AccountRight Plus and Premier, Australia only (see also: AccountEdge and AccountRight v19 information). | UI Text Box |

|---|

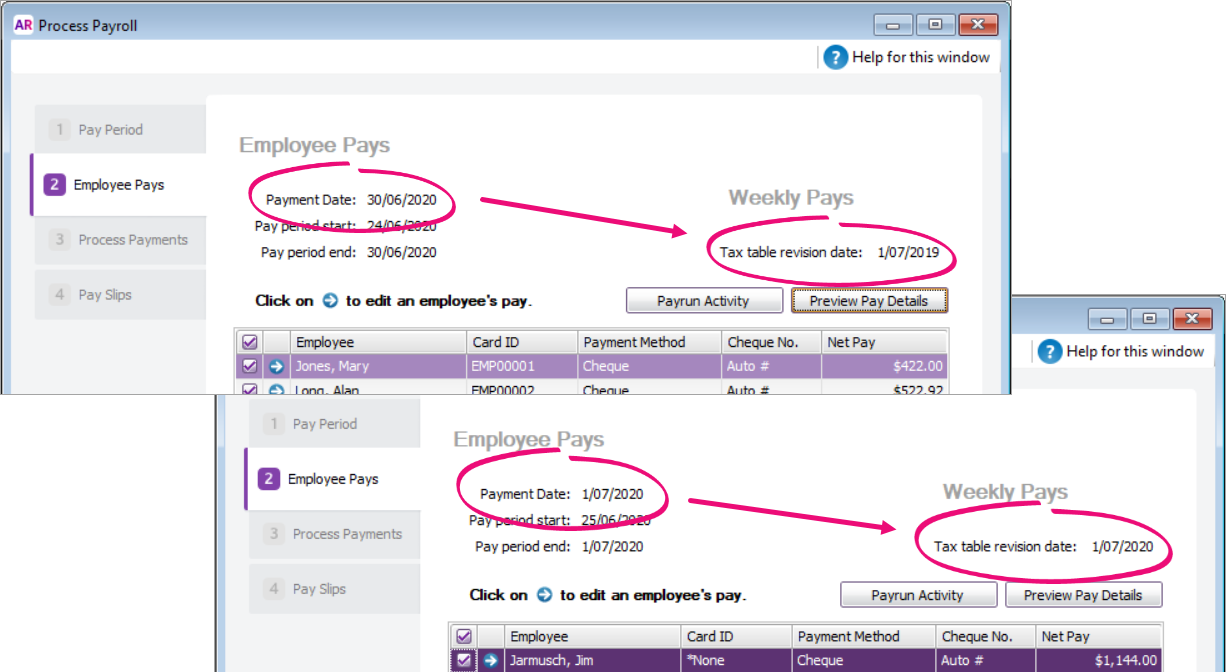

| From AccountRight 2020.2 onwards, you don't need to load the latest tax tables as AccountRight will automatically update them for you. Now, when you process a pay, the right tax table will be applied for you, based on the pay date. That means if you process a pay on June 30, the 2019-20 tax tables will be used. If you process a pay on July 1, the 2020-21 tax tables will be applied. The tax table revision date in your system will update after you do your first pay in July. |

The ATO release updated tax tables, also called the tax scales, each year. They contain the rates of tax to be applied to your employees' pays so the correct amount of tax is withheld.

When you add an employee to AccountRight, you'll specify which tax table applies to them. Learn more about assigning tax tables to your employees. If you're using the latest AccountRight version and you're connected to the internet, you'll always have access to the most up to date tax tables. Tax table automationFrom AccountRight 2020.2 onwards, when you process a pay AccountRight looks at the Payment Date and checks if you have the required tax tables in your file. If you don't, AccountRight will download the latest tax tables. This means if you process a pay in June, the tax tables for that payroll year will be used. But when you process a pay from July onwards, the latest tax tables will be used. Additionally, if you go back and amend or record a pay dated in June, AccountRight will use the previous year's tax tables again. You'll see which tax tables are being used during the payroll process.

In a nutshell—you choose the Payment Date and AccountRight chooses which tax tables to use. This keeps you in the good books with the ATO—and your employees. Not connected to the internet?For AccountRight to access to the most up to date tax tables, you'll need to be connected to the internet. If you're not, AccountRight won't be able to download the latest tax tables. If you are connected to the internet but AccountRight can't download the latest tax tables, there might be a temporary glitch at our end. Either way, make sure you're connected to the internet and try again.

You can choose to continue processing the pay using last year's (outdated) tax tables, but the wrong amount of tax might be calculated. By using the latest tax tables you'll remain compliant and avoid a possible tax debt for your employees. |