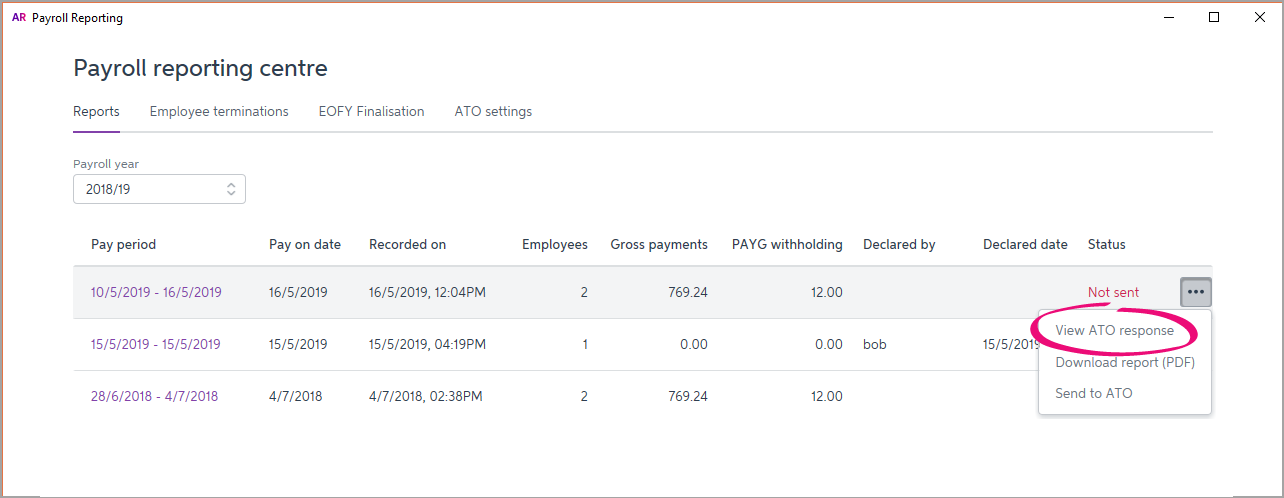

To view ATO responseIf a report you've sent to the ATO isn't accepted, you can view the ATO's reponse to find out why. From the Payroll menu, choose Payroll Reporting. - Click Payroll Reporting Centre.

- Click the ellipsis

button next to a report and choose View ATO response. button next to a report and choose View ATO response.

Details of the ATO's response are displayed. Pay events and update eventsPay runs submitted to the ATO are either pay events or update events. A pay event can only occur in the current payroll year, and will contain a dollar value. A regular pay run is considered a pay event, where both employee and employer year-to-date totals are submitted to the ATO. An update event can only occur in the current payroll year, but it won't contain a dollar value. For example, if you change a paid amount from one payroll category to another—like changing a $20 bonus to a $20 commission. The pay amount won't change, but the details will. For update events, only the employee's year-to-date totals are sent to the ATO, but not the employer's year-to-date totals. |