- Created by MichelleQ, last modified by AdrianC on Jan 17, 2023

https://help.myob.com/wiki/x/vqzMAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

A declarer is someone who can send your business's payroll information to the ATO after each pay run. This might be a payroll officer or a tax or BAS agent.

Whoever set up Single Touch Payroll (STP) for your business will be able to send payroll information to the ATO, but additional people who need to send payroll information must add themselves as declarers.

- Set up STP in your AccountRight company file

- Add the declarer as a user in AccountRight (see Invite a user or Invite your accountant)

Which steps do I follow?

How you add a declarer depends on whether you're set up for STP Phase 1 or STP Phase 2. If you set up STP after mid-December 2021, you're likely on STP Phase 2.

The easiest way to check is to look in one of your wage categories:

- Sign in to your company file and go to the Payroll command centre > Payroll Categories.

- Click the zoom arrow

to open a wage category.

to open a wage category. - Check how many ATO Reporting Category fields there are.

- If there are two ATO Reporting Category fields (and a message about "STP Phase 2 is coming", you're on STP Phase 1 — which is fine!

- If there's only one ATO Reporting Category field, your file is set up for STP Phase 2.

Add a declarer

If your company file is set up on STP Phase 1, the new declarer must complete these steps. How do I get ready for STP Phase 2?

- Sign in to your company file and go to the Payroll command centre > Payroll Reporting.

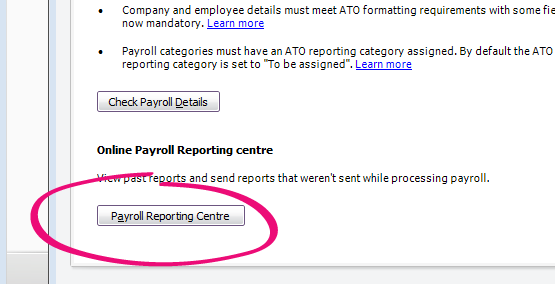

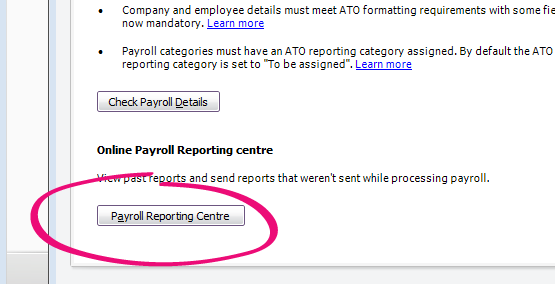

Click Payroll Reporting Centre.

If this button says Connect to ATO, the company file hasn't been set up for Single Touch Payroll.

If prompted, sign in to your MYOB account. The Set up Payroll reporting: Connect to ATO window appears.

If the Payroll Reporting window is displayed, it means you're signed in to AccountRight as a user who's already added as a declarer.- At the Overview step, click Start. If you don't see the Overview step, it means you're signed in as a user who is already an STP declarer.

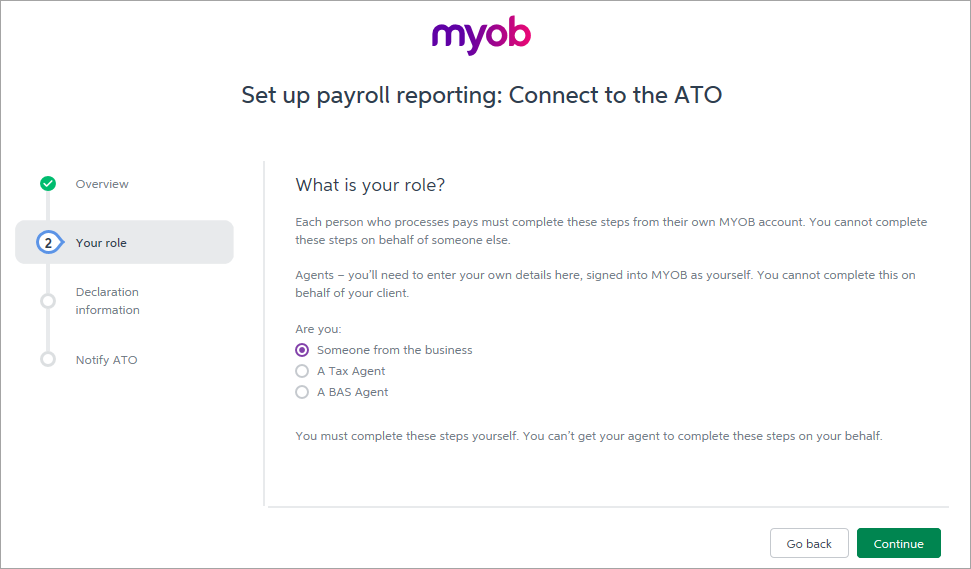

Select your role:

Someone from the business

Someone from the businessSelect Someone from the business.

Click Continue.

If prompted, at the Declaration information step, enter the company’s ABN and your personal details. This is sent to the ATO with the payroll information. Then click Continue.

At the Notify the ATO step, click I’ve notified the ATO. When prompted, confirm by clicking I've notified the ATO again.

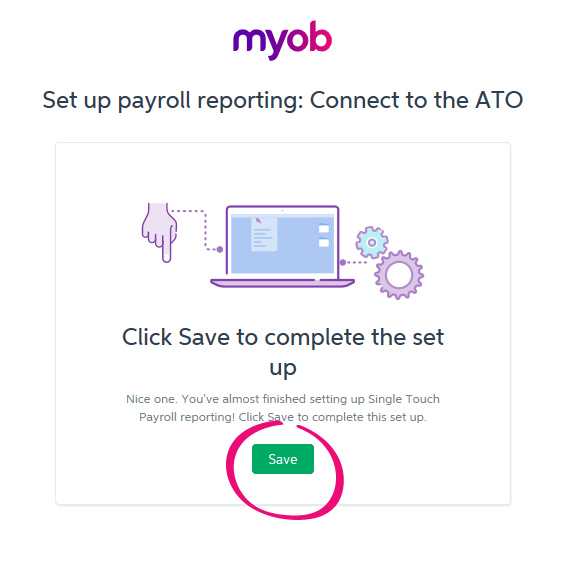

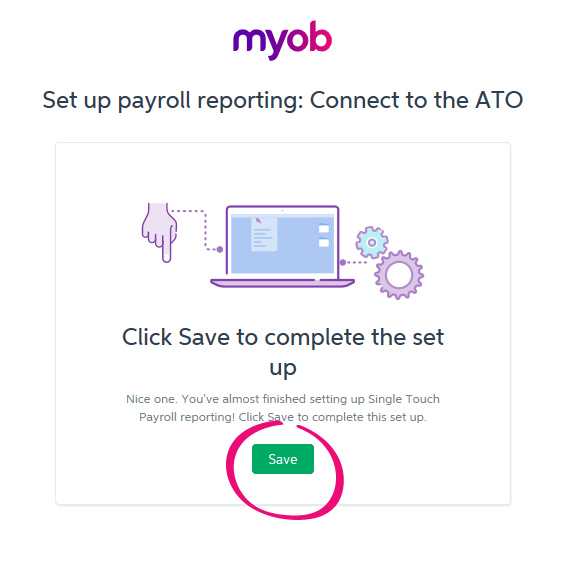

Only one person from the business needs to notify the ATO. If your company is already using STP, additional declarers don't need to do this step.- Click Save to finish.

A Tax / BAS AgentTax and BAS agents will need to provide their Agent ABN and Registered agent number.

Select A Tax Agent or A BAS Agent

Click Continue.

- If prompted, at the Declaration information step, enter the company’s ABN and your personal details. This is sent to the ATO with the payroll information. Then click Continue.

Notify the ATO you're using MYOB for Single Touch Payroll reporting.

You’ll need to enter your own details here, signed into MYOB as yourself. You cannot complete this on behalf of your client.

When you've notified click I’ve notified the ATO. When prompted, confirm by clicking I've notified the ATO again.

Click Save to finish.

You're now able to submit information to the ATO after a pay run. Find out what happens after I've set up Single Touch Payroll.

Online company files only

The following steps need to be completed by the new declarer.

- Sign in to your online company file and go to the Payroll command centre > Payroll Reporting.

Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

At the Overview step, click Next. If you don't see the Overview step, it means you're signed in as a user who is already an STP declarer.

Select your role:

Someone from the businessSelect Someone from the business.

Click Next.

If prompted, at the Declaration information step, enter the company’s ABN and your personal details. This is sent to the ATO with the payroll information. Then click Next.

At the Notify the ATO step, click I’ve notified the ATO. When prompted, click Confirm.

Only one person from the business needs to notify the ATO. If your company is already using STP, additional declarers don't need to do this step.What you do at the Transferring BMS ID step depends on whether Yes or No was selected by the person who set up STP for the business.

If No is selected Click Next. If Yes is selected - Click Report previous BMS ID.

- When prompted to send your payroll information to the ATO, enter your details and click Send.

And that's it — you're done! You're now able to submit information to the ATO after processing your payroll.

A Tax / BAS Agent- Select either A tax agent or A BAS agent

- Enter your Agent ABN and Registered Agent Number.

- Click Search to find your contact details – if you can't find these, you'll need to add them. Click Continue.

- Enter your declarer information, including the business's ABN, your name and contact details and click Continue.

- At the Add clients step, add this business to your client list in the Online Services for Agents (skip this step if they're already on your client list).

Click I've added this client.

At the Declaration information step, you need to let the ATO you're using MYOB for payroll reporting.

- Get the Software ID. This is unique to you and you can't share it – each client and agent will have their own . If you use the wrong Software ID, the ATO will reject your reports.

Choose how you want to notify the ATO that you're using MYOB for payroll reporting.

Option 1. Phone the ATO on 1300 85 22 32

This only takes a few minutes. You'll need your own TFN, ABN or RAN (for agents) handy, to verify your identity.

- Follow the prompts and provide your unique Software ID and MYOB details when requested. This information is generated in MYOB and displayed in the page for this step.

- Once confirmed, click I've notified the ATO.

Option 2. Create notification in Access Manager

If you have an Access Manager you can notify the ATO online. You can also create an Access Manager account.

Detailed instructions: Notifying us of a hosted SBR software service (ATO website).

- Log into Access Manager.

- Click My hosted SBR software services from the left hand menu.

- Click Notify the ATO of your hosted service.

- Complete all steps with the unique Software ID and MYOB details.

- Once confirmed, click I've notified the ATO.

Once you've notified the ATO that you're using MYOB software, click I've notified the ATO and in the message that appears, click Confirm.

What you do at the Transferring BMS ID step depends on whether Yes or No was selected by the person who set up STP for the business.

If No is selected Click Next. If Yes is selected - Click Report previous BMS ID.

- When prompted to send your payroll information to the ATO, enter your details and click Send.

And that's it — you're done! You're now able to submit information to the ATO after processing your payroll.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.