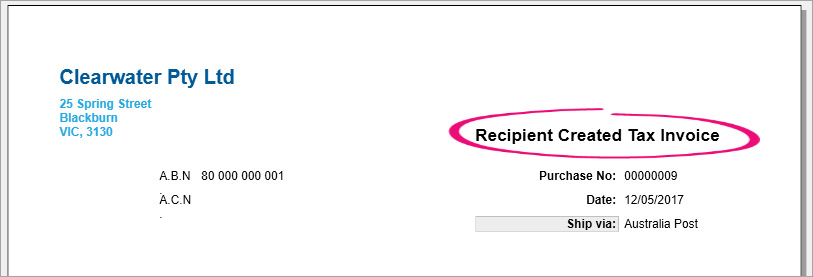

ANSWER ID:10038 Tax invoices are usually issued to you by a supplier. However, in special cases, you, as the purchaser or recipient of the goods or services, may issue yourself a tax invoice. This is known in Australia as a recipient created tax invoice (RCTI), or in New Zealand a Buyer Created Tax Invoice. There are rules and regulations governing the use of recipient created tax invoices. For all the details, speak to your accounting advisor or visit the ATO website or IRD website. Creating an RCTI (as a customer)As the customer receiving the goods or services, a recipient created tax invoice is entered the same way as any other bill. When you print the bill, by default Recipient Created Tax Invoice will be displayed.

If you're also paying the supplier, enter the supplier payment to close the bill. Receiving an RCTI (as a supplier)If you've received an RCTI from a customer, record it in AccountRight like any other invoice. You can then record the payment against the invoice. |