AccountRight Plus and Premier, Australia only Generally, if you pay an employee $450 or more before tax in a calendar month, you have to pay superannuation on top of their wages. The minimum you must pay is called the Superannuation Guarantee. - The super guarantee is currently 9.5% of an employee’s ordinary time earnings.

- You must pay super guarantee contributions to your employees' chosen superannuation funds at least four times a year, by the quarterly due dates (learn how to pay super).

- Super guarantee contributions are not reportable on your employees' payment summaries, but additional contributions may be, such as salary sacrifice. Check the ATO website for help working out if a contribution is reportable.

- If you need to contribute more than the 9.5% super guarantee, see <additional superannuation payments>.

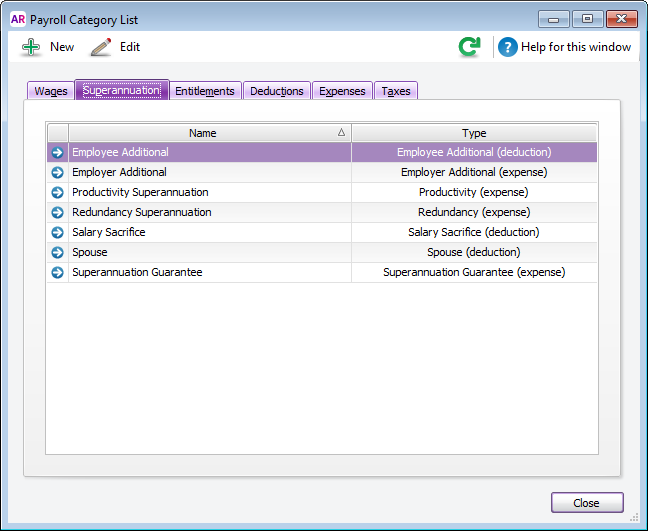

Superannuation categoriesAccountRight comes with a set of superannuation categories which you can use to calculate and track your employees' super payments. To view these categories, go to the Payroll command centre and click Payroll Categories then click the Superannuation tab.  Image Removed Image Removed

These superannuation categories can be set up to suit your needs, or you can create new ones. | UI Expand |

|---|

|