Australia only | UI Text Box |

|---|

| Last updated 1 September 2020 JobKeeper has been extended through to 28 March 2021, but this doesn't impact JobKeeper payments until after 28 September 2020. We'll update this help topic in time for these changes. Make your monthly JobKeeper declaration before 14 September to claim JobKeeper payments made to employees in August. See the ATO website for more dates and details. |

JobKeeper is a government scheme to help businesses continue paying their employees. Eligible employers will be reimbursed a fixed amount of $1500 per fortnight (before tax) for each eligible employee. To be eligible for the JobKeeper payment, employers and their employees must meet a range of criteria. For eligibility criteria for you and your employees, and all the details on the JobKeeper scheme, visit the ATO website. For the latest information about ATO COVID-19 support for your business, visit ato.gov.au/coronavirus | UI Text Box |

|---|

| Before completing any of the setup tasks below, you'll need to enrol for JobKeeper with the ATO. |

Setting up JobKeeper payment in MYOB Essentials Once you've completed the enrollment process, you can set up the following in MYOB Essentials: - a new income account - for receiving JobKeeper payments from the government

- a new allowance pay item - to report your employees JobKeeper payments via Single Touch Payment

- inform the ATO - you need to notify the ATO that you've started paying JobKeeper to eligible employees.

We'll start by creating an income account that you can use to account for the JobKeeper reimbursements from the government. | UI Text Box |

|---|

| If the version of MYOB Essentials you're using doesn't have a Banking menu, you can skip this step. |

| UI Expand |

|---|

| title | 1. Set up an income account to receive JobKeeper payments |

|---|

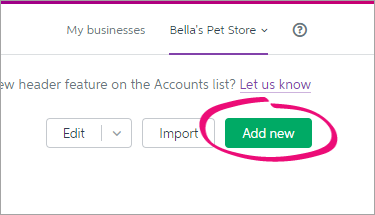

| 1. Set up an income account to receive JobKeeper payments - Click your business name and choose Accounts list.

- Click Add new. The Add new box appears, in the Accounts tab.

Enter a unique Account Number. | UI Text Box |

|---|

| Don’t use your real account number for bank and credit card accounts The number you enter here is only used for tracking the account in MYOB Essentials. You don’t need to use your real bank or credit card account number. |

- Enter the Account Name as JOBKEEPER SUBSIDY NO GST.

- Choose Income from the Account Type list.

- Choose NTR from the Tax Rate list.

- Click Save to add the accounts.

Here's our example:

|

| UI Expand |

|---|

| title | 2. Set up the JobKeeper pay item |

|---|

| You can now set up the required pay item to ensure JobKeeper payments are reported correctly to the ATO. This pay item will be used for employees earning less than the JobKeeper payment amount, or those who've been stood down. These employees are required to be paid a top-up to bring their taxable gross to $1,500 per fortnight. The new pay item must be named: JOBKEEPER-TOPUP. | UI Expand |

|---|

| title | Set up the JobKeeper TOPUP pay item |

|---|

| Set up the JobKeeper top-up pay item- Go to the Payroll menu and choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

- Under Earnings, add a new earning called JOBKEEPER-TOPUP.

- Select the option, JobKeeper top-up payment. The following fields are automatically completed:

- Decide whether you need to Pay super on this earning.

As per the government's information, you must pay super on an employee's regular pay amount, but you can choose whether to pay super on top-up amounts. Take a look at these examples for fortnightly paid employees: | Regular fortnightly income | Fortnightly income with JobKeeper | You must pay super on | You can choose to pay super on |

|---|

| $1000 | $1500 | $1000 | $500 | | $1500 | $1500 | $1500 | N/A | | $3000 | $3000 | $3000 | N/A |

- Here's our example pay item:

- Click Save. The new earning is now listed for the employee.

- Click Save to save your changes to the employee.

- Click the name of another employee that will receive JobKeeper.

- Click the Pay items - earnings & deductions tab.

- Under Earnings, choose the JOBKEEPER-TOPUP pay item.

- Click Save.

- Repeat steps 10 to 13 for every employee that will be receiving JobKeeper.

|

|

| UI Expand |

|---|

| title | 3. Notify the ATO of the start date for eligible employees |

|---|

| 3. Notify the ATO of the start date for eligible employeesWhen you're ready to start paying an employee JobKeeper payments, there's a simple step you need to do to let the ATO know via Single Touch Payroll. Go to the Payroll menu and choose Payroll Reporting. Click the JobKeeper payments tab.

- Choose the applicable Payroll year.

- Select an eligible employee

In the First JobKeeper fortnight list, choose the relevant fortnightly period during which your employee started receiving JobKeeper. Repeat for each eligible employee.

Once you've selected all eligible employees, click Notify the ATO. - When prompted, enter the name of the authorised sender and click Send.

| UI Text Box |

|---|

| If an employee becomes ineligible during the JobKeeper scheme, you'll need to create a new pay item to inform the ATO. See the FAQs below for details. |

|

Paying employees during JobKeeperThe pays you complete under the JobKeeper scheme will look quite similar to any other pay day, but with these changes: For employees who: - earn more than the JobKeeper payment, enter their pay as you normally would and record their pay against Normal

- earn less than the JobKeeper payment, enter a value against the JOBKEEPER-TOPUP pay item to bring their pay up to the minimum of $1500 a fortnight

- have been stood down, enter the full JobKeeper payment against the JOBKEEPER-TOPUP pay item.

| UI Text Box |

|---|

| If it's your first pay under JobKeeper, make sure you notify the ATO in the Single Touch Payroll reporting centre that you're starting to pay JobKeeper to all eligible employees. For details, see task 3 'Notify the ATO that you're starting to pay JobKeeper'. |

Now, let's establish the JobKeeper payment amounts you'll need to pay (before tax) based on an employee's pay frequency: | Pay frequency | JobKeeper payment amount | Calculation |

|---|

| Weekly | $750 | 1500 / 2 | | Fortnightly | $1500 | 1500 x 1 | | Twice a month | $1625 | 1500 x 26 / 24 | | Monthly* | $3250 | 1500 x 26 /12 | | *Monthly paid employees must receive at least $1,500 for each full JobKeeper fortnight within the month. This is a minimum of $3,000 for each month except August 2020 which has 3 full fortnights. You can choose to pay $3,250 each month, but your reimbursements will be based on complete fortnights each month. |

| UI Expand |

|---|

| title | To process a JobKeeper pay |

|---|

| From the Payroll menu, choose Enter pay. The Pay centre page appears. Under Confirm dates: In the How often field, choose the pay frequency. For example, if it's a weekly pay, choose Weekly. In the From and To fields, chose the first and last day of the pay period. Choose the Pay on date. This is typically the day you're processing the pay run.

Under Select employees to pay: Select the employees you're paying. Click in the Email  column to select which employees you want to email payslips to. You'll need to have entered their email addresses on the Employee details tab of their employee record to be able to email their payslip. column to select which employees you want to email payslips to. You'll need to have entered their email addresses on the Employee details tab of their employee record to be able to email their payslip. A tick  shows in the Bank File column if the employee is being paid electronically. shows in the Bank File column if the employee is being paid electronically.

- Under Pay run, click Start pay run. The Pay run page appears where you can review the pay details.

On the Pay run page, enter the number of paid hours against the JobKeeper pay item and reduce their Normal hours by the same amount: | If an employee is | Do this |

|---|

| being paid less than the JobKeeper payment | - Enter the hours for the work they've done against Normal.

- Enter the top-up amount against the JOBKEEPER-TOPUP pay item to bring their pay up to the required JobKeeper payment amount. See the FAQ below for more details.

| | being paid more than the JobKeeper payment | Enter their hours as you normally would against Normal. | | stood down | Enter the full JobKeeper payment against the JOBKEEPER-TOPUP pay item. Stood down employees still accrue their usual leave entitlements. See the FAQ below for more details. |

Here's some examples: | UI Text Box |

|---|

Example 1: Employee paid less than $750 a week Here's an example of a casual employee who works 20 hours per week and whose pay is less than the JobKeeper amount ($750). For their 20 hours they earn $570.00 a week. Under JobKeeper, they'll now earn $750 a week so we've put their extra $180.00 against the JOBKEEPER-TOPUP pay item.

|

| UI Text Box |

|---|

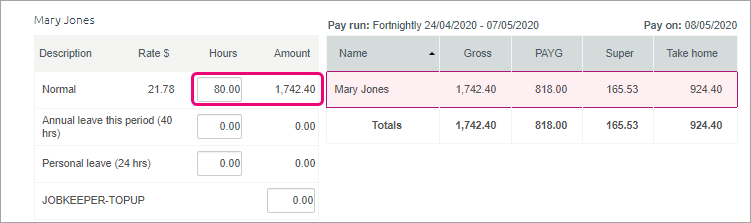

Example 2: Employee paid more than $1500 per fortnight Here's an employee whose weekly pay is more than the fortnightly JobKeeper amount ($1500). They normally earn $1742.40 a fortnight. Under JobKeeper, they'll still be paid the same. So we'll enter their pay as we normally would and record their hours against Normal.

|

| UI Text Box |

|---|

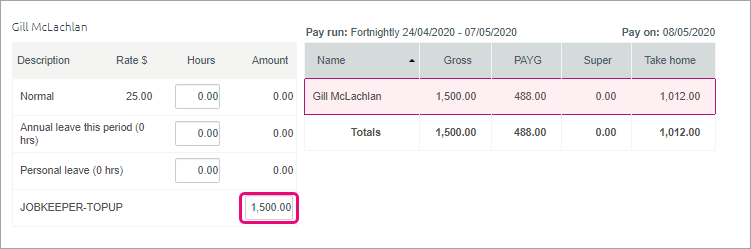

Example 3: Employee who is stood down Here's an employee who has been stood down. Regardless of what they were earning while working, they'll now receive the full JobKeeper payment. So in their fortnightly pay we'll enter $1500 against the JOBKEEPER-TOPUP pay item. We'll record zero hours against Normal and any other pay items.

|

After entering the JobKeeper amount and adjusting the employee's Normal amount, complete the rest of the pay run as normal. Need a refresher?

|

Receiving JobKeeper payments from the governmentThe JobKeeper reimbursements from the government will be deposited into your nominated bank account, so they'll need to be recorded in MYOB Essentials.

How you record these payments in MYOB Essentials depends on whether or not you have a bank feed set up on that account. | UI Text Box |

|---|

| If the version of MYOB Essentials you're using doesn't have a Banking menu, you'll need to find another method to record the receipt of JobKeeper payments from the government. If you need help, contact us, or consult your MYOB Partner. |

| UI Expand |

|---|

| title | If you use bank feeds |

|---|

| If you use bank feedsThe deposits from the government will appear in MYOB Essentials when your bank feed transactions appear. - If you've already recorded a Receive Money transaction for the deposit (as described below), you can match the bank feed transaction to it.

- If you haven't already recorded a Receive Money transaction for the deposit, you can allocate the deposit to the income account you created earlier. For details about allocating, see Allocating bank transactions.

|

| UI Expand |

|---|

| title | If you don't use bank feeds |

|---|

| To manually record a Receive Money transaction- Create a Receive Money transaction (Banking menu> Receive money). Need a refresher?

- In the Deposit into field, select the account the money is being deposited into.

- In the Notes field, enter a description for this transaction.

- If you've set up the Australian Government or the ATO as a contact, choose it from the Payer list. You can add a new payer by clicking Add customer from the Payer list and entering their details.

- In the Allocate to field, select the income account you created earlier.

- In the Amount column, enter the JobKeeper payment amount you've received.

Here's our example:

- Click Save.

|

| HTML |

|---|

<h2><i class="fa fa-comments"></i> JobKeeper FAQs</h2><br> |

| UI Expand |

|---|

| title | How are leave accruals affected by JobKeeper? |

|---|

| How are leave accruals affected by JobKeeper? Typically, an eligible employee's leave entitlements will not change under JobKeeper. The amount of leave they were accruing before JobKeeper, will continue to accrue during JobKeeper. For more information, visit this Fair Work website. If you need to record leave accruals for employees receiving JobKeeper, for example a stood down employee, you'll need to use a new pay item for this. This new pay item will only be used to calculate leave accruals and will have no dollar amount against it. Therefore, it won't need to be reported to the ATO. Let's step you through it: - Go to the Payroll menu and choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

Under Earnings, click the Add earning dropdown button and choose Create new earning. Set up the pay item as per below:

Click Save. Assign this pay item to any other employee who needs to accrue leave under JobKeeper.

When you pay the employee, enter the amount of hours they need to accrue leave on. | UI Text Box |

|---|

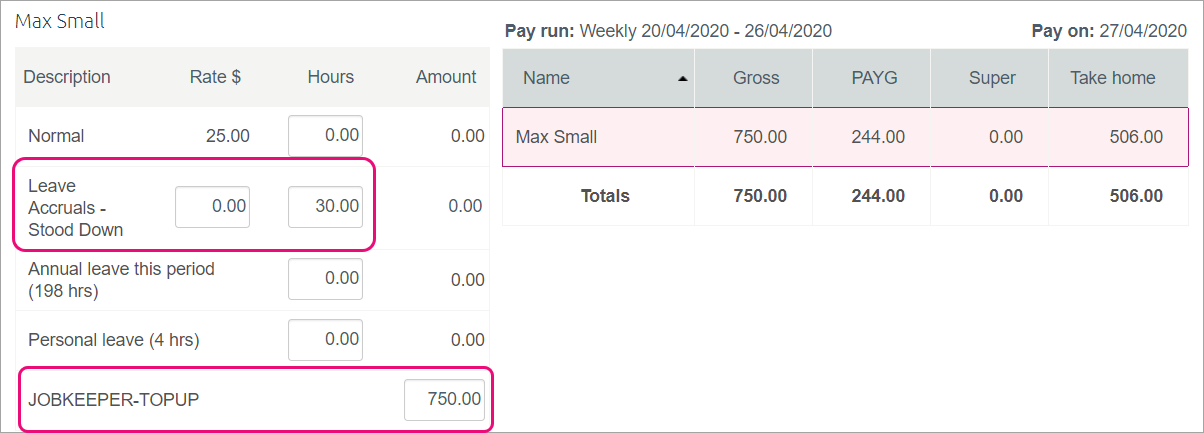

Example: An employee who has been stood down and is currently being paid $750 per week as part of JobKeeper. We've entered the following: - 30 hours against the Leave Accruals - Stand Down pay item (this has a 0.00 amount).

- 750 against the JOBKEEPER-TOPUP category.

|

|

| UI Expand |

|---|

| title | What if I've paid my employees before setting up for JobKeeper payments? |

|---|

| What if I've paid my employees before setting up for JobKeeper payments?No problem, there's no need to change the pays you've already done. Before your next pay run, make sure you notify the ATO that you've started making JobKeeper payments via Single Touch Payroll. For details, see task 3 'Notify the ATO that you're starting to pay JobKeeper'. | UI Text Box |

|---|

| When notifying the ATO, make sure you choose the relevant fortnightly period during which your employee started receiving JobKeeper. For example, if you've already paid employees during the period 30/03/2020 - 12/04/2020, you need to choose the 30 Mar - 12 April fortnightly period in the First JobKeeper fortnight field. |

Do I have to pay back pay?As the ATO requires each eligible employee to be paid at least $1500 per fortnight, you'll need to make sure your first JobKeeper pay includes any required back pay. | UI Text Box |

|---|

Example: Employee whose regular fortnightly pay is $1100 and is owed JobKeeper back pay

Your business became eligible for JobKeeper from 30 March (1st fortnight of JobKeeper scheme), but you already processed a pay for the employee on 10 April (before you set up MYOB Essentials for JobKeeper). Your next pay is scheduled for 24 April (2nd fortnight of JobKeeper scheme). You'll need to workout the amount of JobKeeper back pay you owe the employee from the previous pay and add it to their next pay. So, if you've paid your employee their regular pay of $1100 per fortnight, your next pay will need to include the $400 JobKeeper top-up back pay, as well as the $400 they would be getting for this fortnight's JobKeeper top-up. $1100 (regular pay) + $400 (JobKeeper top-up backpay) + $400 (JobKeeper top-up current pay) = $1900. This will bring their total gross pay to $1900.

This means $800 needs to be recorded against the JOBKEEPER-TOPUP pay item. Here's our example:

|

|

| UI Expand |

|---|

| title | An employee has become ineligible during JobKeeper. What should I do? |

|---|

| An employee has become ineligible during JobKeeper. What should I do?If an employee becomesineligibleduring the JobKeeper scheme, you need to notify the ATO via Single Touch Payroll, by choosing a Final JobKeeper fortnight date for the employee. Go to the Payroll menu and choose Payroll Reporting. - Click the JobKeeper payments tab.

- Select the employee.

In the Final JobKeeper fortnight list, choose the relevant fortnightly period after the last JobKeeper payment they've received. For example, if an employee's last JobKeeper payment was 08 May (during FN03) then choose 11 May - 24 May JOBKEEPER-FINISH-FN04 as the Final JobKeeper fortnight.

Repeat for any other affected employees. Once you're done, click Notify the ATO. - When prompted, enter the name of the authorised sender and click Send.

This will inform the ATO that the employee will no longer receive JobKeeper payments. |

| UI Expand |

|---|

| title | What if I've accidentally selected an ineligible employee for JobKeeper? |

|---|

| What if I've accidentally selected an ineligible employee for JobKeeper?If you've notified the ATO that JobKeeper has started for an employee that is not eligible for JobKeeper, you can easily fix this in the STP reporting centre. - Go to the Payroll menu and click Payroll Reporting.

- Click the JobKeeper payments tab.

- Select the ineligible employee.

In the Final JobKeeper fortnight list, choose the same fortnightly period you chose for the First JobKeeper fortnight.

Repeat this for any other employees who you've accidentally selected. Click Notify the ATO. - When prompted, enter the name of the authorised sender and click Send.

|

| UI Expand |

|---|

| title | What if I've sent the wrong JobKeeper start or finish date for an employee? |

|---|

| What if I've sent the wrong JobKeeper start or finish date for an employee?You can change the start and finish dates you've sent for an employee, but the ATO will only accept the earliest of the dates you send. So if you need to change the start or finish fortnight to an earlier start or finish fortnight, it's easy to fix. For example, changing the start fortnight from FN05 to FN04. To send an earlier fortnight date: - Go to the Payroll menu and click Payroll Reporting.

- Click the JobKeeper payments tab.

- Select the employee.

In the Start JobKeeper fortnight or Finish JobKeeper fortnight list, choose the correct (earlier) fortnightly period. Click Notify the ATO. - When prompted, enter the name of the authorised sender and click Send.

If you need to change the start or finish fortnight to a later start or finish fortnight, you'll first need to cancel the originally submitted fortnight, then submit the correct fortnight. For example, changing the start fortnight from FN04 to FN05. To send a later fortnight date: - Go to the Payroll menu and click Payroll Reporting.

- Click the JobKeeper payments tab.

- Select the employee.

Cancel the originally submitted dates by choosing the same Finish JobKeeper fortnight as you have chosen in the Start JobKeeper fortnight. Here's an example:

Click Notify the ATO. - When prompted, enter the name of the authorised sender and click Send.

- You can now send the correct fortnight date(s) for the employee.

- Go to the Payroll menu and click Payroll Reporting.

- Click the JobKeeper payments tab.

- Select the employee.

Choose the correct Start JobKeeper fortnight and if applicable, the correct Finish JobKeeper fortnight. Click Notify the ATO. - When prompted, enter the name of the authorised sender and click Send.

To learn more about how the ATO handle corrections to JobKeeper submissions, visit the ATO website. |

| UI Expand |

|---|

| title | How do I make a final JobKeeper payment to an employee? |

|---|

| How do I make a final JobKeeper payment to an employee?If you need to make a final JobKeeper payment to an employee, you need to notify the ATO via Single Touch Payroll, by choosing a Final JobKeeper fortnight date for the employee. - Go to the Payroll menu and click Payroll Reporting.

- Click the JobKeeper payments tab.

- Select the employee.

In the Final JobKeeper fortnight list, choose the relevant fortnightly period after the last JobKeeper payment they've received. For example, if an employee's last JobKeeper payment was 14 August (during FN10) then choose 17 Aug - 30 Aug JOBKEEPER-FINISH-FN11 as the Final JobKeeper fortnight.

Repeat for any other affected employees. Once you're done, click Notify the ATO. - When prompted, enter the name of the authorised sender and click Send.

This will inform the ATO that the employee will no longer receive JobKeeper payments. |

| UI Expand |

|---|

| title | Is my business eligible for JobKeeper? |

|---|

| Is my business eligible for JobKeeper?To determine if your business is eligible for JobKeeper, you must calculate if your turnover has reduced. To check your eligibility use the turnover test, visit the ATO website. You can run the following reports to help provide you with the information you need to calculate any change in turnover: - GST report (GST exclusive) – monthly or quarterly

- Profit and loss report

- Budget (if projections are relevant)

Use the appropriate report to identify relevant income, exclusive of GST, for the two periods that you are comparing. This may not be straightforward so check with an MYOB Partner or the ATO for guidance. |

| UI Expand |

|---|

| title | I’m a sole trader. Am I eligible for JobKeeper? |

|---|

| I'm a sole trader. Am I eligible for JobKeeper?Sole traders (with no employees) may be eligible to receive JobKeeper payments if their business has experienced a downturn according to the ATO’s eligibility criteria. To check if you’re eligible visit this ATO website. If you’re eligible, there’s no need to set yourself up as an employee in MYOB Essentials – just enrol directly with the ATO. When you receive JobKeeper payments from the government, follow the steps in this help topic to set up a new income account and record them as a Receive Money transaction in MYOB Essentials. |

Image Modified Image Modified

|