ANSWER ID:9068In your software, a bank account typically represents an asset account (for money coming in), and a credit card account typically represents a liability account (for money being paid out). These accounts can be used in your software for recording customer or supplier payments. This support note explains how to set up and use these accounts in AccountRight. For details on setting up accounts see the AccountRight help (Australia | New Zealand). Once your accounts are created you can enter their opening balances as described in the AccountRight help (Australia | New Zealand). | UI Expand |

|---|

| title | Using a bank or credit card account |

|---|

| - Open Receive Money or Receive Payments.

- Click the Deposit to Account option then select the desired chequebook or credit card account in the adjacent Account field.

- Enter the transaction details as required then click Record. The window below shows asset (bank) account number 1-1110 selected for an example Receive Money transaction.

Image Modified Image Modified

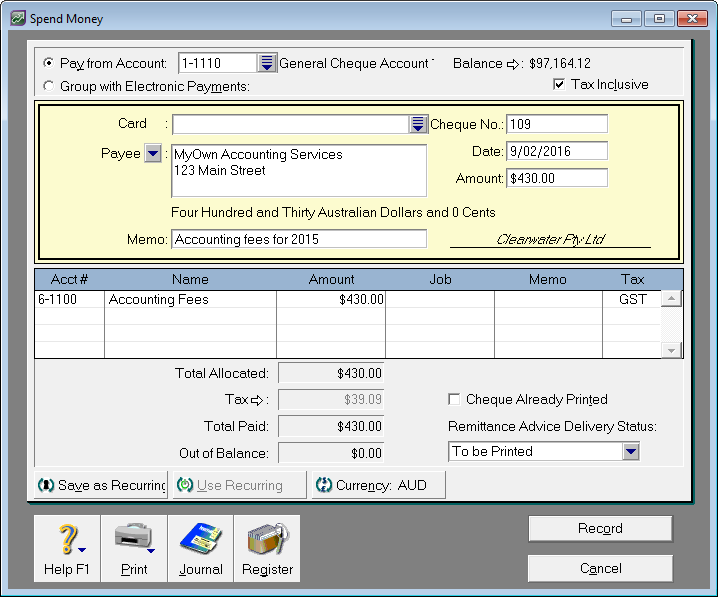

- Open Spend Money or Pay Bills.

Click the Pay From Account option, then select the desired chequebook or credit card account in the adjacent Account field. The window below shows account number 1-1110 General Cheque Account liability (credit card) account 2-9999 selected for an example Spend Money transaction.

Image Removed Image Removed Image Added Image Added

|

| UI Expand |

|---|

| title | Reconciling bank and credit card accounts |

|---|

| Bank and credit card accounts are easily reconciled by using the Reconcile Accounts function. - Go to the Banking command centre and click Reconcile Accounts.

- Enter your bank or credit card account number in the Account field.

- Enter the Bank Statement Date (the bank statement's closing balance date).

- Select the transactions that have been presented to the bank. This will place a tick next to those transactions.

- Enter the bank statement's closing balance in the Closing Statement Balance field (called the New Statement Balance field in some versions), then press the key.

- If the Out of Balance amount is zero, click Reconcile.

- You will then receive a prompt to print the Reconciliation Report. Click Print, then click the Reconcile button again. The window below shows the Reconcile Accounts window.

|

|