...

| UI Expand | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||

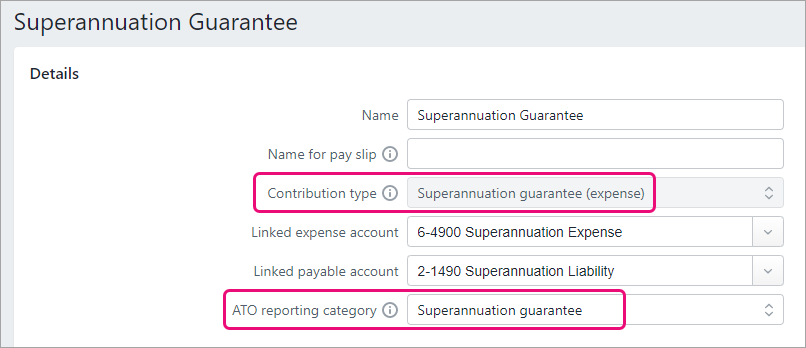

An ATO reporting category is required for each superannuation pay item. The ATO reporting categories you can choose from is based on the superannuation Contribution type. Here's the available ATO reporting categories for superannuation.

|

...

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.