ANSWER ID:9294The following support note explains how to retain, edit and retrieve Business Activity Statement (BAS) related information within your company file. The BAS contains over 50 fields, about half of which are related to GST. Small businesses will be allowed to lodge the form electronically or by post either monthly or quarterly, while large businesses with a turnover greater than $20 million will need to lodge it electronically every month, unless a variation by the Tax Commissioner is granted. Page one of the BAS is a summary page containing fields for your total GST payable and for your total GST credits. The contents of some of these fields come from the Calculation Sheet on page 2 of the BAS. | UI Expand |

|---|

| title | Saving your BAS setup |

|---|

| Your BAS setup, including certain default values, will be saved when you exit BASlink by clicking Save Setup & Exit. This will save your BAS/Instalment Activity Statement (IAS) field setup in your BASlink Setup folder using a combination of your ABN and Branch ABN or Tax File number as the file name. This setup will be used as a template when you next complete your BAS. | UI Text Box |

|---|

| Your field setup is saved when you click OK in the Field Setup window. You should store a copy of your backup away from your computer in case your computer malfunctions or entries are inadvertently made to the settled GST period. This way you can be sure that you can reproduce your activity statement if required. |

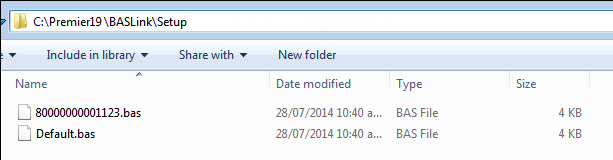

ExampleIf your company ABN is 80 000 000 001 and your Branch ABN is 123, your activity statement setup template will be saved in the BASLink Setup folder as the combination of both, in other words 80000000001123.bas. See the samples shown below from AccountRight and AccountEdge.

|

| UI Expand |

|---|

| title | Editing your BAS setup |

|---|

| Go to the File menu in BASlink and choose Setup & Links > Import Setup & Links. You will then be able to change the setup of the tax codes and the linked accounts. |

| UI Expand |

|---|

| title | Copying your activity statement BAS setup to another computer |

|---|

| Simultaneously press the Windows and E keys on your keyboard (the Windows key is between the Ctrl and Alt keys). The files and folders stored on your computer are displayed. Go to the BASlink folder located within your program folder. The table below shows the default location of your BASlink folder - providing your software has been installed in its default location. AccountRight version | BASlink folder location | AccountRight Standard v19+ | C:\Standard19\BASlink | AccountRight Plus v19+ | C:\Plus19\BASlink | AccountRight Premier v19+ | C:\Premier19\BASlink | AccountRight Enterprise v19+ | C:\Enterprise19\BASlink |

In the BASLink folder, double-click the Setup folder to view its contents. - Copy the .bas file to an external storage device, such as a USB drive.

- Copy the .bas file from the external storage device to the other computer's BASlink\Setup folder.

|

| UI Expand |

|---|

| title | Importing your activity statement BAS setup from an older version |

|---|

| At times you may want to import your activity statement setup from a prior version instead of having to manually setup all the links. This can be done from with the BASlink application following the steps below: - Prepare BASlink so that it opens up to the GST Worksheet.

- Go the File menu and choose Setup & Links > Import Setup & Links. You will be prompted to Backup your activity statement data. Choose No to this option.

- Navigate to your previous version's BASlink Setup folder.

- You will be prompted to choose a .bas file. Select the filename that corresponds to your company's ABN (the software saves the BASlink setup with your company's name with a .bas extension) and click Open.

- Your software may identify new accounts and tax codes. Click OK to any message your receive as these messages are to inform you of prior setup being imported to your activity statement.

All your previous setup will now be imported. Please check your setup to ensure it is as required. |

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | I have more than one company and I require a different activity statement BAS setup for each. How can I achieve this? |

|---|

| If you have more than one company file and require a differtent activity statement setup for each, complete the following: - Go to the File menu within BASlink and choose Setup & Links > Save Setup & Links.

- Name the file using the combination of the company's ABN and Branch ABN (or the Tax File Number if it is an IAS setup file) in order for BASlink to automatically use the setup file for the each company.

|

| UI Expand |

|---|

| title | Why aren't my manual adjustments saved in my activity statement BAS setup? |

|---|

| Manual adjustments made to any values in your activity statement will not be saved in this file. If you need to exit BASlink part way through completing your activity statement, you will need to re-enter any manual adjustments you have made when you return. It is important you have allocated adequate time for completing your activity statement. |

|