When you do a pay run, a separate payroll transaction is recorded for each employee in the pay run. This transaction allocates each part of the pay to various expense and liability accounts. Let's take a closer look. | UI Expand |

|---|

| expanded | true |

|---|

| title | To view a payroll transaction |

|---|

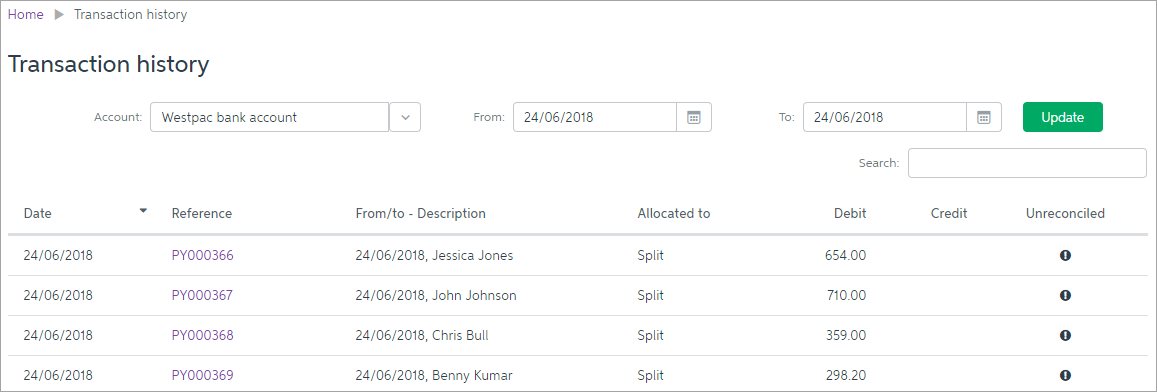

| - Go to the Banking menu and choose Transaction history.

- In the Account field, choose your wages bank account (the one you specified when setting up payroll).

- In the From and To fields, select the date range for the pay. Here's an example pay where 4 employees have been paid:

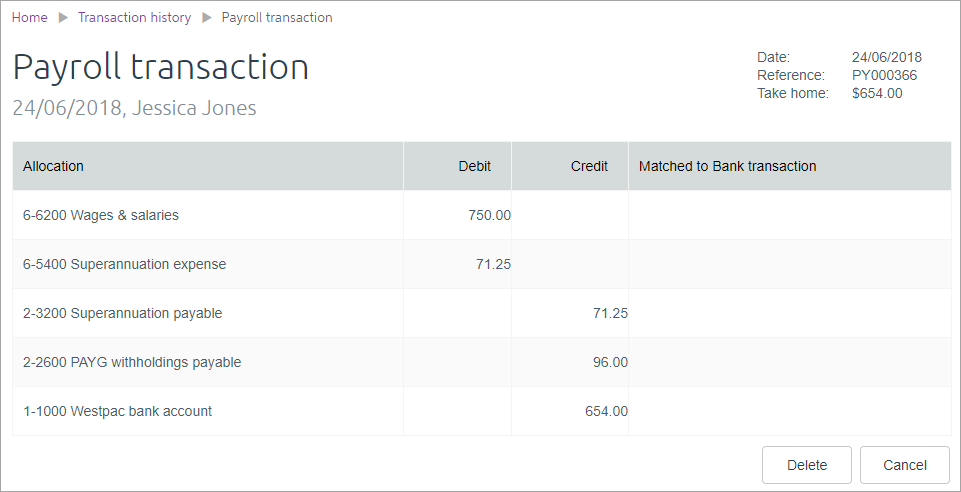

- Click the reference number for an employee's pay (which starts with PY) to open the transaction. The payroll transaction is displayed:

This example shows:The debits and credits which make up this pay transaction: - The first line represents the wage expense to your business for this employee's pay ($750.00)

- The next two lines represent the superannuation ($71.25 being a debit (expense) to your business, and a matching credit (liability) which goes to the employee's super fund)

- The next line is the PAYG (tax) withheld from the employee's pay ($96.00)

- The last line in the list represents the employee's net pay ($654.00), allocated to account 1-1000 Westpac bank account (the account set as the Bank account for paying wages in your payroll settings)

|

Matching and allocating payroll transactionsIf you use bank feeds or import bank statements for your bank account for paying wages, the imported transactions can be easily matched to pay transactions in MYOB Essentials. Depending on how you pay your employees (cash, cheque or electronically), there will be one or many withdrawals from your bank account. For example, if you pay employees electronically using a bank file downloaded from MYOB Essentials, there will be a single withdrawal from your bank account which is the total net amount paid to your employees. In this case you can match the lump sum to the individual pay transactions. If you're trying Trying to match multiple bank transactions to one payroll transaction, currently ? Currently MYOB Essentials doesn't let you do this. But , but check out this community forum post for some options. |