New Zealand only Payday filing means you no longer need to submit your employer deductions (IR 345) and employer monthly schedule (IR 348) to Inland Revenue (IR). But you can still access these reports in MYOB Essentials if you need them: | UI Expand |

|---|

| expanded | true |

|---|

| title | To view the IR 345 and IR 348 reports |

|---|

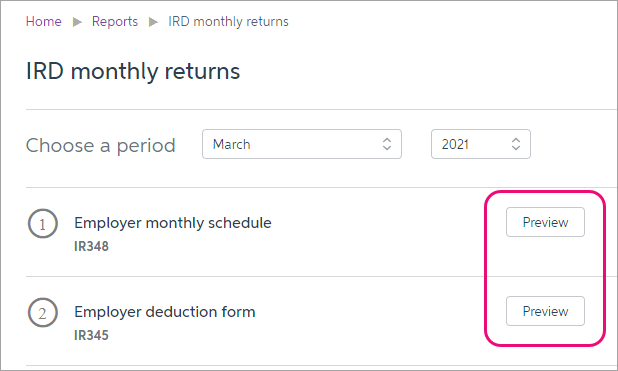

| - Go to the Reports menu and choose All reports.

- Under the Payroll heading, click to open IRD monthly returns.

In the Choose a period section, choose the month and year you want to view the reports for. Click Preview for the report you want to view.

|

|