MYOB Essentials, Australia only The final step to set up Single Touch Payroll is to connect to the ATO. This is where you let the ATO know you're using MYOB software. | Checklist |

|---|

| - Make sure you're connected to the internet

- Sign in to your MYOB account (you'll be prompted to do this automatically if you open MYOB Essentials). If you don't have an MYOB account, you'll need to get one

|

Learn how to connect to the ATO| HTML |

|---|

<iframe width="560" height="315" src="https://fast.wistia.com/embed/medias/vw4t16r7x8" frameborder="0" allowfullscreen></iframe> |

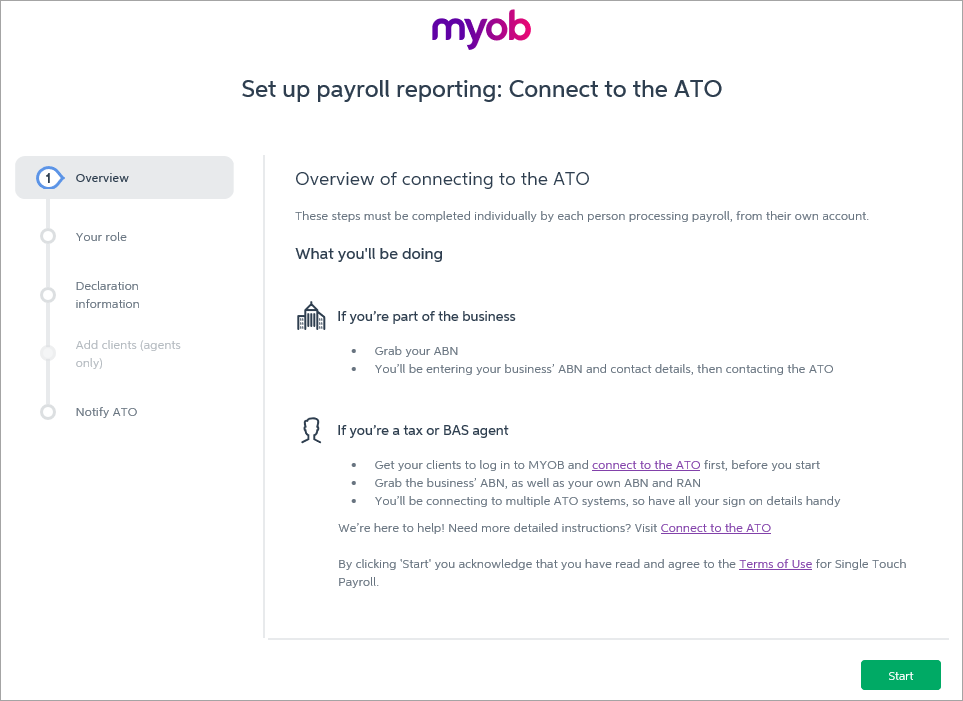

Who needs to complete these steps?Only the person setting up Single Touch Payroll will need to connect to the ATO for STP. Additional users will need to add themselves as declarers before they can send payroll information to the ATO. They can do this when they go to Payroll > Payroll Reporting after you have connected to  Image Removed Image Removed

| UI Expand |

|---|

| expanded | true |

|---|

| title | To connect to the ATO |

|---|

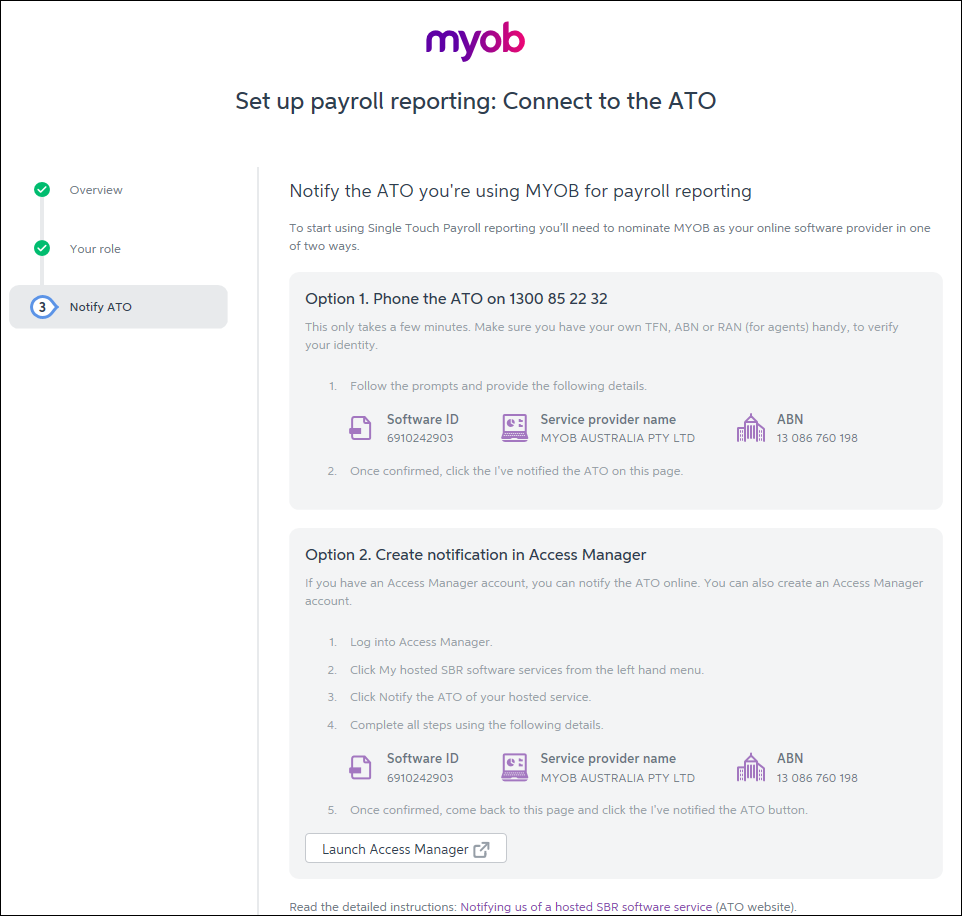

| To connect to the ATO- Go to Payroll > Payroll Reporting.

- Click Connect to ATO.

- If prompted, click Check Payroll Details to fix any issues with your payroll setup.

- Click Start and follow the prompts to complete the ATO connection.

Image Modified Image Modified

|

See the table below for guidance on who needs to complete each step. |

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.