To deduct child support payments from an employee's pay, you'll need to set up a deduction pay item in MYOB Essentials. You then assign the pay item to the employee. The rules governing child support differ in Australia and New Zealand, so it's a good idea to know your obligations. In Australia, the Department of Human Services website is a good place to start. In New Zealand, check the IRD website. Let's step you through how to set up a child support deduction, assign it to an employee, then what it looks like when you process a pay. | UI Expand |

|---|

| title | 1. Set up a child support pay item |

|---|

| 1. Set up a child support deduction pay item| UI Expand |

|---|

| Set up a child support deduction pay item (Australia)- Go to the Payroll menu and choose Pay items. The Pay items page appears.

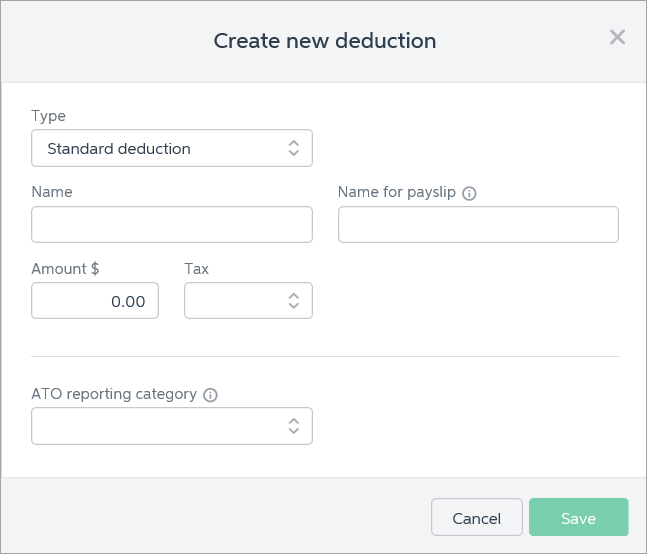

- Click Create deduction. The Create new deduction window appears.

Select the Standard deduction Type. Enter the deduction Name, such as "Child support". If you'd like a different, more personalised, name to show on payslips for this deduction, enter a Name for payslip, such as "Child support - Steven". Enter the deduction Amount. This can be changed when you process your pays. In the Tax field, choose whether the deduction is Before tax or After tax. If unsure, check with your accounting advisor or the ATO. Select the applicable ATO reporting category for Single Touch Payroll. If unsure, check with your accounting advisor or the ATO. Learn more about Assign ATO reporting categories for Single Touch Payroll. Here's our example of a child support deduction pay item:

- Click Save.

You can now assign this pay item to the applicable employee - see the next task for details. |

| UI Expand |

|---|

| Set up a child support deduction pay item (New Zealand)- Go to the Payroll menu and choose Pay items. The Pay items page appears.

- Click Create deduction. The Create new deduction window appears.

Select the Child support deduction Type. Enter the deduction Name, such as "Child support". If you'd like a different, more personalised, name to show on payslips for this deduction, enter a Name for payslip, such as "Child support - Steven". Enter the Default amount per pay (New Zealand). | UI Text Box |

|---|

| You can override this amount for an employee on the employee page. |

Skip the Tax field – it's automatically set to After tax and cannot be changed. Here's our example of a child support deduction pay item:

- Click Save.

You can now assign this pay item to the applicable employee - see the next task for details. |

|

| UI Expand |

|---|

| title | 2. Assign the pay item to an employee |

|---|

| Assign the pay item to an employeeTo include the child support pay item in an employee's pay, you need to assign it to them. Here's how: - From the Payroll menu, choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

- In the Deductions section, click the dropdown arrow next to the Add deduction... field.

- Choose the child support pay item, then click Save.

| UI Text Box |

|---|

| (New Zealand only). You can also override the default amount for the employee – just enter a new figure in the Amount field. |

Next time you process a pay, the child support deduction will be listed for the employee. See the next task for details. |

| UI Expand |

|---|

| title | 3. Process a pay with a child support deduction |

|---|

| Process a pay with a child support deduction After you've assigned a child support deduction pay item to an employee, it'll appear in their pay. Let's take a look: - Go to the Payroll menu and choose Enter Pay.

Select the employee to be paid then click Start Pay Run.

The child support deduction is shown. Here's our example:

| UI Text Box |

|---|

| Protected net earnings (New Zealand) The child support deduction amount cannot be changed in the pay run. Based on the employee's pay, the child support amount may automatically reduce to protect minimum earnings. Learn more about protected net earnings on the IRD website. |

- Continue processing the pay as normal. Amounts deducted are allocated to your payroll deductions account, ready to be paid to the applicable governing body.

|

What happens to the deducted money?In Australia, child support deductions need to be paid to the Department of Human Services (learn about their payment options). In New Zealand, child support payments are paid to the IRD at the time of reporting your Employer Monthly Schedule (IR 348). Learn more about Payroll IRD monthly returns. You can make a record of these payments in MYOB Essentials using a Spend money transaction (Banking menu > Spend money). Here's an Australian spend money example for child support payments that have been paid to the Department of Human Services. Note the following: - In the Pay from account we've chosen the MYOB Essentials bank account the payment is coming from.

- In the To field we've chosen who the payment went to (we set up a supplier record for this purpose).

- In the Allocate to field we've chosen the MYOB Payroll Deductions account.

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | Can I change the account my deductions are allocated to? |

|---|

| Can I change the account my deductions are allocated to?Deductions withheld from pays are allocated to a liability account in MYOB Essentials called Payroll deductions. This is a system account which cannot be changed. You can find this account by clicking your business name and choosing Accounts list, then scrolling down to Liability > Current Liabilities. |

| UI Expand |

|---|

| title | What if the deduction amount varies between employees? |

|---|

| What if the deduction amount varies between employees?If you're in New Zealand, you can set a different amount for employee deductions when assigning pay items. In Australia you can either: |

|