| UI Text Box |

|---|

| This topic is based on information provided by Work and Income, so check their website to keep up to date, find frequently asked questions and other information. If the steps below don't suit your business needs, check with your accounting advisor. |

The New Zealand Government has announced a wage subsidy if you face laying off staff or reducing their hours because of some business support payments to help pay staff during the COVID-19 . To see if your business qualifies for the subsidy, check the Work and Income website. Employers are expected to make their best efforts to retain employees and pay them a minimum of 80% of their normal income for the subsidised period. Your employees will need to pay tax on their wage subsidy payment as it’s paid to them as part of their normal wages. This means it's subject to the usual deductions, like PAYE, Student Loan, KiwiSaver and ACC. The government will pay the wage subsidy as a lump sum covering 12 weeks per employee. The amounts of the subsidy are: - $585.80 (for employees who work 20+ hours), or

- $350.00 (for employees who work less than 20 hours)

This is a Gross amount and supplemented with the employee’s wages up to 80% of what they would normally earn. To keep it clear for your employee’s and yourselvespandemic. For details of available payments and eligibility criteria, visit business.govt.nz If your business is eligible for any wage subsidy payments, we recommend setting up a new pay code for the subsidy payment. For more information, see the NZ Government’s Employer COVID-19 wage subsidy and leave payment information sheet. | UI Text Box |

|---|

Example: An employee normally earns $1000 for a 38-hour week. Under the COVID-19 wage subsidy, the employer will now be required to pay their employee $800 per week, which is 80% of their normal wage. Of the $800 payment, $585.80 will consist of the government subsidy. |

COVID-19 pay code to make those payments to the affected employees. | UI Expand |

|---|

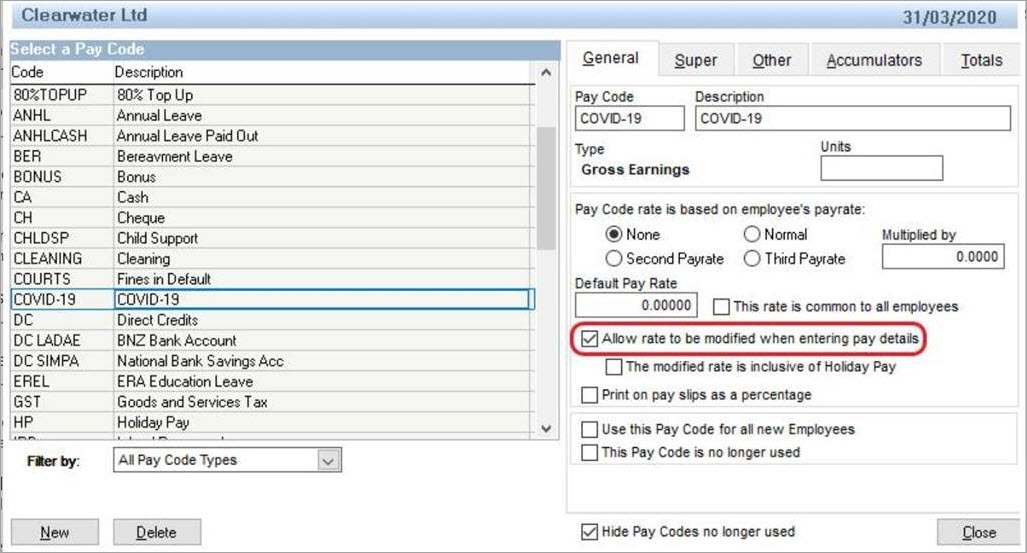

| title | Create a new pay code |

|---|

| - Go to the Maintenance command centre and click Maintain Pay Codes.

- Click New. The New Pay Code window appears.

- In the Pay Code Type field, choose Gross Earnings.

- Enter COVID-19 in the Pay Code and Description fields.

- If you're applying the COVID 19 subsidy to all employees, select Add this Pay Code to all current employees.

Here's the pay code example:

- Click OK.

Click the new COVID-19 pay code. On the General tab, select the option Allow rate to be modified when entering pay details.

- Click Close.

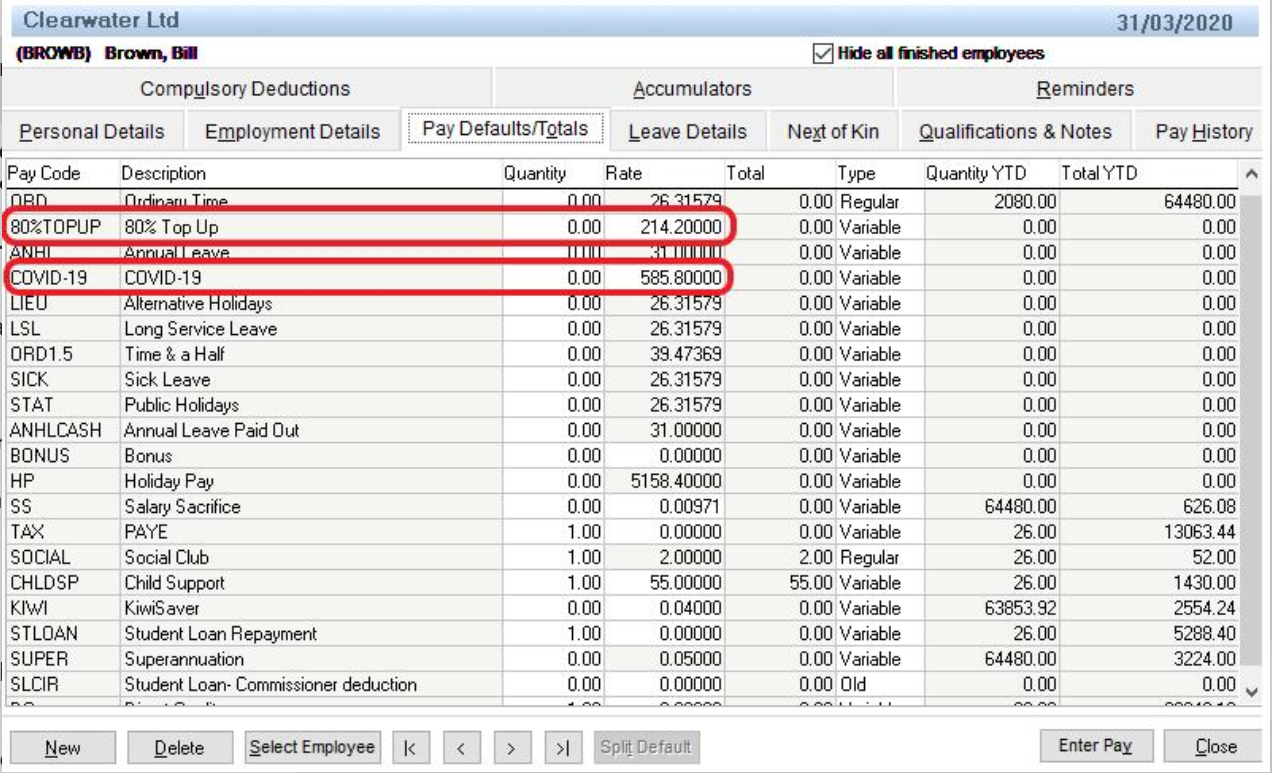

- In the Maintenance command centre, click Maintain Employees.

- Click Select Employee.

- Select an employee who'll receive the subsidy and click OK.

- Click the Pay Defaults/Totals tab.

- Click New.

Select the COVID-19 pay code and click OK. In the Quantity field, enter 0.00. In the Rate field, enter the subsidy amount. If there's a top up amount, enter this against the applicable pay code. This will be based on the employee's circumstances, so might be entered against ordinary time or annual leave (for example). If you wanted to track the top up amounts separately, you could also set up a pay code for the top up amount following the steps above you used to create the subsidy pay code.

Here's our example where we've assigned a top up amount to a pay code created for this purpose, also with 0.00 entered as the Quantity.

Image Removed Image Removed - Repeat from step 8 Repeat from step 10 for all employees eligible for the COVID 19 subsidy.

- Click Close.

|

| UI Expand |

|---|

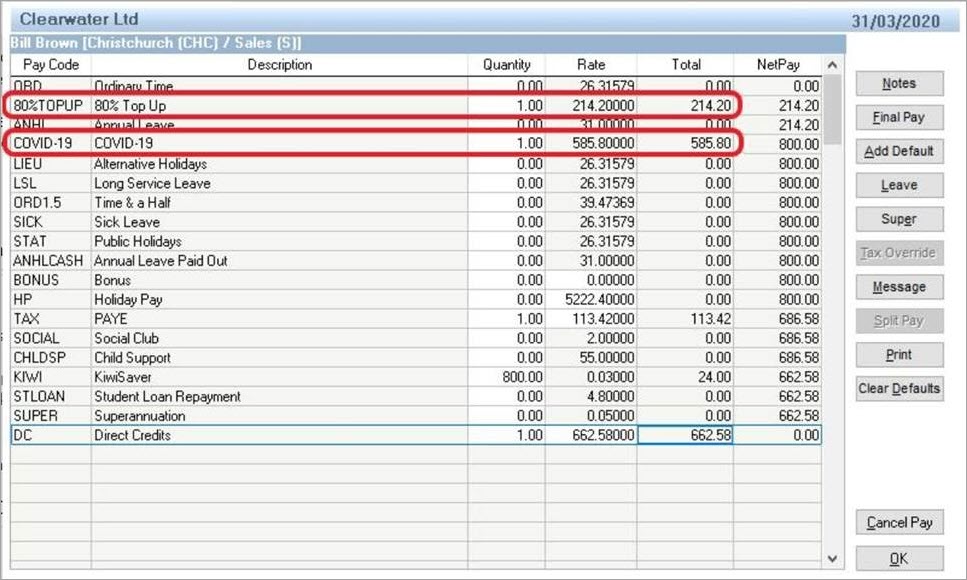

| Go to the Prepare Pays command centre and click Enter Pays. Select the employee. - Enter 1 against the COVID-19 pay code.

- If there's a top up amount, enter 1 against the 80% Top Up pay code.

Here's our example:

Image Removed Image Removed - amount of their subsidy payment in the Rate column.

Process the rest of the pay as normal.

|

|