When you prepared your payment summaries, you might have saved them as PDF documents. If so, you can simply open the saved PDF and print it again. If you didn't save PDF copies (or you can't find them), print them again from the PAYG Payment Summary Centre. | UI Expand |

|---|

| expanded | true |

|---|

| title | To reprint a payment summary |

|---|

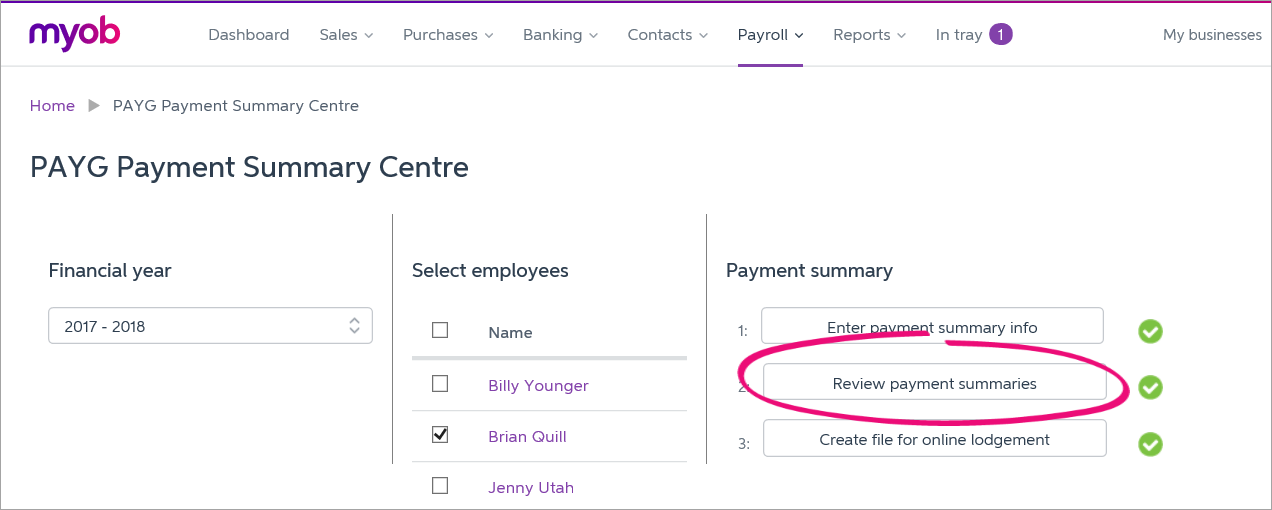

| To reprint a payment summaryGo to the Payroll menu and choose PAYG payment summaries. Choose the Financial year for the payment summaries you want to reprint. Select the employee whose payment summay you need to reprint. - Click Review payment summaries. If this button isn't clickable, make sure you've selected the correct Financial year, and that you have previously completed the payment summaries for that year.

Image Added Image Added - Click the PDF

Image Added icon in the right hand column to display the payment summary in a PDF viewer window. Image Added icon in the right hand column to display the payment summary in a PDF viewer window. - In the PDF viewer window, click the print

Image Added button or go to the File menu and choose Print. Image Added button or go to the File menu and choose Print.

| UI Text Box |

|---|

| | We recommend also saving the payment summary for your records, and just in case you need to print it again. |

|

|