| UI Text Box |

|---|

| This topic is based on information provided by Work and Income, so check their website to keep up to date, find frequently asked questions and other information. If the steps below don't suit your business needs, check with your accounting advisor. |

The New Zealand Government has announced a wage subsidy to those impacted by COVID-19. To see if your business qualifies for the subsidy, check the Work and Income website. Employers are expected to make their best efforts to retain employees and pay them a minimum of 80% of their normal income for the subsidised period. Your employees will need to pay tax on their wage subsidy payment as it’s paid to them as part of their normal wages. This means it's subject to the usual deductions, like PAYE, Student Loan, KiwiSaver and ACC. The government will pay the wage subsidy as a lump sum covering 12 weeks per employee. The amounts of the subsidy are: - $585.80 (for employees who work 20+ hours), or

- $350.00 (for employees who work less than 20 hours)

This is a Gross amount and supplemented with the employee’s wages up to 80% of what they would normally earn. To keep it clear for your employee’s and yourselves, we recommend setting up a new pay rate structure for the subsidy payment. For more information, see the NZ Government’s Employer COVID-19 wage subsidy and leave payment information sheet. | UI Text Box |

|---|

Example: An employee normally earns $1000 for a 38-hour week. Under the COVID-19 wage subsidy, the employer will now be required to pay their employee $800 per week, which is 80% of their normal wage. Of the $800 payment, $585.80 will consist of the government subsidy. |

To track this in Ace Payroll, set up a COVID-19 pay rate structure. OK, let's step you through it. | UI Expand |

|---|

| title | To set up a COVID-19 pay rate structure |

|---|

| To set up a COVID-19 pay rate structure- From the front screen click Setup, then Company Defaults.

- Click Pay Rate Structure.

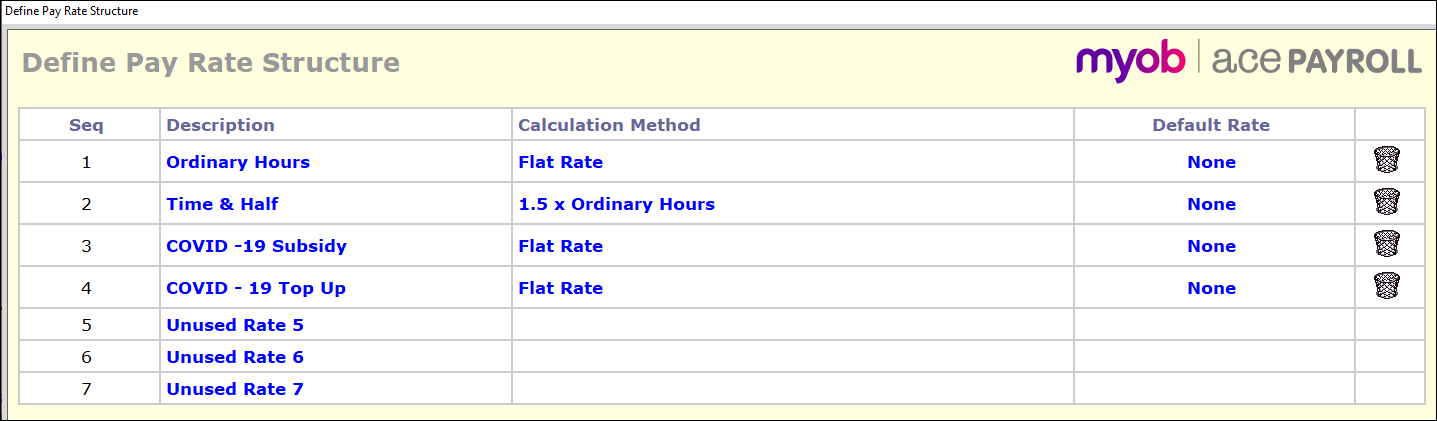

- In the Define Pay Rate Structure window, click an Unused Rate and add a description such as 'COVID - 19 Subsidy'.

- Click GO. The Define Pay Rate Structure window reappears with the 'COVID - 19 Subsidy' pay structure.

- (Optional) If you are going to top up the employee's pay to the 80% level (or to a level in any other agreement you have), repeat steps 3 and 4 to enter a top-up pay rate structure.

- Click GO.

|

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | How do I calculate 80% of the wage of an employee who works variable hours? |

|---|

| How do I calculate 80% of the wage of an employee who works variable hours?If an employee works varying hours, you can estimate the 80% figure. For example, if they worked: - varied hours all the time or are casuals, average their last 52 weeks of earnings, then take 80% of this amount

- regular overtime, look at their last 4 weeks’ pay and calculate 80% of that.

If an employee worked only part of the year, average the hours worked during their total employment period. This will determine whether they are eligible for the greater than 20 hours or less than 20 hours subsidy rate. Note that employees are only eligible for the subsidy if they are employed at the time the employer applies for it and would have been expected to work during the time the employer will receive the wage subsidy. See the Work and Income website for more information. |

|