The New Zealand Government has some business support payments to help pay staff during the COVID-19 pandemic.

For details of available payments and eligibility criteria, visit business.govt.nz

If your business is eligible for any wage subsidy payments, we recommend setting up a COVID-19 pay code to make those payments to the affected employees.

Create a new pay code

- Go to the Maintenance command centre and click Maintain Pay Codes.

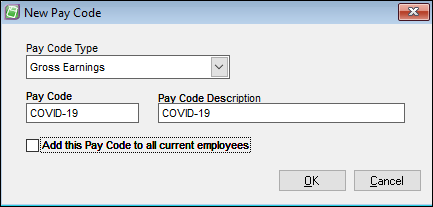

- Click New. The New Pay Code window appears.

- In the Pay Code Type field, choose Gross Earnings.

- Enter COVID-19 in the Pay Code and Description fields.

- If you're applying the COVID 19 subsidy to all employees, select Add this Pay Code to all current employees.

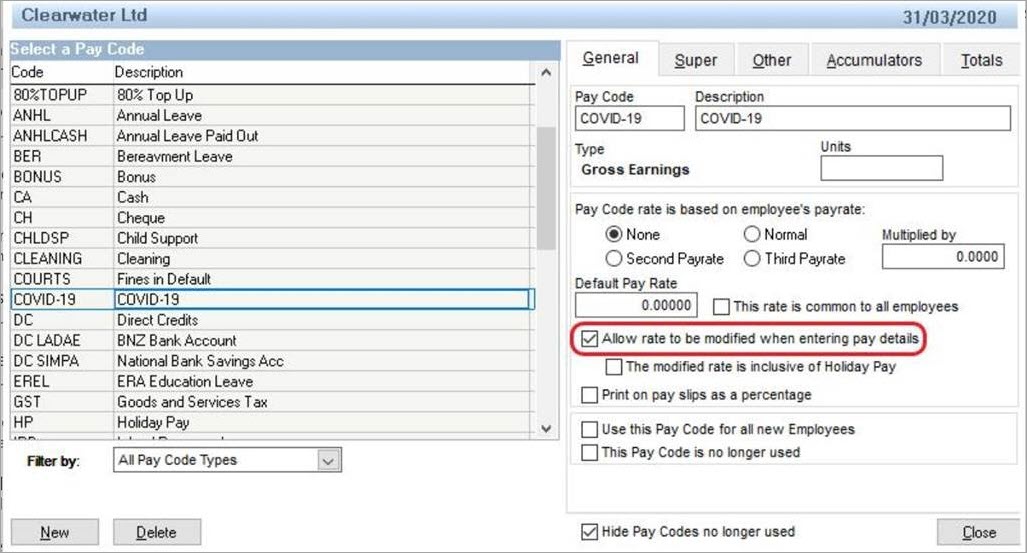

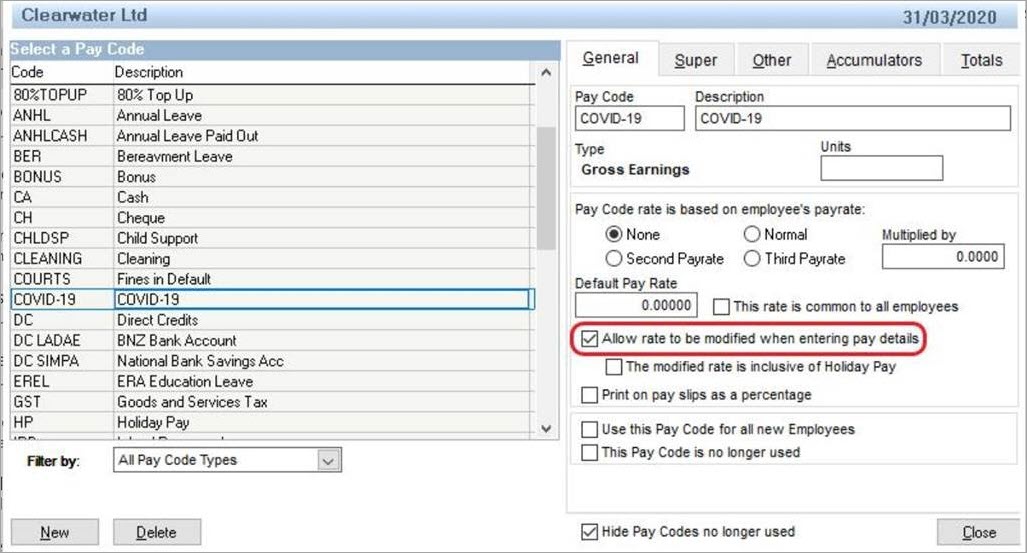

Here's the pay code example:

- Click OK.

Click the new COVID-19 pay code.

On the General tab, select the option Allow rate to be modified when entering pay details.

- Click Close.

- In the Maintenance command centre, click Maintain Employees.

- Click Select Employee.

- Select an employee who'll receive the subsidy and click OK.

- Click the Pay Defaults/Totals tab.

- Click New.

Select the COVID-19 pay code and click OK.

- Repeat from step 10 for all employees eligible for the COVID 19 subsidy.

- Click Close.

Process the pay

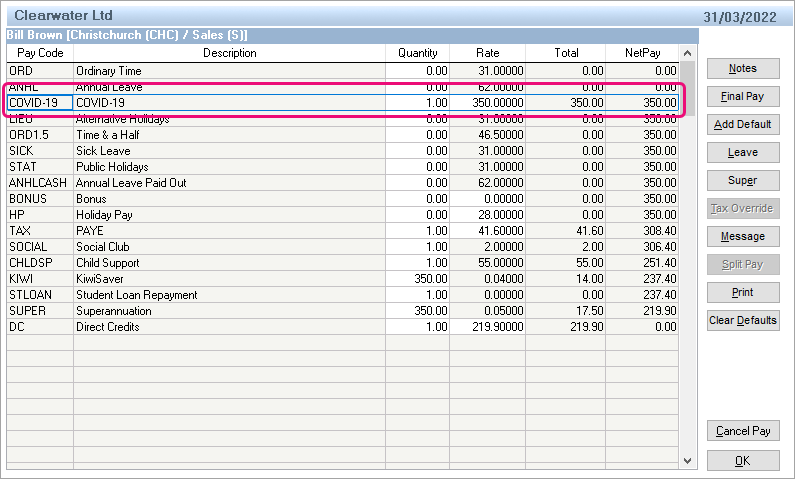

Go to the Prepare Pays command centre and click Enter Pays.

Select the employee.

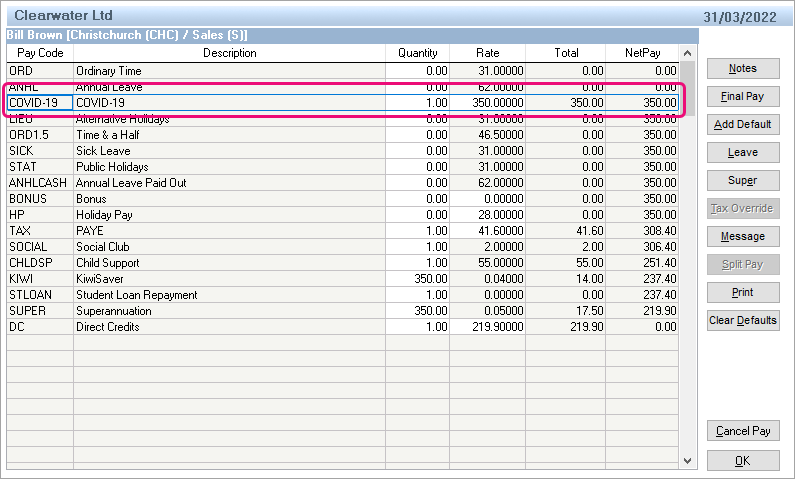

- Enter 1 in the Quantity column and the subsidy amount in the Rate column.

Here's an example of a $350 subsidy payment:

Process the rest of the pay as normal.