Australia only Online invoice payments is a secure payment service that gives your customers an easier and faster way to pay you. Now they can pay online using their VISA, MasterCard, AMEX, BPAY, Apple Pay or Google PayTM or PayPal. | UI Text Box |

|---|

| Coming soon: PayPal! PayPal will soon be a payment option for your customers when you use Online Invoice Payments. This means they can use PayPal's Pay In 4 option, with no interest or late fees. For now, PayPal is only available for early adopters. |

Let customers pay how they want to pay. Check out the video to see what online invoice payments can do for your business. | HTML |

|---|

<div class="wistia_responsive_padding" style="padding:56.25% 0 0 0;position:relative;"><div class="wistia_responsive_wrapper" style="height:100%;left:0;position:absolute;top:0;width:100%;"><iframe src="//fast.wistia.net/embed/iframe/hf4d2gv8hm?videoFoam=true" title="Wistia video player" allowtransparency="true" frameborder="0" scrolling="no" class="wistia_embed" name="wistia_embed" allowfullscreen mozallowfullscreen webkitallowfullscreen oallowfullscreen msallowfullscreen width="100%" height="100%"></iframe></div></div>

<script src="//fast.wistia.net/assets/external/E-v1.js" async></script> |

Fees and chargesThere are no setup or cancellation fees with online invoice payments, but there is a transaction fee that will apply to all payments made online. Transaction fee: $0.25 per transaction + 1.8% of the total invoice (which you can pass on to your customers through surcharging, excluding BPAY). You'll only be charged after your customer makes the payment. If you'd like more information on how fees and charges work with online payments, see Fees and charges. Apply nowIt's easy to get set up with online invoice payments, just make sure you have the following information ready: | Checklist |

|---|

| Title | Make sure you have your: |

|---|

| - Australian Business Number (ABN)

- Business trading and sales details

- Proof of identity — have your driver's licence or passport handy

- Bank details to settle your funds and to pay associated fees and charges

- Estimates of total annual sales in dollars and number of online invoice transactions per month (see your Sales reports)

|

You can start your online invoice payments application by visiting this website, or from within MYOB by following the steps in 'Get set up' below.We'll step you through the application and ask you a few simple questions so that we can verify your business and account details to make sure that your information is kept safe and secure.

| UI Expand |

|---|

| Get set upIt's easy to set up online invoice payments — you can do this when you're entering an invoice. | UI Text Box |

|---|

| You can also set up online invoice payments from the Setup menu > Preferences > Emailing tab > Get set up button. |

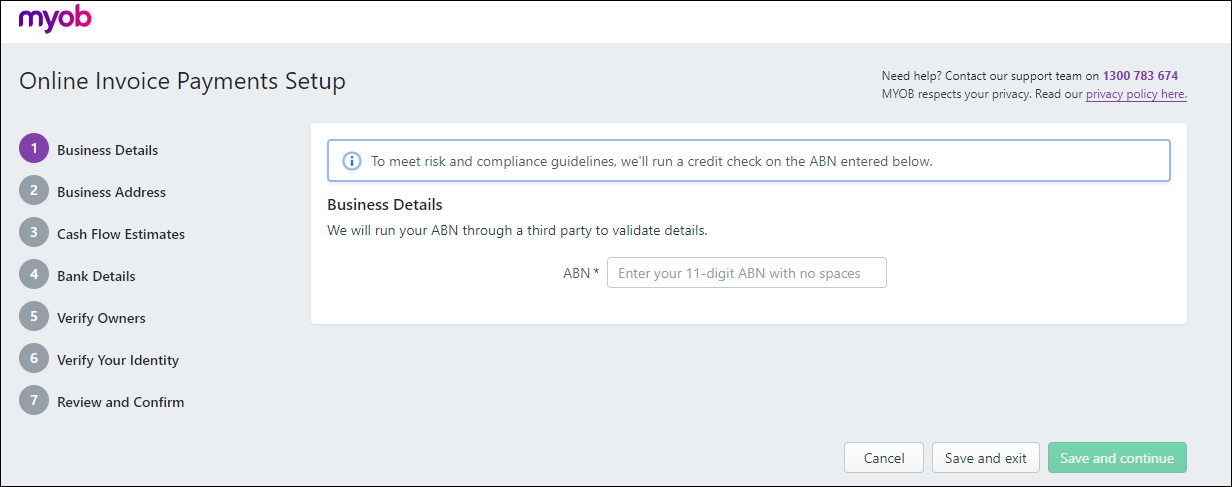

- Click the the Online Invoice Payments button in the Sales command centre:

- Follow the prompts to complete the application:

Business Details – enter details like your ABN, business name and industry. This is to help confirm and protect the information provided. - Business Address – enter the registered office address of your business. The is where all communications and notices to the company are sent. It can be different to the trading address or principal place of business.

Cashflow Estimates – enter estimates of annual sales turnover, the number of invoices you send a month and the percentage of deposits taken on invoices. If you're a new business, enter forecasts of these figures. Bank Details – enter the details of the settlement bank account and the account MYOB will direct debit transaction fees from. If there are other authorisers for the direct debit account, you'll need to provide their details. Verify Owners – enter the email address and mobile number of the beneficial owner(s). They’ll be contacted by email to verify their identity. If they are not listed you can add them. Verify Applicant – enter details from your driver's licence or passport. Review and Confirm – check over the details you’ve entered and agree to the terms and conditions. | UI Text Box |

|---|

| To save an application and complete it later, click Save and exit. To resume your application, repeat from step 1 above and click Resume application on the Online invoice payments page. |

- When you've completed the application, click Submit application.

Once the application is submitted, we'll begin the verification process. If more information is required, we'll get in touch with you within two business days. | UI Text Box |

|---|

| Application status. Once your application is successful, you'll receive an email from us letting you know you're ready to use online invoice payments. You'll then need to choose the MYOB account that your customers' online payments will be settled into – see 'What to do once your application is approved' below. |

|

| UI Expand |

|---|

| title | What to do once your application is approved |

|---|

| What to do once your application is approvedOnce your application is approved, all new invoices will have the Online payments option selected by default.

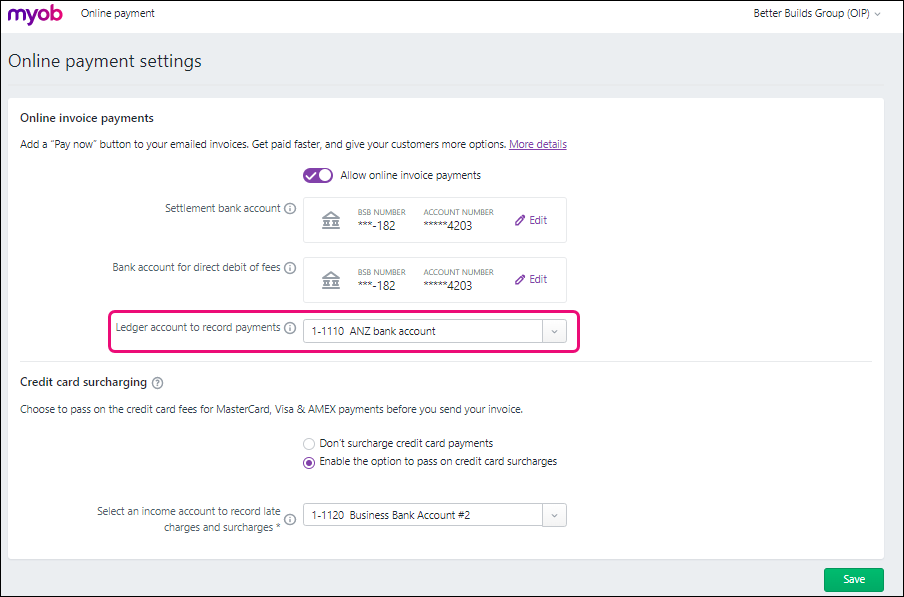

For existing open invoices, you’ll need to resend the invoice so the customer can see their online payment options. If you use bank feeds or import bank statements, you can set up AccountRight to automatically reconcile your invoice payments to your bank feed to save time on admin. To do this, you need to choose the AccountRight account to record online invoice payments: - Go to Setup and choose Preferences.

- Click the Emailing tab.

- Click Edit payment options. If prompted, log in with your MYOB details.

- Choose the Ledger account to record payments.

- If you want to pass on credit card surcharges to your customers, select this option and choose the MYOB account for recording your online invoice payment fees and charges. Learn more about Customer surcharging for online payments.

- Click Save.

| UI Text Box |

|---|

| After you've set up Online Invoice Payments, you have the option to switch on online invoice payments when you import invoices. See Importing data. |

|

| UI Expand |

|---|

| Sending an invoiceYou can select whether to enable online invoice payments for each individual invoice by selecting the Online payments option (as seen below). - Create your invoice as you usually do. Need a refresher?

- Select the Online payments option shown below.

If you'd like to pass on the 1.8% surcharge for debit and credit card payments, and you've set up customer surcharging, select the Apply surcharge option. | UI Text Box |

|---|

| You're not able to pass on the surcharge for BPAY payments yet. |

- Click Send To and choose Email.

- Check the details of the email and update if required.

- (Optional) Click Attach to select an additional file to attach to the email.

- (Optional) Click To if you have additional email addresses in a contact's card in a contact’s card which you want to use. Or type email addresses directly into the To field, separated by semi-colons (;).

(Optional) Send a link to the online invoice via an SMS message*: | UI Text Box |

|---|

| SMS is only available when you email an online invoice payments-enabled invoice using AccountRight's email service. It's not available when you email invoices via Microsoft Outlook. |

Select the Send SMS option. Choose the customer's Mobile number (if it has been entered into the customer's card), or enter a valid mobile number here.

| UI Text Box |

|---|

| If you key in an SMS number, it won't be added to the customer's card. You'll need to update the customer if you want to retain this number. |

- When you're ready, click Send.

- Your customer clicks the automatically generated link that’s in the email or SMS message they receive, and their full invoice will appear online.

- They can click the Pay now button to make their payment on the spot.

| UI Text Box |

|---|

| If you'd like to avoid paying a surcharge for a large invoice, you can remove the online payment option from that particular invoice. Just deselect the Online payments option when creating the invoice. See Deactivating online payments for more information. |

* SMS is provided by a third party service, SMS Global (read their Terms and Conditions). SMS is included as part of Online Invoice Payments – you don't need to sign up to SMS Global separately. |

| UI Expand |

|---|

| title | How the invoice looks to your customers |

|---|

| The customer will receive an online invoice email as they normally would. However, with the online invoice payments option enabled, they'll see a Pay now button.

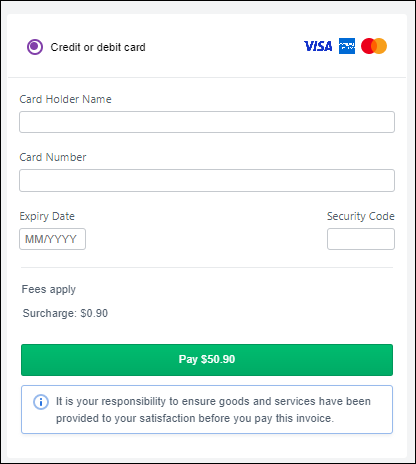

When they click Pay now, they'll be asked to select their payment method.

If you've activated customer surcharging for this invoice and the customer chooses to pay by credit or debit card, the 1.8% card surcharge will automatically be applied. Once they've entered their payment details, they click Pay.

You'll only be charged after the customer's payment has been processed. |

| UI Expand |

|---|

| title | Reconciling customer payments |

|---|

| Reconciling customer paymentsWhen a customer makes an online payment, it'll automatically be recorded into AccountRight, and the associated invoice will be closed off. You'll also receive an email notification about the payment. Providing you've specified the bank account to record your online invoice payments when you applied, here's how it'll work: - The individual payments you receive for a day, along with any credit card surcharges, will be recorded in your Undeposited Funds account.

- 1-2 days later when the funds have been disbursed to your settlement bank account, a bank deposit will then be automatically created to include all undeposited funds that were settled.

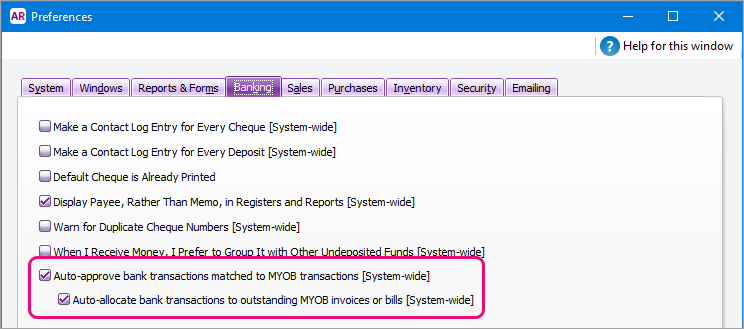

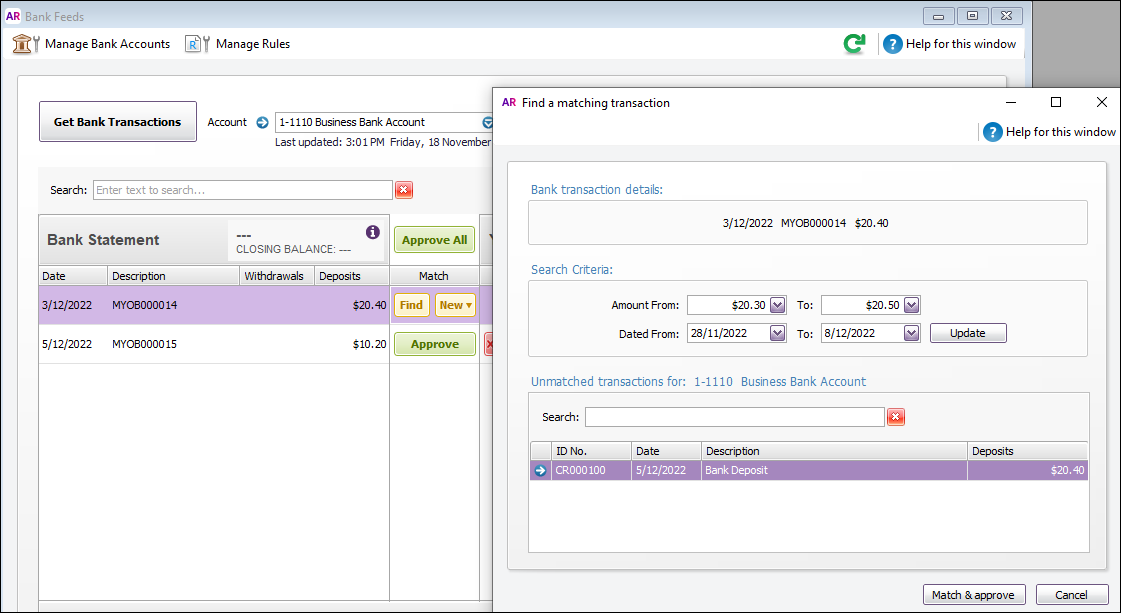

If you use bank feeds, the lump sum deposit for the day's customer payments will be automatically matched to the bank deposit. | UI Text Box |

|---|

| If your customer payments aren't automatically matching to bank deposits, you may need to turn auto matching on. Go to the Setup menu > Preferences > Banking tab and select the Auto-approve bank transactions matched to MYOB transactions and the Auto-allocate bank transactions to outstanding MYOB invoices or bills options.

|

Learn more about how matching works.

Manually matching payments If you prefer to manually match bank feed transactions, or you notice that there isn't an automatic match, you can click Find to find the bank deposit and manually match it:

To help you match transactions, you can run the Transaction details report: - Go to the Reports menu and choose Index to Reports.

- Click the Sales tab.

- In the Online invoice payments section, click View reports then click Display Report. The report displays in a web browser.

On the Reports page, click Transaction details to open the Transaction details report.

You can use the details in the report, such as the Transaction description, to help you identify online invoice payments in your bank feeds.

For more details about online invoice payments reports, see Online invoice payment reports. |

Google Pay is a trademark of Google LLC. | HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | How do I pay the fees and charges? |

|---|

| How do I pay the fees and charges?You'll be sent an invoice for fees and charges, and then billed on a monthly basis via direct debit. If you're just getting set up for online invoice payments, you can select a separate account to pay your fees and charges. See Step 5 in the Get set up section above. If you're already set up for online invoice payments, we'll charge the same account used to pay for your MYOB subscription. If you'd like to specify a different account you can change it via the Setup menu > Preferences > Emailing tab > Edit payment options.> Edit your service preferences. Also, learn about Customer surcharging for online payments. |

| UI Expand |

|---|

| title | Can I disable online payments for one invoice? |

|---|

| Can I disable online payments for one invoice?You can remove your customer's option to make online invoice payments by deselecting the Online payments option when creating an invoice. |

| UI Expand |

|---|

| title | Can customers pay multiple invoices at once? |

|---|

| Can customers pay multiple invoices at once?If you send customers emails from AccountRight, they can pay multiple invoices in one go through their list of unpaid invoices. All they need to do is select the invoices they wish to pay and click the Pay invoices button below.

| UI Text Box |

|---|

| The total amount of invoices selected cannot exceed $99,999. |

They can access the list of their unpaid invoices in a number of ways: - From invoices using Online Invoice Payments emailed from AccountRight, (this feature isn't yet available for those sent via Microsoft Outlook):

- Through their monthly statement of unpaid invoices

- Through a reminders email

|

| UI Expand |

|---|

| title | How long does it take for a payment to appear in my bank account? |

|---|

| Depending on when the payment was made and the bank's processing cut off time, it can take between 1 and 2 business days for the payment to appear in your bank account. We'll send you an email as soon as the customer has paid the invoice so you'll know when you can expect the money in your bank.

The payee also receives an email confirming that they've paid. You can also check the Transaction details report: - Go to the Reports menu and choose Index to Reports.

- Click the Sales tab.

- In the Online invoice payments section, click View reports then click Display Report. The report displays in a web browser.

On the Reports page, click Transaction details to open the Transaction details report.

Any paid transactions will have a status of Settled money:

|

| UI Expand |

|---|

| title | Can a customer part-pay an invoice? |

|---|

| Can a customer part-pay an invoice?Unfortunately, no. Online Invoice Payments only allows for full payment to be made on an online invoice – partial payments are not able to be recorded. If you have an invoice that requires deposits or multiple payments, you should set these payments up as multiple invoices in AccountRight and send them to the customer so they can pay those invoices individually. | UI Text Box |

|---|

| | If the amount the customer will pay each time is the same, you can save yourself some effort by setting up a recurring invoice. AccountRight will automatically create as many invoices you want according to a schedule you choose – you then just need to send each invoice to the customer. Find out more about Recurring transactions. |

|

| UI Expand |

|---|

| title | What if my payee requests a receipt? |

|---|

| What if my payee requests a receipt?When the payee pays the invoice (using the Pay now button), they receive an email notification that they have paid. In the online invoice, the Pay now button changes to View Receipt – they can click this to view or download the receipt. |

| UI Expand |

|---|

| title | Can I change the SMS message text? |

|---|

| Can I change the SMS message text?No, the SMS message template is fixed and can't be changed. |

| UI Expand |

|---|

| title | Can I send an invoice SMS without sending an email? |

|---|

| Can I send an invoice SMS without sending an email?No, an SMS message can only be sent when you send an email for an online invoice payments-enabled invoice using AccountRight's email service (not via Microsoft Outlook). |

| UI Expand |

|---|

| title | Can I send multiple invoice SMS messages at a time? |

|---|

| Can I send multiple invoice SMS messages at a time?No, you can only send SMS message for a single invoice at a time. You can resend an email and SMS for an invoice – go to the Sales command centre > Sales Register > Open Invoices, click the number of the invoice you want to message and click Send to > Email.... Refer to the steps in 'Sending an invoice', above. |

| UI Expand |

|---|

| title | Why has the "Pay now" button disappeared from my invoices? |

|---|

| If your customers have told you they can no longer see the Pay now button in their online invoices, it might be related to some recent communications we sent about completing some additional business verification requirements for online invoice payments. If you didn't provide the required information, your online invoice payment service may have been terminated. If you want to continue providing your customers the means to pay you online, you'll need to reapply for online invoice payments. For all the details see Online invoice payments termination. Also, the Pay now button will be missing if the invoice has been imported into AccountRight or it's set as a recurring transaction. |

| UI Expand |

|---|

| title | Why are some payment options not available? |

|---|

| Why are some payment options not available?Depending on the nature of your business, some Online Invoice Payments payment options may not be available due to certain eligibility criteria. |

| UI Expand |

|---|

| PayPal FAQsPayPal is only available for early adopters for now | UI Expand |

|---|

| title | How do I make PayPal available for my customers? |

|---|

| Once you set up Online Invoice Payments, PayPal (and PayPal Pay in 4) is automatically one of the payment options your customers have, there is nothing additional you need to do. |

| UI Expand |

|---|

| title | Will PayPal be available for all merchants? |

|---|

| Will PayPal be available for all merchants?PayPal will be available for most merchants. However, it's not available for these business and transaction types: - Non-profit

- Gambling

- Security Brokers/Dealers

- Foreign Currency, Money Orders

- Stored Value Cards

|

| UI Expand |

|---|

| title | Do I need a PayPal account to accept PayPal payments? |

|---|

| Do I need a PayPal account to accept PayPal payments?No, you don't need a PayPal account, only your customers do. |

| UI Expand |

|---|

| title | Can I turn on customer surcharging for PayPal? |

|---|

| Can I turn on customer surcharging for PayPal?Yes, you have the option to pass on surcharging fees associated with online invoice payments to customers paying with PayPal. You can turn on customer surcharging for an invoice or all invoices for PayPal, just as you can for any other payment method (except BPAY). The surcharge will appear as ‘Handling’ in the payer's PayPal wallet. |

| UI Expand |

|---|

| title | Can I have Online Invoice Payments funds settled into my PayPal wallet? |

|---|

| Can I have Online Invoice Payments funds settled into my PayPal wallet?No. If you have a PayPal account, you're not able to have Online Invoice Payment funds settled into it. Payments can only be settled into the settlement bank account you nominated when you applied for Online Invoice Payments. |

| UI Expand |

|---|

| title | Why is MYOB shown as the merchant in my payers' notification emails and PayPal account? |

|---|

| Why is MYOB shown as the merchant in my payers' notification emails and PayPal account?As MYOB is the master merchant for PayPal Online Invoice Payments, MYOB will be displayed as the merchant name in the email payment notification and viewing transactions from the PayPal account. Your trading name appears in the bank statement and in an automated email receipt the payer receives from MYOB. |

|

|