Australia only Additional super contributions can be: Need to fix overpaid or underpaid super? See Checking and adjusting superannuation. | UI Text Box |

|---|

| Check the rules Super contributions above the compulsory superannuation guarantee might be reportable to the ATO. To check if a contribution is reportable, see the ATO's guidelines or speak to your accounting advisor. |

Employee additional superIf an employee wants to contribute one or more extra payments to their super fund from their net (after-tax) pay, here's how to do it. | UI Expand |

|---|

| title | To set up employee additional super |

|---|

| To set up employee additional super- From the Payroll menu, choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

- Under Deductions, click Add deduction then choose Create new deduction.

- Set up the deduction:

- For the Type, select Super personal contribution.

- (Optional) Change the Name for this deduction.

- If you'd like a more personalised name to show on payslips for this deduction, enter a Name for payslip, such as "Additional super - Steven".

- Enter the Amount of super to be deducted each pay. If the amount varies each pay, leave this at $0.00. You'll be able to enter or change the amount deducted when processing the pay.

The ATO reporting category will default to Not reportable and cannot be changed.

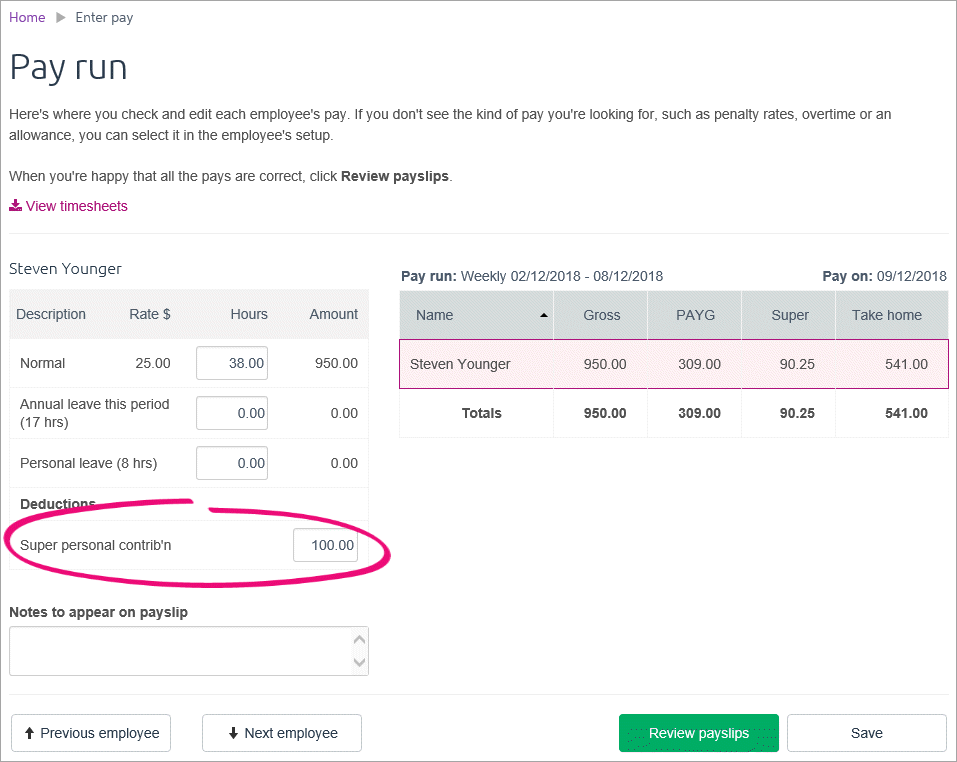

Here's our example:

- Click Save. The deduction is listed for the employee.

- Click Save to finish the setup.

Paying the additional superWhen you do a pay run for this employee, enter or change the deduction amount.

| UI Text Box |

|---|

| One-off super payments For one-off additional super payments, complete the steps above. Then after making the payment, unlink the pay item from the employee so it no longer appears on their pay. |

|

Employer additional superIf you as an employer contribute more than the the ATO's compulsory super guarantee rate, this is called employer additional super. It's a tricky area because some employer additional superannuation contributions need to be reported to the ATO (known as reportable employer super contributions RESC). For clarification, check the ATO's guidelines or speak to your accounting advisor. If your employer additional super is: - not reportable - you can enter the increased Super guarantee rate against each employee (Payroll > Employees > click the employee > Superannuation tab). Here's an example:

- reportable - you won't be able to set up these employer additional super contributions in MYOB Essentials. This is because MYOB Essentials can't determine the reportable portion of the employee's super which is above the compulsory super guarantee rate. But all is not lost! Speak to your accounting advisor about your options, or ask the experts on the community forum.

|