Next, create some basic profiles for each of your employees so that you can pay them. At this point the profiles only need a name, an IRD number, and a bank account, but you can add more details later by opening the Modify Employee Details window.

| UI Expand |

|---|

| expanded | true |

|---|

| title | To add an employee |

|---|

| - From the front screen click Employee > Add A New Employee. Enter an identifier such as your employee’s initials, and click Go.

- Enter a short name. This can be a full name, or a nickname or a shortened version of their name (for example 'Tim', 'Timothy' or 'Tim Wilson'), then click Go.

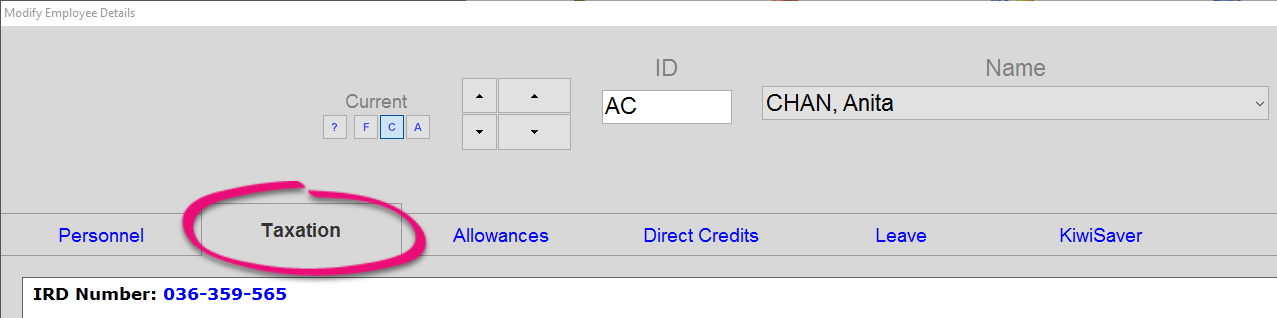

- From the front screen click Employee > Modify Employee Details > Taxation.

- Click IRD Number and enter your employee's IRD number, then click Go.

- If you are paying you employee electronically, click Direct Credits > Add > Account Number and enter your employee's bank details.

- Click Go.

|

| UI Button |

|---|

| color | green |

|---|

| size | large |

|---|

| title | Next step |

|---|

| url | http://help.myob.com/wiki/display/ace/7.+Add+allowances+and+deductions |

|---|

|

|