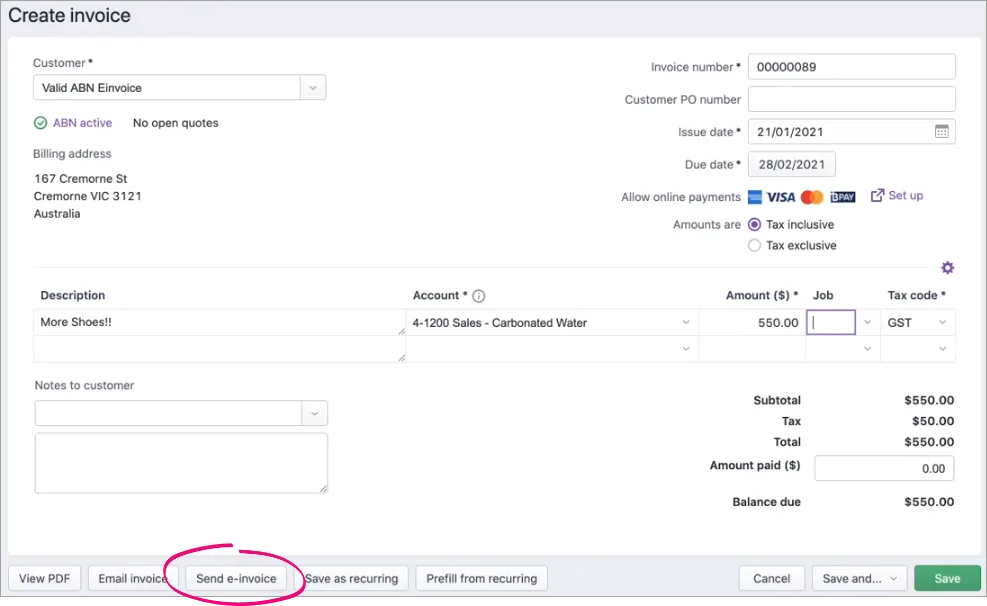

Once you're registered for eInvoicing, you'll see a new Send eInvoice button in your invoices.

Create the invoice as you normally would (need a refresher?).

The invoice customer must have a valid ABN and you must complete the invoice Description to be able to send an invoice as an eInvoice.

If applicable, enter a Customer PO number and any additional reference numbers — see the FAQ below.

Click Send eInvoice. If you can't see this button, make sure you've registered for eInvoicing as described above. If you have previously used eInvoicing and can't see the Send eInvoice button, you'll need to re-register.

At the Send eInvoice confirmation:

Check the summary of the eInvoice you're sending.

(Optional) Attach any supporting documents by dragging them onto the Send eInvoice screen or clicking browse for files to select them. Supported file types are PDF, JPG, PNG, XLSX, CSV. Note that a PDF of the invoice will automatically be attached when you send the eInvoice.

(Optional) If you don't want to use the default invoice template for the PDF that'll be attached to the eInvoice, choose a different Invoice template. Click Preview PDF to see what the PDF invoice will look like with your chosen template. Learn more about sales templates.

Click Send eInvoice.

The invoice is sent, with a PDF of the invoice attached, and you'll see it listed on your Invoices page (Sales menu > Invoices). See below for more details on eInvoice statuses.

Need to resend an eInvoice? Easily done. Sales menu > Invoices > click to open the invoice > make any required changes > Send eInvoice.

Check the status of sent eInvoices

The status of eInvoices that you send will be shown on the Invoices page in MYOB. These statuses are sent from your customer's accounting software via their eInvoice provider.

You can check the status of sent eInvoices in a couple of places:

the Activity column on the Invoices page (Sales menu > Invoices)

the Activity history at the bottom of the invoice (Sales menu > Invoices > click to open the invoice). The activity history shows the current status and each previous status. If available, you can click More details for additional information for a status.

Here's a list of eInvoice statuses you might receive from the customer's accounting software. Depending on the customer's accounting software and their eInvoice provider, some of these statuses might not be applicable.

Status | Definition |

|---|---|

Acknowledged | The customer has acknowledged that you've sent an eInvoice. |

Accepted | The customer has accepted the eInvoice (given it final approval at their end) and their next step is payment. |

Rejected | The customer has rejected the eInvoice and they won't process it any further. This might be a problem in their accounting software or they have an issue with the invoice details. Click More details in the Activity history on the invoice for additional information. |

In process | The eInvoice is being processed in the customer's accounting software. |

Under query | The customer has stopped processing the eInvoice pending a response to a query. This means the customer won't accept the eInvoice until they receive the additional information from you. Click More details in the Activity history on the invoice for additional information. |

Conditionally accepted | The customer has accepted the eInvoice under certain conditions, and they'll proceed to pay unless you dispute the conditions. Click More details in the Activity history on the invoice for additional information. |

Paid | The customer has initiated full payment of the eInvoice. |

Part paid | The customer has initiated a partial payment of the eInvoice and has the intention of paying the balance later. |

You can now receive eInvoices from suppliers straight into your In tray – see Receiving eInvoices.

FAQs

Are there extra costs for using eInvoicing?

No, eInvoicing in MYOB Business is included in your MYOB subscription.

How can I check if a customer is registered to receive eInvoices?

You can ask them or visit the Peppol Directory and search for them. If they have a registration date, they're registered to receive eInvoices:

Why hasn't a customer received an eInvoice that shows 'eInvoice sent' in its activity?

The customer may not be registered for eInvoicing. Businesses must register to be able to receive eInvoices and invoice responses. You can check the Peppol Directory to see if they are registered to receive eInvoices.

If the customer is registered to receive eInvoices and passed Peppol validation but still not receiving your eInvoice there may be a rounding issue in the amounts of the invoice.

You may be able to fix this by changing the tax settings in the eInvoice.

If the eInvoice amount is Tax inclusive, try changing it to Tax exclusive and send it again.

Will it become mandatory to use eInvoicing?

eInvoicing is mandatory for many government agencies. To find out the latest requirements for businesses, visit your government's website: Australia | New Zealand.

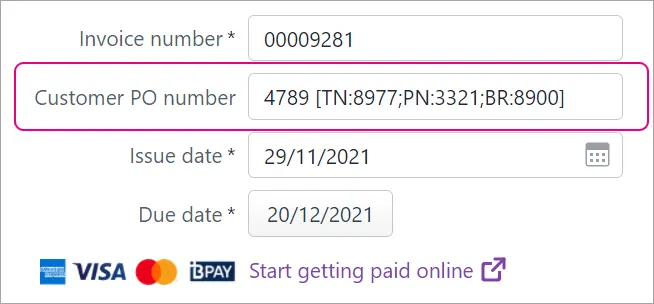

How do I enter additional reference numbers for eInvoicing?

ou can use the Customer PO number field to enter additional reference numbers for eInvoicing. When entering these numbers, use the relevant prefix:

Reference number | Prefix |

|---|---|

Tender Reference Number | TN: |

Project Reference Number | PN: |

Contract Reference Number | CN: |

Buyer Reference Number | BR: |

If you have a customer PO number, enter that first then enclose any additional reference numbers in square brackets [ ] and separate each reference number by semicolons.

Here's an example showing the Customer PO number, followed by a Tender Reference, Project Reference and Buyer Reference:

What if I’m registered with another eInvoicing service provider?

To be able to use eInvoicing in MYOB, you’ll need to contact your current service provider and cancel your eInvoicing agreement with them.

You can then register for eInvoicing through your MYOB software, following the steps in ‘Register for invoicing’, above.

If you’re not sure who your current eInvoicing provider is or you need their contact information, visit these eInvoicing government websites: AU | NZ.

How do I cancel my eInvoicing registration?

If you need to cancel you MYOB eInvoicing registration (for example, so you can register with a different provider), contact MYOB support.