If the incorrect super is from a previous payroll year, check with your accounting advisor before attempting to correct this in your software. Make sure your employees have the correct super guarantee percentage set in their record, otherwise the wrong amount of super will be paid for them. If you need to fix overpaid or underpaid superannuation, you can: - adjust the superannuation amount in a future pay, or

- create a separate pay for the adjustment (only for fixing underpaid super).

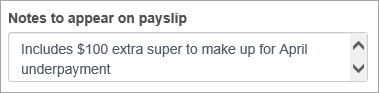

| UI Text Box |

|---|

| Use the Notes to appear on payslip box in the employee's pay to provide information to the employee about the super adjustment.

|

To make the super adjustment in a future payIdeally, this should occur in the employee's final pay for the current month. But if it's too late for this, you can process it in the employee's final pay for any future month. In the employee's pay, click into the Super field and adjust the amount. Here's an example where the super amount is manually increased by $100 ( to make up for an underpayment from a previous month).. If you're fixing an overpayment, reduce the super amount accordingly.

To make the super adjustment in a separate payBecause you can't record a negative pay in MYOB Essentials, you can only use this method to fix a superannuation underpayment. If possible, process the separate pay at the end of the month in which the underpayment occurred. If it's too late to do this, it can be processed at the end of any subsequent month. Start a new pay for the employee and zero out all hours and amounts from the pay. Then enter the super adjustment amount in the Super field. Here it is in action showing $100 being paid in super to make up for an earlier underpayment:, but the same approach can be used for an overpayment.

|