The initial payment is made in EURO, which will debit the local $ value from the contra clearing account. You then transfer the applicable amount from your USD bank account to "clear" (balance) the contra clearing account. Record the payment in EURO- Go to the Purchases command centre and click Pay Bills.

- Click the Pay from Account option then select the Contra Clearing Account in the adjacent Account field.

- Select the Supplier then enter the Amount Paid.

- Enter the Memo and the Date of the purchase.

- Place your cursor in the Amount Paid field and if necessary enter the amount.

- Click Record.

This example shows the Pay Bills transaction. This will result in a withdrawal of Local $26133.33 from the Contra Clearing Account. This can be quickly checked by viewing the Contra Clearing Account balance in the Accounts List window. The amount withdrawn from the Contra Account will be the equivalent of EUR 16000 (at the current exchange rate EUR 1=Local $1.633333). AccountRight will AccountEdge will automatically convert the EUR amount into Local$ and transfer it from your Contra Clearing Account taking into consideration the Transaction Exchange Rate.

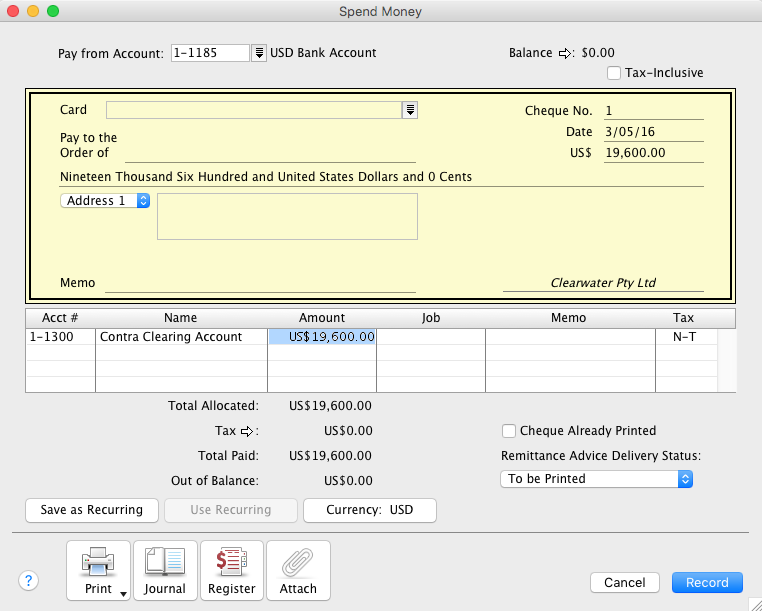

Transfer funds to the USD bank accountYou can now transfer funds from your USD Bank Account to the Contra Clearing Account so that the purchase for EUR 16000 can be paid off. To do this, record a Spend Money transaction (Banking > Spend Money) from the USD Bank Account to the Contra Clearing Account. Here's our example:

Please note that the equivalent of Local $26133.33 is USD$19600 at the exchange rate of Local $1=USD $1.333333 This calculation is performed as follows: USD $1=Local $1.333333 USD $19600=Local $? USD $ 19600 * 1.333333=$26133.33 This will result in a deposit of $26133.33 into the Contra Clearing Account and a withdrawal of $19600 in the USD Bank Account and the remainder in the USD Exchange Account. This can be quickly checked by viewing the Accounts List window. If you have a few cents balance in the Contra Clearing Account, a General Journal entry can be done, allocated to the Currency Gain/Loss Account as this difference can be caused due to rounding in different exchange rates. See Unrealised currency gain or loss. |