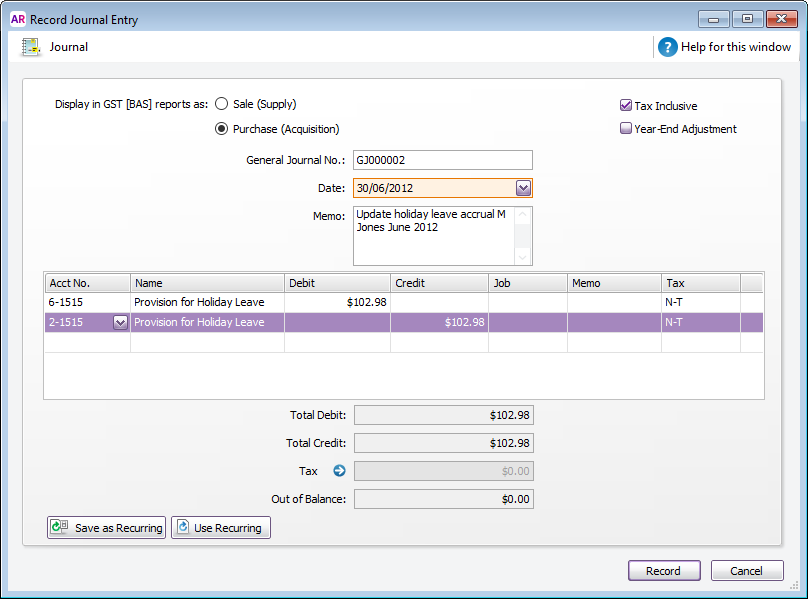

Regularly update your accrued liabilitiesYou can regularly update the monetary value of your leave accrual liabilities. For example, if you want to update the liabilities each month you will need to run the Entitlement Balance Summary report filtered for the specific month in question. Do this once you have completed all payroll transactions for that month. Note that the report will need to be dated from the last time you recorded a journal entry to update the accrued liabilities, up to the current date. The value shown in the report will be the current entitlement balance, so you will need to subtract the previously reported entitlement balance value to determine the value of the accrued leave for the reported period. Example: The last time you completed this process an employee's accrued leave value was $2500. The following month when you run the Entitlement Balance Summary report, the employee's accrued leave value is $2602.98. $2602.98 - $2500=$102.98. This means the value of the accrual liability for this employee needs to be increased by $102.98. The journal shown here will increase the value of the leave accrual liability by $102.98.

To decrease the value of the leave accrual liability, you would debit the liability account and credit the expense account. | UI Text Box |

|---|

| If you want to make provision for Leave Loading , increase the values by the applicable leave loading percentage. |

|