When an asset is sold, Client Accounting creates a journal to the Accumulated Depreciation, Depreciation, Asset Realisation, Profit/Loss on Sale and the cost of asset account (e.g. Fixtures & Fittings). The account code in which the amounts are posted to are specified in your Control Group settings. Selling and unselling an assetSold assets are not rolled forward to future years however they're still displayed as an active asset in years prior to when the asset was sold, but cannot be resold, edited or deleted. You can reverse the sale of an asset only in the year the asset was sold - for example, if you've sold the wrong asset by mistake. Any journal entries created by the sale of the asset are reversed. If you're in Australia, you can also select whether to calculate Capital Gains Tax (CGT) on the asset when sold where the acquisition date is on or after 20 September 1985. | UI Expand |

|---|

| To sell an asset- From within the asset year, select the asset to be sold from the Assets Listing.

- From the TASKS bar, click Sell.

In the Sell Assets window, Enter the Disposal date of the assetin the format dd/mm/yyyy or select it from the drop-down calendar.

The CAV (Closing Asset Value) at disposal date is calculated based on the disposal date entered. The Disposal date cannot be earlier than the asset start date, or later than the current financial year. | UI Text Box |

|---|

| (NZ) this does not include depreciation for the year the Asset is being sold in. |

Enter the Termination value. This is the amount received for the asset when it was sold or disposed of (after balancing adjustments have been made). | UI Text Box |

|---|

| (AU) If required, select the Calculate capital gains tax using checkbox and select the CGT calculation Method from the drop-down menu (i.e. Discount or Indexation). This checkbox is only active if the depreciation calculation is for Taxation purposes. See Capital gains tax for more information. |

Click OK to sell the asset and close the window.

On the Assets Listing page, the entry line for the sold asset will be greyed out. |

| UI Expand |

|---|

| title | To reverse the sale of an asset |

|---|

| To reverse the sale of an asset or unsell an asset- From within the asset year, select the sold asset to be unsold from the Assets Listing.

- Click Unsell on the Tasks bar. A message is displayed requesting confirmation to unsell the selected asset.

- Click Yes. The selected sold asset is unsold and reverts to an active asset for the current and subsequent years. All entries created by the sale of the asset are reversed.

|

Calculating profit / loss on saleAssets performs several calculations to make up the journal entry for the sale. The calculation of profit or loss on the sale of asset may differ. For example, consider the following scenario: | BMW 3 Series Sedan | Taxation details | Accounting details |

|---|

| Current Financial Year | 2018 | 2018 |

|---|

| Date asset began depreciating | 27/03/2014 | 27/03/2014 |

|---|

| Original Cost | $ 67,950 | $ 67,950 |

|---|

| Motor Vehicle Cost Limit at year of purchase (AU only) | $ 57,466 | N/A |

|---|

| Opening Written Down Value (OWDV) | $ 22,645 ** | $ 26 801 |

|---|

| Depreciation Rate / Method | 25% Diminishing Value | 25% Diminishing Value |

|---|

| Date of sale | 02/11/2017 (125 days held this FY) | 02/11/2017 (125 days held this FY) |

|---|

| Consideration | $ 25,000 | $ 25,000 |

|---|

** 2016 is a leap year for taxation purposes (366 days held / 365 days in year). ATO Cost Limit for 2014 Financial Year is $57,466. | UI Expand |

|---|

| title | Taxation journal explained |

|---|

| | Center |

|---|

|

| | Description | Formula | Example |

|---|

| A | Write back accumulated depreciation | Original Cost – Opening written down value (OWDV) Motor Vehicle (MV) cost limit – OWDV (for vehicles subject to cost limit) | 57,466 – 22,645 = 34,821 |

|---|

| B | Apply depreciation for the current year, up to the date of sale (NZ) In the year a Taxation Asset is sold, no depreciation for that year is applied. | OWDV * Rate * Days held / Days in year | 22,645 * 0.25 * 125 / 365 = 1938.78 |

|---|

| C | i). Calculate Closing Adjusted Value (CAV) | OWDV – Accumulated Depreciation for days held this financial year | 22,645 - 1938.78 = 20,706.22 |

|---|

| ii). Calculate Adjusted Termination Value (if applicable) | [(MV cost limit + second element costs) / Total cost of car] * Termination value

(see ITAA97 s 40-325 and ITAA97 s 40-320) | [(57466 + 0) / 67950] * 25000 = 21,143 | | iii). Calculate the assessable Profit or Loss on sale for Taxation purposes | Adjusted termination value – Closing adjusted value | 21,143 - 20706.47 = 436.75 ** | | D | Write back original cost of the asset. |

|---|

| E | Balance the journal by offsetting the net to the Realisation account. |

|---|

** subject to rounding |

| UI Expand |

|---|

| title | Accounting journal explained |

|---|

| | Center |

|---|

|

| | Description | Formula | Example |

|---|

| A | Write back accumulated depreciation. | Original Cost – Opening written down value (OWDV) | 67950 – 26801 = 41,149 |

|---|

| B | Apply depreciation for the current year, up to the date of sale | OWDV * Rate * Days held / Days in year | 26801 * 0.25 * 125 / 365 = 2294.62 |

|---|

| C | Calculate Closing Adjusted Value (CAV), then calculate Profit or Loss on sale. | OWDV – Accumulated Depreciation for days held this financial year Consideration – Closing Adjusted Value | 26 801 - 2294.62 = 24,506.38 25,000 - 24506.38 = 493.62 |

|---|

| D | Write back original cost of the asset. |

|---|

| E | Balance the journal by offsetting the net to the Realisation account. |

|---|

|

| HTML |

|---|

<br><h2><i class="fa fa-comments"></i> Selling Assets (FAQs)<FAQs</h2> |

| UI Expand |

|---|

| title | How do I part-sell an asset? |

|---|

| To sell part of an assetPart-selling an asset is currently unavailable in Assets. If you need to part sell an asset, split the original asset into 2 assets and sell the one being sold. This needs to be performed in the year the asset was added. - Edit the existing asset and reduce the cost by the cost value of the part of the asset being sold.

- Create a new asset for the cost value of the part being sold. Make sure the assets details (e.g. depreciation rate, method and private use %, etc.) are the same as the main asset.

The net effect on depreciation and total closing written down value should be the same as before you split the asset into 2. Open the year in which the part-sale is being made and sell the asset. |

| UI Expand |

|---|

| title | How do I fix the error "Asset journal entries cannot be submitted without account code..."? |

|---|

| Asset journal entries cannot be submitted without an account codeThis error message appears where assets is trying to post a journal, but the account the journal needs to be debited/credited to has not yet been specified. To resolve this issue: - Check the Maintain Control Group settings in Assets and make sure all fields under Integrated accounts have an account selected for each control group.

If you're posting journals for Accounting, make sure you've also specified integrated accounts in the Accounting tab of the control group.

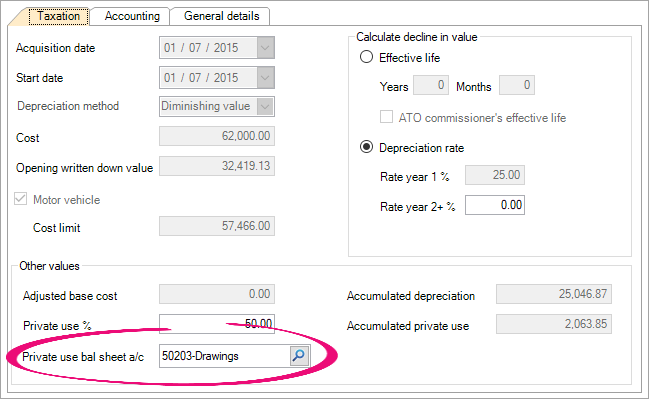

- Assets with a private use portion must have a balance sheet account to post private use to. This is specified in the asset's details.

To nominate a private use balance sheet account, right-click on the asset and choose Edit Asset and enter an account code in the Private use bal sheet a/c field.

Once all accounts are specified, click Submit journals in assets to re-submit the journals. Make sure you delete the journal in the workpapers period with blank lines to avoid double-counting. For detailed steps on resolving this error, refer to KB 37822: Error: "Asset journal entries cannot be submitted without account code...". |

| UI Expand |

|---|

| title | How do I work out the disposal date? |

|---|

| Disposal dateThe disposal date of an asset sold under contract is taken to be the date on the legal binding contract. In circumstances where no legal contract is present, the disposal date is taken to be the date in which the asset changes ownership. When the asset is destroyed or lost, the date of disposal is the date when first compensation is received; or if there is no compensation, the disposal date is the date on which the asset was first discovered, lost or destroyed. |

|