Time off in lieu (TOIL) is a type of leave that isn't specifically covered by the Holidays Act 2003. Prior to the Holidays Act 2003, days accrued for working on a public holiday were known as "day in lieu" or "lieu time". But since the implementation of the Holidays Act 2003, they're now known as Alternative Leave. When an employee works extra hours, they can either be paid overtime or they can take the equivalent time off at a later date. This often depends on company policy. In a company, this is sometimes done informally, and at other times it's managed quite formally. To set up time in lieu in MYOB Advanced People, you need to do two things: First, create This page explains all the steps to paying time off in lieu: expandtitleTo create an entitlement | To learn more about how entitlements work in MYOB Advanced People, check out our support article about creating an entitlement. |

how entitlements work pay items in MYOB Advanced People, check out our support article |

on creating an entitlement.- Adding the pay items to an employee's pay details.

- Paying time off in lieu in a current pay.

| UI Expand |

|---|

| title | To create an entitlement for time off in lieu |

|---|

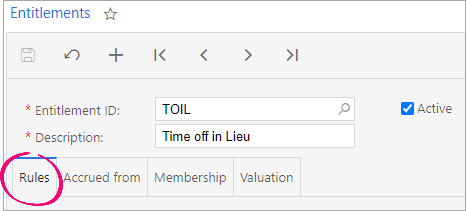

| - Go to the Entitlements screen (MPPP3300).

- On the toolbar, click the Add New Record plus icon (

). ). - In the Entitlement ID field, enter

TOIL. - In the Description field, enter

Time off in Lieu. - Click the Rules tab.

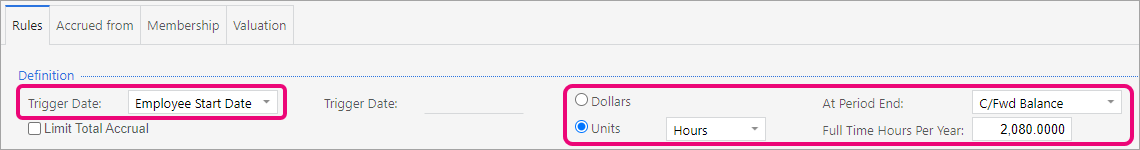

- In the Definition section:

- From the Trigger Date dropdown, select Employee Start Date.

- Select the Units option.

- From the Units dropdown, select Hours.

- From the At Period End dropdown, select C/Fwd Balance.

- In the Full Time Hours Per Year field, enter

2080.

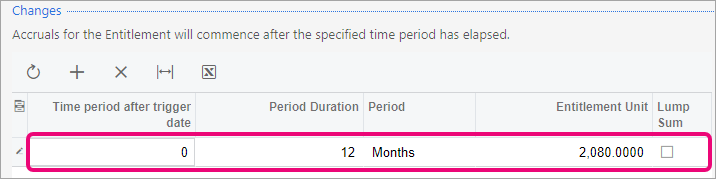

- In the Changes section:

- Click the Add Row plus icon (

). ). - In the Period Duration field, enter

12. - In the Entitlement Unit field, enter

2080.

- In the Properties section:

- Select the Leave option.

- Select the Entitlement may be paid/taken in advance option.

On the toolbar, click save the entitlement by clicking the Save icon ( ). ). | UI Text Box |

|---|

| Completing information When following the procedure for creating the TOIL calculation pay item, you'll come back to this entitlement to edit settings on the Accrued from tab is part of the next procedure. |

|

| UI Expand |

|---|

| title | To create three pay items for time in lieu |

|---|

| The next step is to setup 3 different pay items:- TOIL Accrual - Needs to be Accrued Pro Rata

Image Removed Image Removed - TOIL Taken

Image Removed Image Removed - TOIL Calculation - this pay item will ensure that this is not paid in the pay that TOIL is accrued and that it doesn't show on the payslip.

Image Removed Image Removed

Image Removed Image Removed

Update the "Accrued from" field in the TOIL entitlement and set it to accrue from TOIL Calculation. | - Go to the Pay Items screen (MPPP2210).

- On the toolbar, click the New Pay Item plus icon (

Image Added). Image Added). - In the Description field, enter

TOIL Taken. - In the Payslip label field, enter

TOIL Taken. - In the Type field, enter

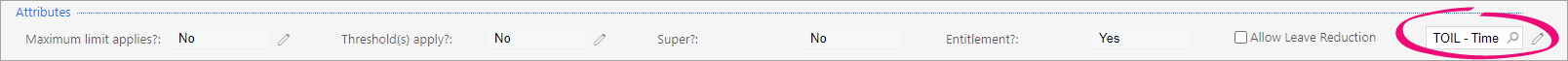

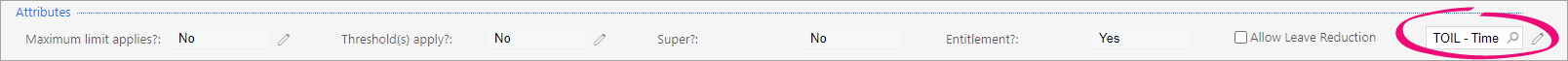

ENTITLEMENT PAYMENT. - In the Attributes section, in the search field, enter the entitlement you created for time off in lieu.

Image Added Image Added - Click the Calculation Method tab.

- From the Method dropdown, select Rated.

- Click the Additional Info tab.

In the Analysis section, complete the General Ledger Purpose field. | UI Text Box |

|---|

| The typical practice is to journal the leave accrual (debit the expense, credit the liability account). That way, when leave is paid out, it will debit the liability account instead of the expense account. The termination workflow uses whichever general purpose you choose, it'll be used by the termination workflow |

On the toolbar, save the pay item by clicking the Save icon ( Image Added). Image Added).

|

| UI Expand |

|---|

| title | To create the TOIL calculation pay item |

|---|

| - Go to the Pay Items screen (MPPP2210).

- On the toolbar, click the New Pay Item plus icon (

Image Added). Image Added). - In the Description field, enter

TOIL Calculation. - In the Payslip label field, enter

TOIL Calculation. - In the Type field, enter

INCOME. - Click the Calculation Method tab.

- From the Method dropdown, select Rated.

- Click the Additional Info tab.

- In the Override Value section:

- Select the Standard Pay option.

- Select the Current Pay option.

In the Analysis section, complete the General Ledger Purpose field. | UI Text Box |

|---|

| The typical practice is to journal the leave accrual (debit the expense, credit the liability account). That way, when leave is paid out, it will debit the liability account instead of the expense account. The termination workflow uses whichever general purpose you choose, it'll be used by the termination workflow |

On the toolbar, save the pay item by clicking the Save icon ( Image Added). You can now add this pay item to the time off in lieu entitlement. Image Added). You can now add this pay item to the time off in lieu entitlement. | UI Expand |

|---|

| title | To add the TOIL calculation pay item to the TOIL entitlement |

|---|

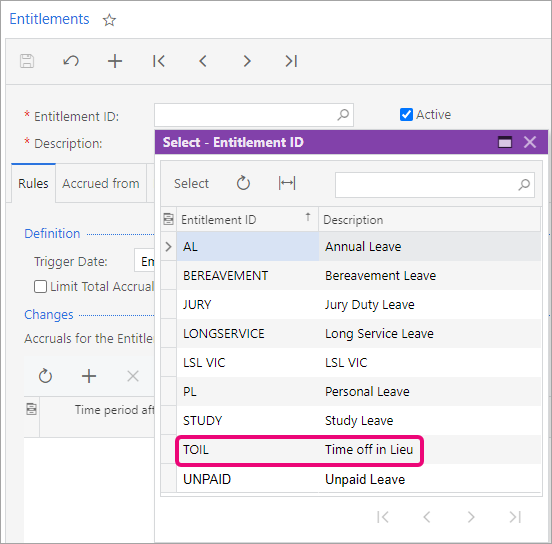

| - Go to the Entitlements screen (MPPP3300).

- In the Entitlement ID field, click the magnifying glass icon (

Image Added). Image Added). - In the Select - Entitlement ID window, select the time off in lieu entitlement.

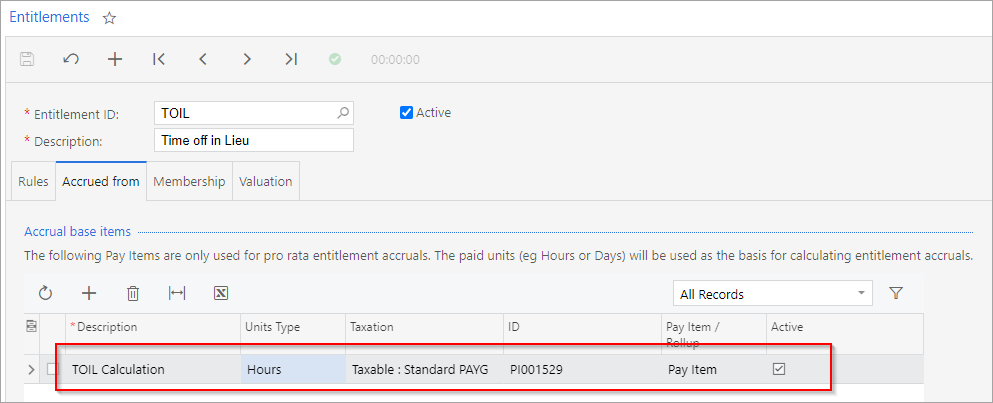

Image Added Image Added - Click the Accrued from tab.

- In the Accrual base items section, click the Add Row plus icon (

Image Added). Image Added). - In the new row, add the details of the TOIL Calculation pay item.

Image Added Image Added - On the toolbar, save the entitlement by clicking the Save icon (

Image Added). Image Added).

|

|

| UI Expand |

|---|

| title | To create the TOIL accrual pay item |

|---|

| - Go to the Pay Items screen (MPPP2210).

- On the toolbar, click the New Pay Item plus icon (

Image Added). Image Added). - In the Description field, enter

TOIL Accrual. - In the Payslip label field, enter

TOIL Accrual. - In the Type field, enter

ENTITLEMENT ACCRUAL. - In the Attributes section, in the search field, enter the entitlement you created for time off in lieu.

Image Added Image Added - Click the Calculation Method tab.

- From the Accrual Method dropdown, select Accrued Pro rata.

- Click the Additional info tab.

In the Analysis section, complete the General Ledger Purpose field. | UI Text Box |

|---|

| Update the Pay item liabilities as required. |

Image Removed Image Removed

Add all 3 items to the employee's standard pay details.  Image Removed Image Removed

- Enter the Hours of Time in Lieu the employee has accumulated in the Quantity column against the TOIL Calculation pay item in the Current Pay.

Image Removed Image Removed - The balance is shown in the Entitlement Balances report and can be paid at a later date using the TOIL Taken pay item in the current pay.

Image Removed Image Removed The typical practice is to journal the leave accrual (debit the expense, credit the liability account). That way, when leave is paid out, it will debit the liability account instead of the expense account. The termination workflow uses whichever general purpose you choose, it'll be used by the termination workflow |

On the toolbar, save the pay item by clicking the Save icon ( Image Added). Image Added).

|

| UI Expand |

|---|

| title | To add TOIL pay items to an employee's pay details |

|---|

| - Go to the Pay Details screen (MPPP2310).

- In the Employee ID field, select an employee who you want to pay time off in lieu.

- On the Standard Pay tab, click the Add Row plus icon (

Image Added). Image Added). - In the new row, in the Pay Item column, select one of the time off in lieu pay items you created.

- Repeats steps 3–4 for each pay item.

- On the toolbar, save the employee's pay details by clicking the Save icon (

Image Added). Image Added).

|

| UI Expand |

|---|

| title | To pay time off in lieu |

|---|

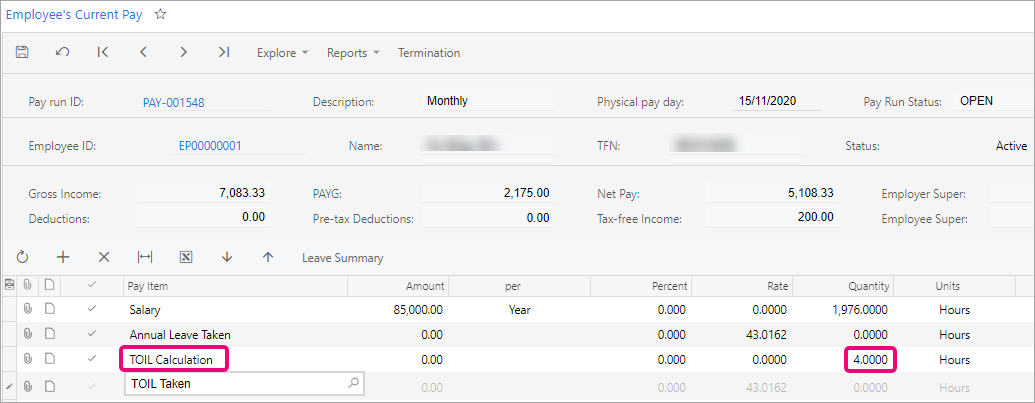

| - Go to the Manage Pays screen (MPPP4110).

- From the list of pay runs, click the Pay run ID of the one you want to open.

Click the name of the employee you want to pay time off in lieu. The Employee’s Current Pay screen opens. In the TOIL Calculation row, in the Quantity field, enter the number of hours of time off in lieu that the employee has accumulated. | UI Text Box |

|---|

| To view an employee's entitlement balances, go to the employee's Pay Details screen (MPPP2310) and click the Entitlement Balances tab. |

Image Added Image Added

- On the toolbar, save the employee's current pay by clicking the Save icon (

Image Added). Image Added).

|

|