Filing to the IRD

ANSWER ID:22973

The latest versions of MYOB Payroll can produce files for reporting to the IRD using ir-File.

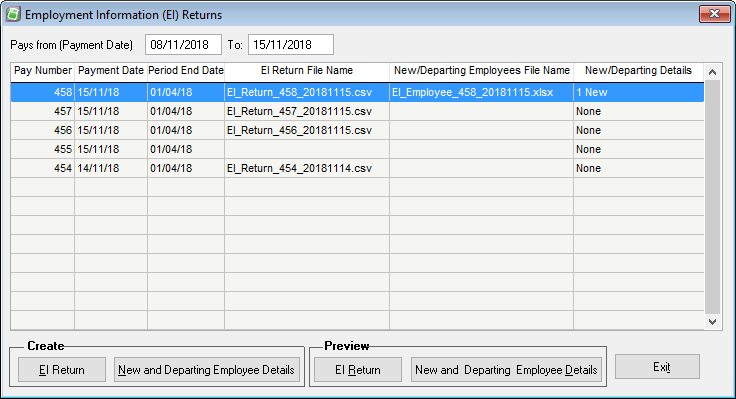

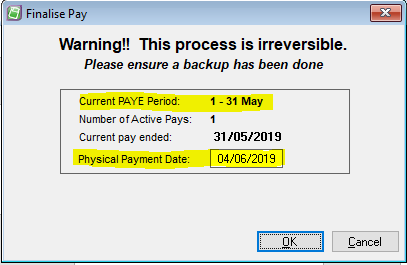

From 1 April 2019, payday filing is compulsory. Payday filing is a new way of reporting employee pay details to the IRD: instead of sending an Employer Monthly Schedule (IR348) every month, under payday filing you generate and send an Employment Information (EI) return file for every pay run. The EI return file contains the same information as the IR348, as well as ESCT amounts for each employee and dates for the pay run. Information about new and departing employees is also sent to the IRD in a New and Departing Employees file.

This page explains how to generate the required return files for payday filing to the IRD. These include:

- your Employer Superannuation Contribution Tax (ESCT),

- the Employer Monthly Schedule (EMS/IR348), and

- the Employer Deductions Remittance Advice (EDF/IR345).

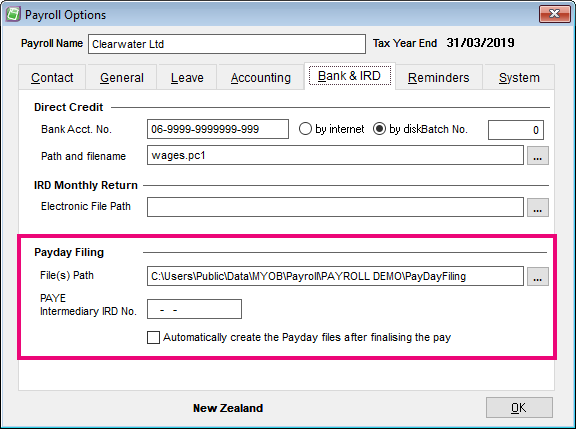

Payday filing

Before you can upload EI return files, you need to be registered for filing using the IRD's myIR website. If you currently file your IR348 returns electronically, you will be registered already—if not, you will need to go to the IRD website and register. The IRD's website has information on registering for myIR.

Once you are registered for myIR, you can opt in to payday filing from the myIR website—the IRD's website has information on shifting to payday filing.