Australian companies only. You can use this form to register Australian company for an ACN. If required, you can also register an ABN and TFN in this form. There are five tasks to registering a company in MYOB Practice. - Choosing a company name and entering the company details

- Appointing officers and directors

- Establishing a share structure

- Registering for ATO obligations

- Declaration and lodgement

| UI Expand |

|---|

| title | Step 1: Enter company details |

|---|

| - Enter the Date of the application. This is pre-populated with today's date. If you need to backdate it, you can select another date.

- Select either Yes or No to the question Do you wish to use the Australian Company Number (ACN) for its name?

Select the legal elements that apply for the company. Select which Australian state or territory the company will be registered in. | UI Text Box |

|---|

| Your company will still be registered Australia-wide however, you must nominate a state or territory when submitting your application. |

Answer either Yes or No to the following questions. Depending on your selection, you may have additional fields to complete. | Is this company a special purpose company? | If you answer Yes: - Select the subclass of the propriety company. The options are Superannuation trustee or charitable purposes only.

- Click I declare that this company is a special purpose company as defined under Regulation 3 of the Corporations (Review Fees) Regulations 2003 to accept the declaration.

|

|---|

| Is the proposed name identical to a registered business name? | If you answer Yes: - Click "If yes, I declare that I hold, or am registering the company for the holder(s) of, the identical business name(s), the registration details of which are listed below. and The proprietor of the business name must be represented as a company officer or member."

- Answer either Yes or No to Does the registered business name have an ABN?.

- If you choose Yes,enter the ABN of the business name in the field.

- If you choose No, enter the Registration number of the business and select the state or territory the business name is registered in.

|

|---|

| Will the company have an ultimate holding company upon registration | If you answer Yes: - Enter the name of the holding company (including legal elements) in the Holding company name field.

- Enter the holding company's ACN or ARBN.

- Select the Country of incorporation.

|

|---|

Enter the Registered office address in the Search Address field. As you type, a list of addresses appear matching the address. When the correct address appears click the address to automatically populate the Street address, Country, State and Suburb fields. | UI Text Box |

|---|

| This is where all ASIC communications to the company is be sent. This must be an Australian address and it can't be a PO Box. |

Answer either Yes or No to the following questions. Depending on your selection, you may have additional fields to complete. | Will this company be the sole occupier of this address? | If you answer No: - Enter the Name of Occupier in the field provided.

|

|---|

| Will this company use this address as principal place of business? | If you answer No:- Enter the main business address in the Search Address field of the Principal place of business panel. As you type, a list of addresses appear matching the address. When the correct address appears click the address to automatically populate the Street address, Country, State and Suburb fields.

|

|---|

Click Next step.

|

| UI Expand |

|---|

| title | Step 2: Appoint company officers |

|---|

| - Click + Add new officer. The Search for new officer field appears.

- To appoint an existing MYOB contact as an officer for this organisation, type the name of the contact in the Search for new officer field.

- To create a new contact and appoint them as an officer for the organisation, click + Create new officer.

Enter the personal details such as First name, Last name, Date of birth, Country of birth and Street address. To enter the officeholder's street address: Type the address in the Search address field. A list of valid address suggestions appear. Select the correct address from the list of suggestions. The Street address, State and Suburb fields populate.

| UI Text Box |

|---|

Overseas address? Click Manually enter address and enter the Street address, Country and Locality (i.e. suburb, province or region) in the relevant fields. |

Select Director, Secretary and/or Primary contact. | UI Text Box |

|---|

An officer can occupy more than one role. For example, they could be a director and a secretary. A propriety company must have: - one director

- one Australian resident director

- one primary contact

|

- Click Add officer. The officer appears in the list.

- Click Next step.

|

| UI Expand |

|---|

| title | Step 3: Establish shareholders |

|---|

| Officers appear in the Shareholders list by default. If the officer is not a shareholder, click the ellipses button in the last column and choose Delete to remove them from the list. Enter the following information for each shareholder. | Field | Description |

|---|

| Share code | Select the class of shares the shareholder holds. | | Total shares | Enter the total number of shares the shareholder holds for the selected share class. | | Total paid | Enter the total amount paid for all shares | | Total unpaid | Enter the total amount unpaid for all shares | | Beneficially held | Select whether the shares are beneficially held by the shareholder. | | Beneficial owner (if applicable) | Enter the name of the beneficial owner. |

| UI Text Box |

|---|

If a shareholder holds multiple classes of shares, click in the next blank row for the shareholder and fill in the details. |

Add additional shareholders by clicking + Add new shareholder. - To appoint an existing MYOB contact as a shareholder, type the name of the contact in the Search for new shareholder field.

- To create a new contact and appoint them as a shareholder, click + Create new shareholder and fill in their details.

- Click Next step.

|

| UI Expand |

|---|

| title | Step 4: Register for ATO obligations |

|---|

| - Select the obligations to register the company for. You may have additional fields to complete depending on your selection.

Complete the fields for each section. Once complete, click Next Step. | UI Text Box |

|---|

A registration form for these obligations is lodged to the ATO at the same time as the company registration is lodged to ASIC. If you choose any of the above, registration for TFN is also created. To register for one obligation only, visit the ATO website. |

|

| UI Expand |

|---|

| title | Step 5: Review and lodge |

|---|

| - Review the company, shareholder and officeholder information. To edit information, click Edit details at the top-right of the section.

- Read the declaration and select the checkbox to agree to the terms.

- Click Lodge form. The 201 - Application for registration as an Australian Company registration form is submitted to ASIC, and any ATO registrations selected at step 4 are submitted to the ATO for processing.

| UI Text Box |

|---|

| Sometimes company registrations can take longer than expected. This usually occurs when ASIC manually review the application as the company name might not meet their guidelines. You can view the Company name availability guidelines on the ASIC website. |

|

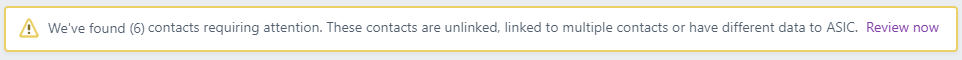

Once the company is registered...After ASIC accepts your application to register a company. You'll receive the following message on the Client lodgements page:

All you need to do now is link your new company, their officers and members to their corresponding AE/AO contact record. | UI Expand |

|---|

| - Click Review Now in the alert. The Review contacts page opens.

For each contact listed under Unlinked ASIC contacts, click Link contact. Enter the name of the contact as is in AE/AO. If no contact exists in AE/AO, click Create new contact and fill in their details. | UI Text Box |

|---|

| If you use AE/AO, we'll also create this contact in AE/AO. It can take up to 5 minutes for new contacts to appear in your AE/AO contacts list. |

- Repeat steps 2 and 3 for each unlinked contact. When all contacts are linked, click Save and close.

|

|