| HTML |

|---|

<!--Product families-->

<div style="display: none;" data-swiftype-name="productFamily" data-swiftype-type="enum">Accountants Office Suite</div>

<div style="display: none;" data-swiftype-name="productFamily" data-swiftype-type="enum">Accountants Enterprise Suite</div>

<!--Countries-->

<div style="display: none;" data-swiftype-name="country" data-swiftype-type="enum">Australia</div>

<!--Product capabilities-->

<div style="display: none;" data-swiftype-name="productCapability" data-swiftype-type="enum">AO Tax (AU)</div>

<div style="display: none;" data-swiftype-name="productCapability" data-swiftype-type="enum">AE Tax Series 6 & 8 (AU)</div>

<div style="display: none;" data-swiftype-name="productCapability" data-swiftype-type="enum">AE Tax (AU)</div>

|

| div |

|---|

| ARTICLE LAST UPDATED: | Page Information Macro |

|---|

| modified-date |

|---|

| modified-date |

|---|

|

|

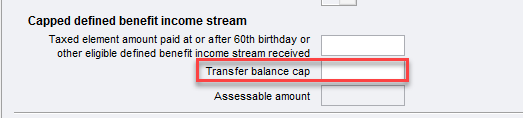

In MYOB Tax version 2018.0 when calculating the tax-free element for Item 7 : Australian annuities and superannuation income streams, the system does not include the $100,000 benefit cap. This happens if you have not completed the new field at Item 7 - Transfer balance cap. You'll need to complete this item for the correct calculation.  Image Removed Image Removed

What value do I need to enter in the Transfer balance cap label?Use the the ATO calculator : Defined benefit income cap tool to calculate the amount and enter it in MYOB. | UI Text Box |

|---|

| If you are getting a PLS rejection: CMN.ATO.IITR.000666, check your amounts at Item 7 : Australian annuities and superannuation income streams and Item T2 - Australian Super income stream |

| UI Text Box |

|---|

| There is currently an issue if you have more than one payment summary. Enter the correct value in one of the schedules by calculating the Transfer balance cap using the ATO calculator Defined benefit income cap tool. Make sure the value in MYOB matches the ATO calculator. |

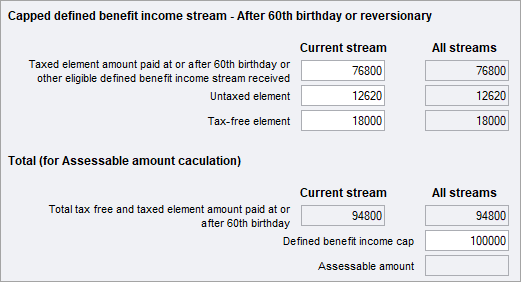

The ATO has made some changes to the way capped defined benefit income streams are taxed. From July 1 2017, if the total income from all capped defined benefit income streams is more than the Defined benefit income cap for the year, you might have some additional tax to pay. Any tax-free or taxed element amounts received from a capped defined benefit income stream over the Defined benefit income cap at or after the taxpayer's 60th birthday, is treated as assessable income. If the taxpayer is: 60 years of age or over; or 59 years of age or less and receiving a pension from a spouse who was over 60 when they died,

you'll need to complete the Capped defined benefit income stream – After 60th birthday or reversionary fields of the Annuities and superannuation income stream (asi) worksheet. | UI Expand |

|---|

| title | Step 1: Complete the Capped defined benefit income stream – After 60th birthday or reversionary fields |

|---|

| - Open the individual tax return and click any label at item 7 to open the Annuities and superannuation income stream (asi) worksheet.

- Choose the Type of Payment then enter the Payer's name, ABN and the Total tax withheld.

- In the Capped defined benefit income stream – After 60th birthday or reversionary fields, enter the:

- Taxed element

- Untaxed element

- Tax-free element

Any amounts entered at Taxed element amount paid at or after 60th birthday or other eligible defined benefit income stream received or Tax-free element also appears in the Total tax free and taxed element amount paid at or after 60th birthday field to calculate any assessable income.  Image Added Image Added

|

| UI Expand |

|---|

| title | Step 2: Work out the Defined benefit income cap and assessable amount |

|---|

| For most taxpayers, the defined benefit income cap is $100,000. However, for some individuals this amount is less – for example, if you started receiving income from a capped define benefit income stream part-way through the year, the cap may be pro-rated. To work out the Defined benefit income cap for the year, use the ATO Defined benefit income cap tool. Any Assessable amounts are then shown at item 7 label M. |

| UI Expand |

|---|

| title | Step 3: Apply the T2 - Australian superannuation income stream offset |

|---|

| - At item T2 - Australian superannuation income stream, click label S. The Annuity and Super Income Stream Offset window appears.

- Choose the reason for offset.

- Enter the Taxed, Untaxed and Tax-free amounts.

Image Added Image Added - Click OK. The tax offset calculates.

- Click Close. The offset (if applicable) appears at Item T2 label S.

|

For more information see Item 7 - Australian annuities and superannuation income streams 2019 on the ATO website.

| div |

|---|

| MYOB INTERNAL STAFF ONLY Insert PR# 159202379683 SR# 159192780547 Use PR# 162039823120 when there is multiple payment summaries. Use the ATO calculator Defined benefit income cap tool to make sure the value in MYOB Tax matches the ATO calculator. |

| div |

|---|

| MYOB INTERNAL STAFF ONLY Insert PR# 159202379683 SR# 159192780547 Use PR 162039823120 when there is multiple payment summaries. |

|