New Zealand only You can now lodge your GST return online, from within MYOB Essentials. MYOB Essentials will automatically complete your GST return for you, using the data you've entered throughout the period. You'll be able to check it, and make changes if you need to. Once you're happy with the figures, you can lodge the return with Inland Revenue, all without leaving MYOB Essentials. | UI Text Box |

|---|

| | Currently the GST lodgement report only supports the one-month and two-month taxable periods. The 6-month GST taxable period is currently not available for online lodgement. |

How does it work?Check out this short video for an overview of lodging your GST return online in MYOB Essentials. | HTML |

|---|

<script src="//fast.wistia.com/embed/medias/oiy8j35mhs.jsonp" async></script><script src="//fast.wistia.com/assets/external/E-v1.js" async></script><div class="wistia_responsive_padding" style="padding:56.25% 0 0 0;position:relative;"><div class="wistia_responsive_wrapper" style="height:100%;left:0;position:absolute;top:0;width:100%;"><div class="wistia_embed wistia_async_oiy8j35mhs videoFoam=true" style="height:100%;width:100%"> </div></div></div> |

| UI Expand |

|---|

| expanded | true |

|---|

| title | To lodge your GST return online |

|---|

| To lodge your GST return online- Click Reports in the MYOB Essentials menu bar, then choose All reports.

In the Business reports section, click GST Lodgement. If this report isn't listed, contact MYOB support. | UI Text Box |

|---|

| If it's the first time you're lodging your GST return through Essentials, |

you'll need to enter your login details and click Allow access to allow Essentials to lodge directly to the IRD. |

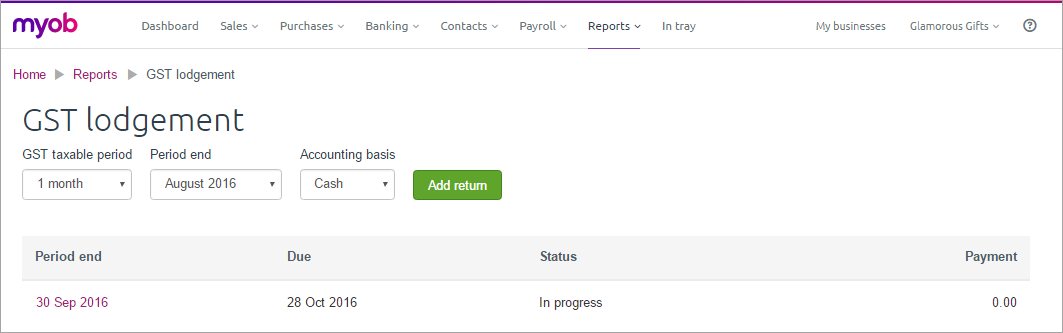

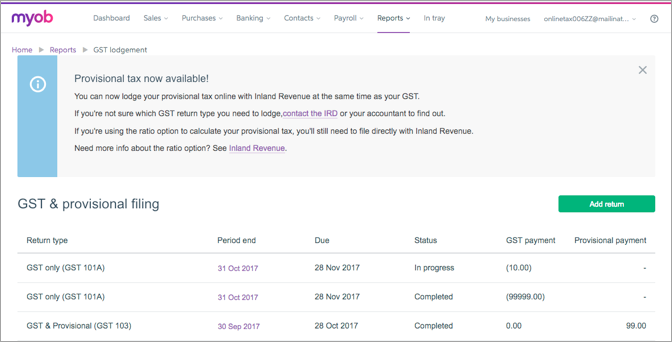

The GST lodgement page appears.

Image Removed Image RemovedIf you want to  Image Added Image Added To continue working with an on an existing return, click the date listed in the Period end column, then skip to step 5. Or, to To start a new return, select your criteria from the : - Click Add return. The Tax filing page appears.

Select your GST taxable period, Period end and Accounting basis

drop-down lists at the top of the page. Note that the 6 month GST taxable period option is not yet available.

Then click Add return to create the new return.

The Goods and services tax return page appears. | UI Text Box |

|---|

| Can't select a month in Period end? If you've prepared a GST return for a previous period, that period won't appear in the Period end drop down list. |

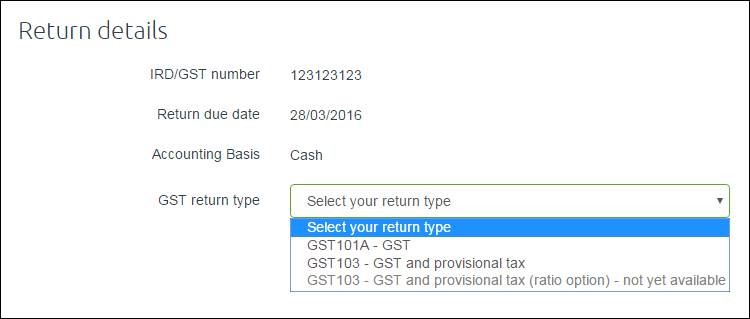

In Return details,  Image Added Image Added

Click Create.

The Goods and services tax return page appears. - If you haven't already, enter your IRD/GST number and select your GST return type dropdown menu.. The return appears, pre-filled with the amounts from MYOB Essentials.

Image Modified Image Modified

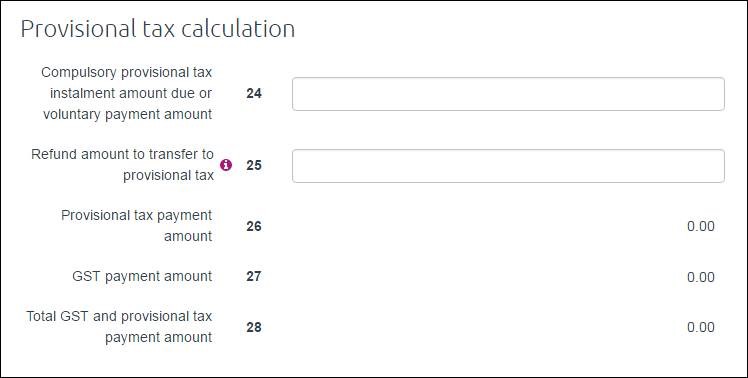

Note that if you're working with return type GST103, you need to enter information in fields 24 and 25. See the IRD GST Guide for more information on these fields.

Image Modified Image Modified

- If you need to correct any amounts on the return, click in the fields and type the new amounts.

- (Optional) To save your changes (if you want to complete the return later) click Save.

- When you're happy with the return, click Validate to check the figures.

You'll need to fix any errors before you can lodge the return. - Once the return is validated and you don't want to make any more changes, click Finalise.

The status will display Completed meaning the return is now ready to be lodged with Inland Revenue. - When you're ready to lodge your GST return with Inland Revenue, click File.

A pop-up will appear confirming the filing. - Click Confirm, and you'll be taken to the IRD website.

Enter your myIR user ID and password. - Click Authorise to complete the filing.

Once you've lodged your return, pay any outstanding amounts to the IRD. After you've paid your GST or received your refund, you'll need to record the payment in MYOB Essentials. See Recording IRD payments and credits. |

|