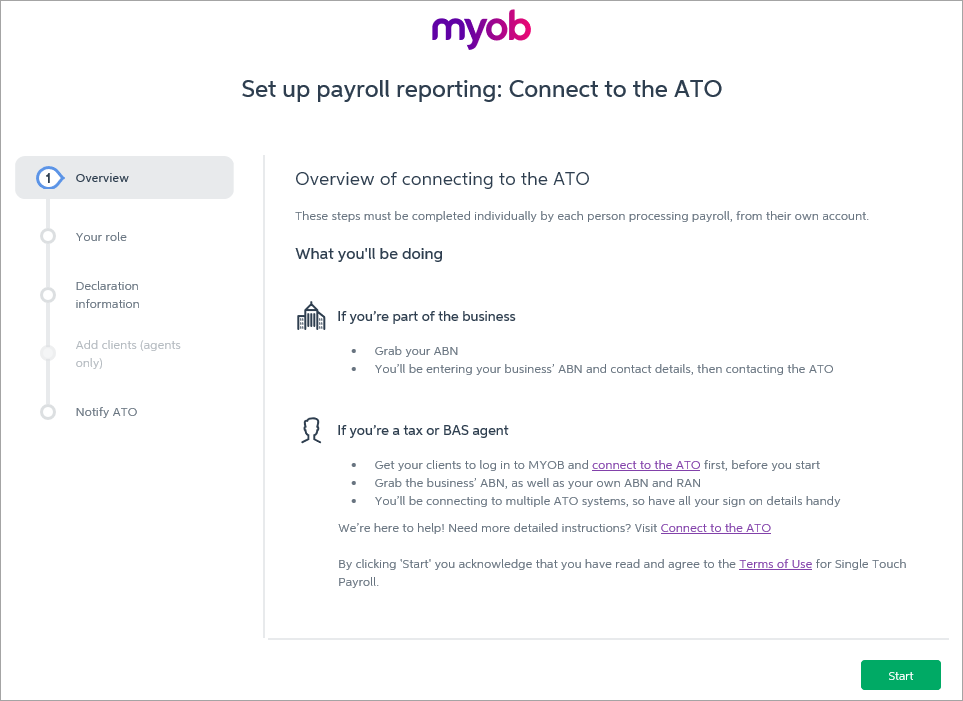

The final step to set up Single Touch Payroll is to connect to the ATO. This is where you let the ATO know you're using MYOB software. | Checklist |

|---|

| - Make sure you're connected to the internet

- Sign in to your MYOB account (you'll be prompted to do this automatically if you open MYOB Essentials). If you don't have an MYOB account, you'll need to get one

|

Learn how to connect to the ATO| HTML |

|---|

<iframe width="560" height="315" src="https://fast.wistia.com/embed/medias/vw4t16r7x8" frameborder="0" allowfullscreen></iframe> |

Who needs to complete these steps?Only the person setting up Single Touch Payroll will need to connect to the ATO for STP. Additional users will need to add themselves as declarers before they can send payroll information to the ATO. They can do this when they go to Payroll > Payroll Reporting after you have connected to the ATO To connect to the ATO- Go to Payroll > Payroll Reporting.

- Click Connect to ATO.

- If prompted, click Check Payroll Details to fix any issues with your payroll setup.

- Click Start and follow the prompts to complete the ATO connection.

See the table below for guidance on who needs to complete each step. | Steps |

I process payroll for the business |

I am a tax or BAS agent who works with the business |

|---|

| 1. Overview |  Yes Yes |  Yes Yes |

|---|

2. Your role |  Yes Yes |  Yes Yes |

|---|

- Someone from the business

- If you are not a tax or BAS agent, but process payroll for the business, choose this option. There are extra steps that a tax or BAS agent must do, that you don't have to.

| If you are a registered agent, there are a few extra steps you'll need to complete to set up. | UI Text Box |

|---|

| We recommend getting your client to go through these steps first, before you do this. |

| | 3. Declaration information |  Yes Yes |  Yes Yes |

|---|

Each person who processes payroll must enter their details. This is so we can identify who can sign the declaration when sending payroll reports to the ATO. New staff members will be prompted to enter their details when they go to Payroll > Payroll Reporting after you have connected to the ATO. | | 4. Add clients (agents only) |  No No |  Yes Yes

If this hasn't been done already. This is done outside of MYOB in the tax or BAS agent portal. |

|---|

| 5. Notify ATO |  Yes YesOnly one person from the business needs to notify the ATO. You'll need your unique Software ID which is provided in the software, during this step. Learn how to notify the ATO. |  Yes Yes

If you're a tax or BAS agent you must notify the ATO that you're using MYOB for payroll reporting for this business. Learn how to notify the ATO. |

|---|

What happens after I've connected to the ATO?Once you've connected to the ATO, your payroll information will be automatically sent to the ATO the next time you process payroll. |