| CSS Stylesheet | ||

|---|---|---|

| ||

|

| CSS Stylesheet |

|---|

.container {

width:100%;

padding-left:0px;

padding-right:0px;

}

.container>p, .row {

padding-left:10.5%;

}

.row{

width:100%;

padding-bottom:100px;

margin-left:0px;

margin-right:0px;

padding-top:50px;

}

.col-md-6.col-sm-12, .col-lg-12, .col-md-12 {

margin-top:50px;

}

.row h2 {

font-size:28px!important;

font-family:NeutroMYOB-Medium,Arial,sans-serif;

color:#2e3e4f!important;

margin-bottom:0.6667em;

line-height:1.166;

padding-bottom:15px;

}

.brikit-content-layers .brikit-content-layer-backdrop, .brikit-container-backdrop .brikit-content-layer-backdrop .brikit-content-layer {

margin-left:0px;

margin-right:0px;

}

#content-layer-0 {

margin-left:0px;

margin-right:0px;

}

.row:nth-of-type(even) {

background:#f3f4f5!important;

}

#content-block-0 {

padding-left:0px;

padding-right:0px;

margin-left:0px;

margin-right:0px;

}

iframe {

margin-top:5px;

}

.col-lg-6 {

padding-right: calc(50% - 640px);

padding-right:-moz-calc(50% - 640px);

padding-right:-webkit-calc(50% - 640px);

padding-right:-webkit-calc(50% - 640px);

padding-right:-o-calc(50% - 640px);

}

/*.col-lg-6.col-md-4:first-child {

padding-right:50px;

}*/

.col-lg-6.col-md-4 {

padding-right:50px;

}

.col-lg-6.col-md-4:last-child {

padding-left:50px;

}

.tab-pane {

padding-top: 20px;

width:80%;

margin-left:auto;

margin-right:auto;

}

.videoContainer {

width: calc(100% - 50px);

width: -moz-calc(100% - 50px);

width: -webkit-calc(100% - 50px);

width: -o-calc(100% - 50px);

}

.nav-tabs {

width: 80%;

margin-left: auto;

margin-right: auto;

border-bottom:0;

}

.nav-tabs li, .nav-tabs.active li {

width: 25%;

text-align:center;

}

.nav-tabs>li.active>a, .nav-tabs>li.active>a:focus, .nav-tabs>li.active>a:hover {

border-top: 0;

border-left: 0;

border-right: 0;

border-bottom: purple 3px solid;

}

li[role=presentation] {

border-bottom: #ddd 1px solid;

}

.tab-pane .row {

padding-left: 0px;

}

.col-lg-6 p, .col-lg-6 li {

max-width: calc(100% - 50px);

max-width: -webkit-calc(100% - 50px);

max-width: -moz-calc(100% - 50px);

max-width: -o-calc(100% - 50px);

}

.tabSection {

padding-top:40px;

}

.yes img, .no img {

height: 60px!important;

} |

| div | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |||||||||||||||||

|

...

|

...

|

...

|

...

|

|

...

|

...

Report payments to contractors

...

|

| HTML |

|---|

<img src="/wiki/download/attachments/5668961/Line-09.png?version=1&modificationDate=1426207682000&api=v2" width="100%"><br> |

| HTML |

|---|

<iframe src="//fast.wistia.net/embed/iframe/hbl8y8c6lx?videoFoam=true" allowtransparency="true" frameborder="0" scrolling="no" class="wistia_embed" name="wistia_embed" allowfullscreen mozallowfullscreen webkitallowfullscreen oallowfullscreen msallowfullscreen width="560" height="315"></iframe><script src="//fast.wistia.net/assets/external/E-v1.js"></script> |

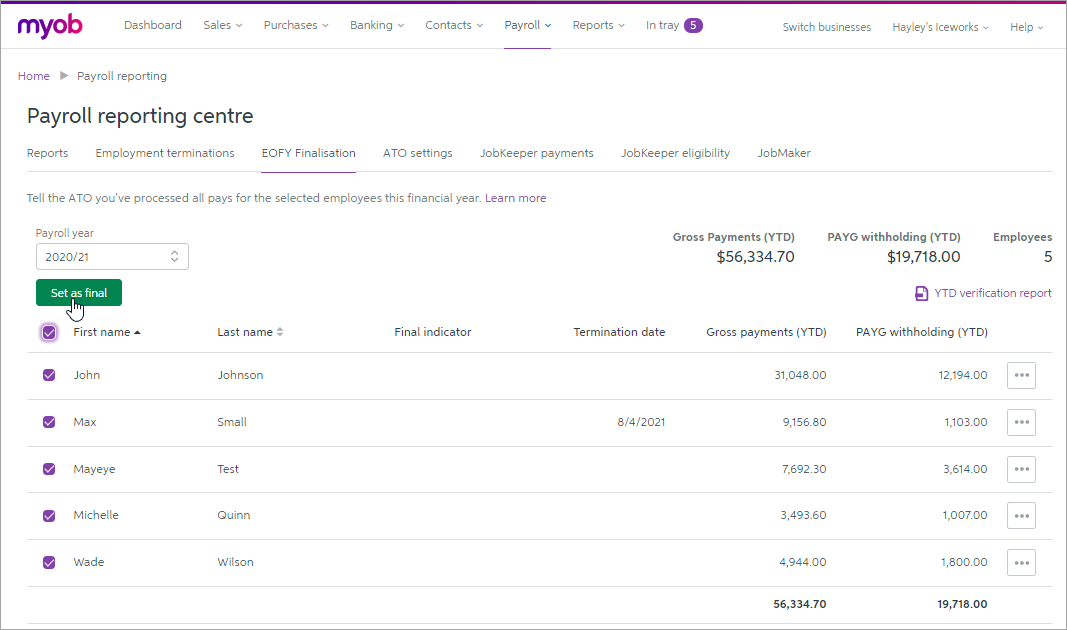

Lodge payment summaries

If you've paid any employees this year, you'll need to provide them with PAYG payment summaries (previously called group certificates) before 14 July. You'll also need to send this information to the ATO before 14 August. You can use MYOB Essentials to create and electronically lodge your payment summaries.

See Producing PAYG payment summaries.

| HTML |

|---|

<img src="/wiki/download/attachments/5668961/Line-09.png?version=1&modificationDate=1426207682000&api=v2" width="100%"><br> |

|

...

|

...

|

...

|

...

|

| HTML |

|---|

<img src="/wiki/download/attachments/5668961/Line-09.png?version=1&modificationDate=1426207682000&api=v2" width="100%"><br> |

|

| HTML |

|---|

<img src="/wiki/download/attachments/5668961/Line-09.png?version=1&modificationDate=1426207682000&api=v2" width="100%"><br> |

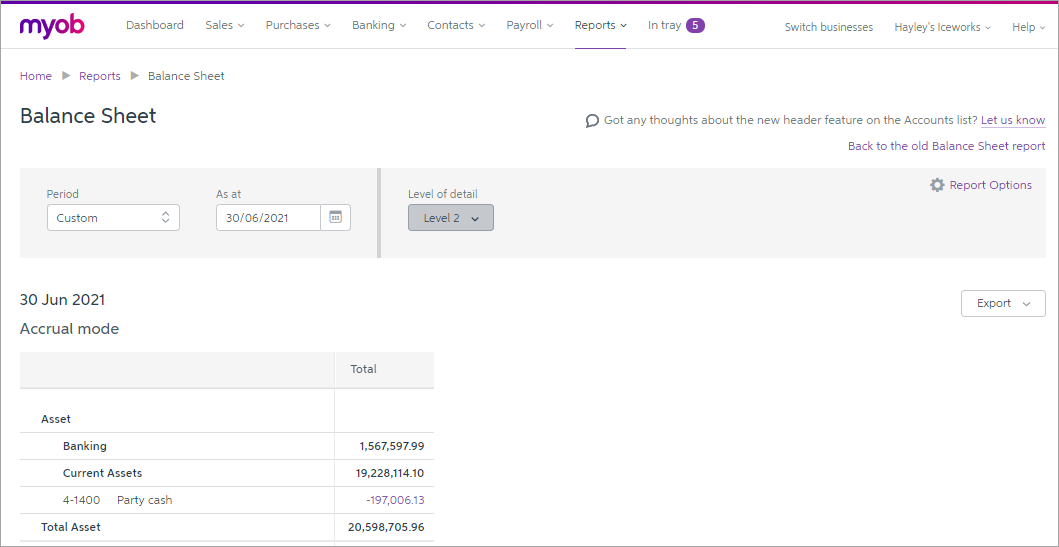

Enter end-of-year adjustments

After taking a look at your financial information, you or your accountant might need to make some adjustments to your records. In most cases, you'll enter these as journal entries. If you're missing any bank transactions (like deposits, withdrawals or bank charges), enter them on the Spend Money or Receive Money pages.

See General Journals for information about entering journal entries, or Spend money and Receive money for information about entering bank transactions.

| HTML |

|---|

<img src="/wiki/download/attachments/5668961/Line-09.png?version=1&modificationDate=1426207682000&api=v2" width="100%"><br> |

Lock the period (optional)

...

|