Australia only Some industries, including building and construction, cleaning or courier services, or government entities, are required to report to the ATO the amount of payments made to contractors for services (such as labour). Payments need to be reported to the Australian Taxation Office (ATO) on the Taxable Payments Annual Report, or electronically. Do I need to report payments?There's a growing list of businesses which may need to report payments. To check the list, visit the ATO website. What transactions do I need to report?You need to report the total payments you make to each contractor or supplier for building and construction services each year. This doesn’t include payments for materials, but you should report any transactions that include a service component. For example, you would be required to report a transaction involving the purchase of paint alongside painting services. For more information, see the ATO website. What do I need to do?At the end of the financial year, you need to produce the Taxable payments annual report to declare all of your taxable payments to the ATO. To be able to produce the report, you need to follow the setup steps below. For information about producing the report, see Producing the Taxable payments annual report. | UI Expand |

|---|

| title | To set up reportable contractor payments |

|---|

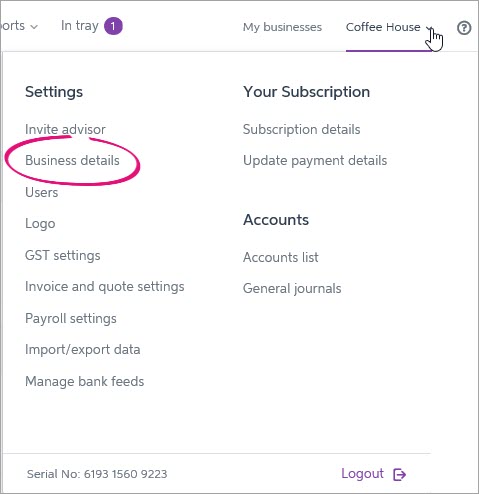

| To set up reportable contractor paymentsIf you need to report your taxable payments: - Click your business name and choose Business details.

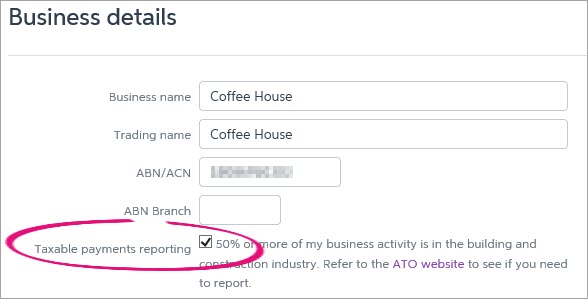

- Select the Taxable payments reporting option.

- Click Save.

MYOB Essentials will now allow you to mark contacts and transactions as reportable (see below). |

| UI Expand |

|---|

| title | To mark contacts as reportable |

|---|

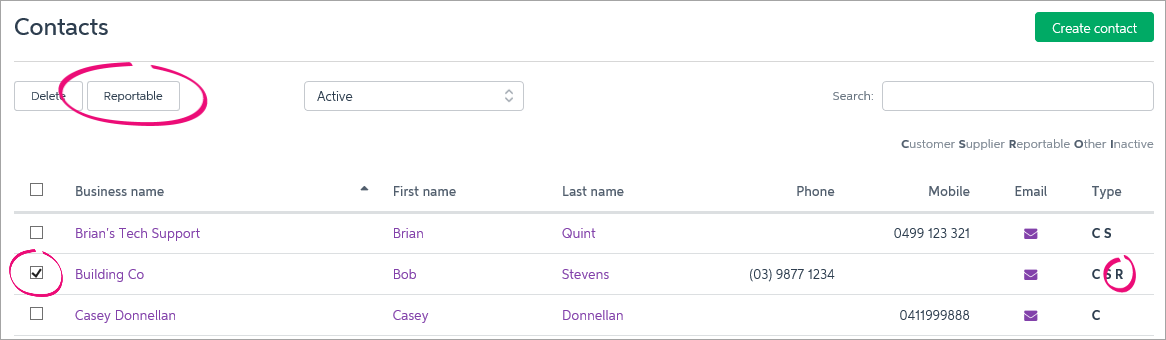

| If most of your transactions with a particular contact are reportable, you can save time by marking the supplier as reportable. When you do this, all transactions involving this contact will be automatically marked as reportable. If you need to, you’ll be able to change whether an individual transaction is reportable (see To mark transactions as reportable or not reportable below). - Go to the Contacts menu and choose View contacts.

- Select the contacts you want to make reportable by clicking in the checkbox next to their name.

- Click Reportable. The contacts are marked as reportable, and the letter R appears in the Type column.

|

| UI Expand |

|---|

| title | To mark transactions as reportable or not reportable |

|---|

| To mark transactions as reportable or not reportableWhen you're entering a bill, if the Reportable option is selected it means the transaction is reportable. Deselect this option of the transaction isn't reportable.

|

|