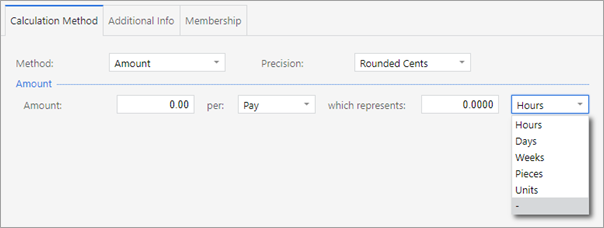

On the Calculation Method tab, you can choose one of three options for the Method field:methods for calculating a pay item: Amount, Rated or Percent Of. AmountThe Amount method is best for fixed dollar amounts. If you want to use an amount-based pay item for multiple employees and for different pay groups, leave the Amount and which represents fields blank.

RatedThe Rated method is best for a pay item that's paid in units. You can either use the employee's wage rate or a custom rate. For example, to calculate overtime, you could select Use Employee's Rate, then use the Rate Multiplier field to apply a time-and-a-half or double time amount. For the Units section, you have two options. The Entered option lets you set a default number of units as Hours, Days, Pieces or Units. The Derived option gets its units from other pay items, like wages and salary.

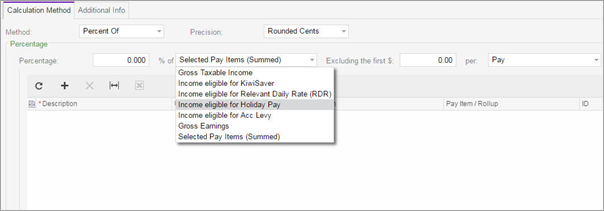

Percent OfThe Percent Of method lets you select how much of a pay item's value will be included in a pay. For example, you could use this method for a casual employee who should be paid 8% of gross earnings every pay period.

|