| Banking transactions are typically entered using Receive Money and Spend Money, but as bank charges are usually entered when reconciling your bank account, they can be entered using the Bank Entry function from within the Reconcile Accounts window. To do this: - Go to the Banking command centre and click Reconcile Accounts.

- Select your Account and enter the Bank Statement Date.

- Click the Actions button and choose Bank Entry. The Bank and Deposit Adjustments window appears.

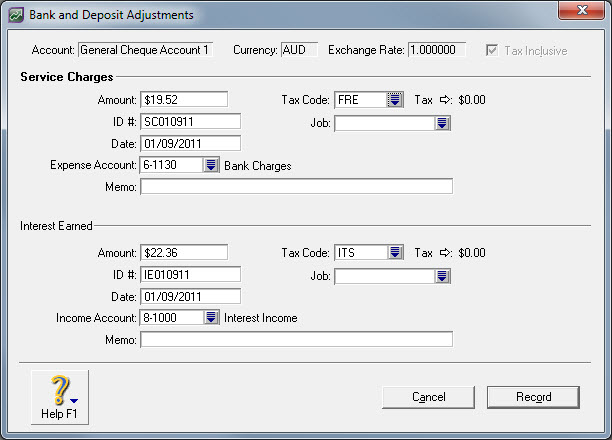

- Enter the transaction details then click Record. The window below shows an example entry.

| UI Text Box |

|---|

| | The tax/GST codes used in the example above are FRE for the bank charges and ITS for the bank interest earned. Please check with your accountant or the ATO/IRD for advice on the applicable tax/GST codes for your circumstances. |

Upon returning to the Reconcile Accounts window, you will notice that any Bank Entry transactions recorded through this window have been automatically selected as Cleared. |