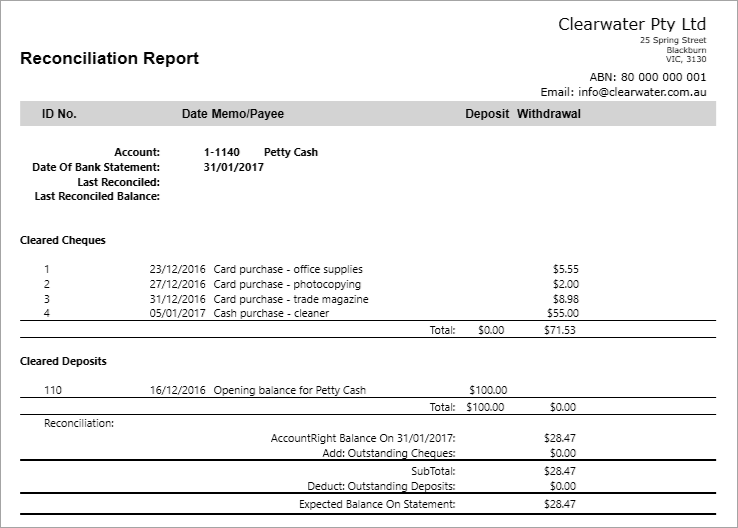

If you set a top-up limit for your petty cash (like, $500 each month), then you can use the Total of the Reconciled transactions shown in the Reconciliation Report as the amount needed to reimburse the Petty Cash account. Here's an example Reconciliation Report which shows $71.53 is needed to reimburse the petty cash account.

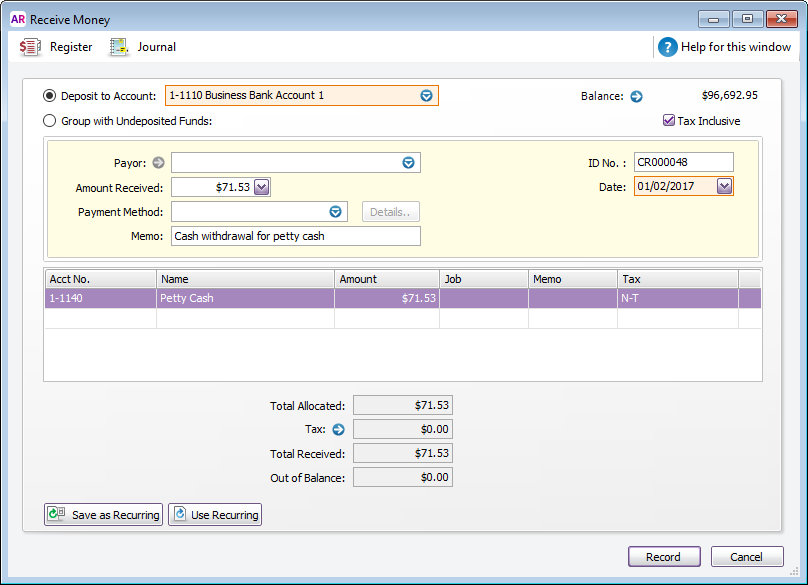

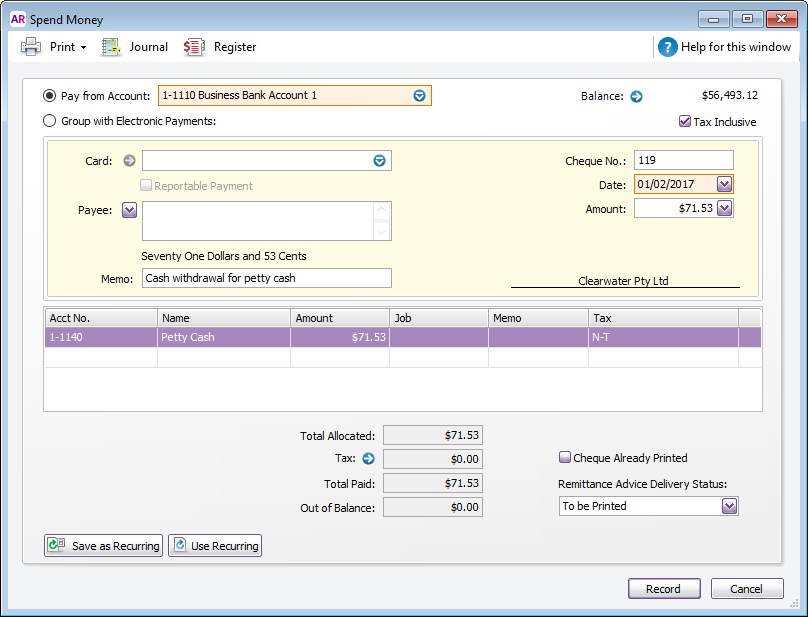

You can now record a Spend Money transaction to reimburse the account. - Go to the Banking command centre and click Spend Money.

- In the Pay From Account field, select your bank account in the adjacent field.

- Enter the Cheque No, Date, Amount and Memo.

- In the Acct No. field, select your petty cash account.

- Select the N-T Tax/GST code. Here's our example:

Image Removed Image Removed Image Added Image Added - Click Record.

After entering this transaction, the petty cash account balance should equal its original opening balance. |