| HTML |

|---|

<span data-swiftype-index="true"> |

| html-wrap |

|---|

| New Zealand only If you're a New Zealand business who's signed up for an MYOB Atlas site, each business is entitled to a free .co.nz domain name for one year. You can also purchase any number of domain names and link them to your website if you need them. For information about domain names and domain name variants, see About domain names (web addresses) and extensions. Or, for help with choosing a domain name, see Choosing a domain name. | UI Expand |

|---|

| | expanded | true |

|---|

| title | To register your free .co.nz domain name |

|---|

| To register your free .co.nz domain nameCashing up annual holidays is where an employee is paid for annual holidays (or annual leave) without taking the time off work. It's sometimes called cashing in, cashing out or selling annual holidays. If an employee is simply taking paid leave, learn how to pay leave. If the employee is leaving your business and has unpaid leave, find out how to process their final pay. | UI Expand |

|---|

| title | To check the status of your domain name registration |

|---|

| - Click My account in the Settings toolbar.

- Click Manage domain names in the Domain names section.

- On the My domain names page, check the status next to the domain name in the Domain names purchased through MYOB section. If it shows Pending registration, the registration is still being processed.

|

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | What is a domain name registrar? |

|---|

| What is a domain name registrar?Your domain name registrar is the company who you registered your domain name through. They're responsible for several different services including updating your details and renewing your domain name when it expires. |

| UI Expand |

|---|

| title | How long does it take to register a domain name? |

|---|

| How long does it take to register a domain name?It can take up to 24 hours for a domain name to be registered. After this time, you'll be able to use it to access your MYOB Atlas website. See above for how to check the status of your registration request. |

| UI Expand |

|---|

| title | Do I own my domain names? |

|---|

| Do I own my domain names?Any domain name that you register through MYOB Atlas, regardless of whether it’s the free domain you have claimed or a paid domain, is yours for the duration of the licence of that domain. For .co.nz domain names this is a 12-month period. |

| UI Expand |

|---|

| title | Where can I find my domain name's expiry date? |

|---|

| Where can I find my domain name's expiry date?You can find out when your domain is due to expire by going to the Site settings menu and choosing My Domain Names. Under Domain names purchased through MYOB will be a list of all your domains and expiry dates. |

| UI Expand |

|---|

| title | How do I change the registrant contact information for my domain name? |

|---|

| How do I change the registrant contact information for my domain name?The registrant contact information for your domain name is the information that your domain name registrar (the company who you registered your domain name through) uses to contact you, the registrant. If your domain name is registered with MYOB Atlas, your registrant contact information, including your registrant email address, will be the same as the contact information for your MYOB Atlas account (that is, the contact information MYOB Atlas uses for all communications with you). To update this contact information, click My account on the Site settings menu, then click Update my details (under the Website information section). This will update both your registrant contact information for any domain names registered with MYOB Atlas, and the contact information for your MYOB Atlas account. |

html | Check the rules! There are rules and regulations relating to the cashing out of annual holidays, so first check with the appropriate regulatory body about the rules that affect you. A good place to start in Australia is the Fair Work Ombudsman or in New Zealand visit the Employment Relations website. The steps below describe a general scenario which might not suit your requirements. Always check with an accounting advisor (or the experts on our community forum) to clarify the best solution for your business. |

To cash up annual holidays in MYOB Essentials, create a new pay item for the employee and use it to make the payment. You'll also need to reduce the employee's leave balance by the number of hours they're cashing up. Let's take you through it. | UI Expand |

|---|

| title | 1. Create a new pay item |

|---|

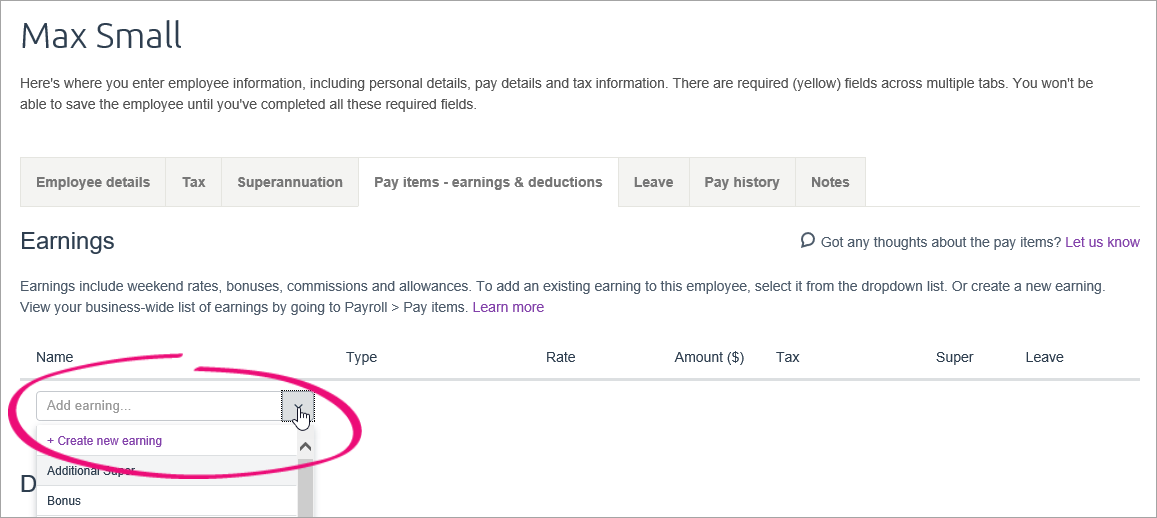

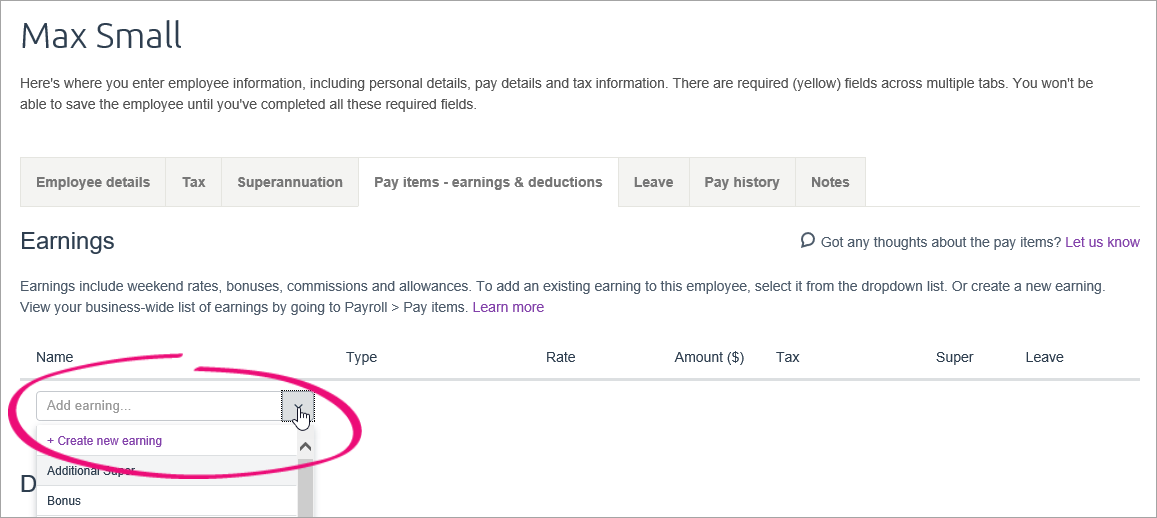

| We'll create a pay item for the employee who's cashing out annual holidays. This lets you pay them for the value of the leave they're cashing in. - From the Payroll menu, choose Employees.

- Click the employee's name to open their record.

- Click the Pay items - earnings & deductions tab.

- Click the dropdown arrow next to Add earning... and choose + Create new earning.

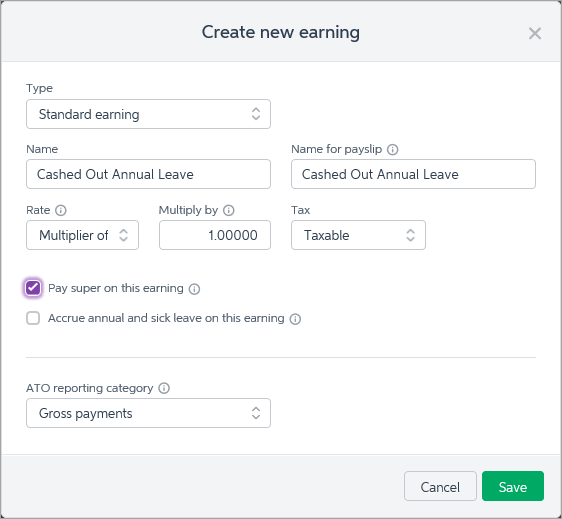

Image Added Image Added - Set up the earning:

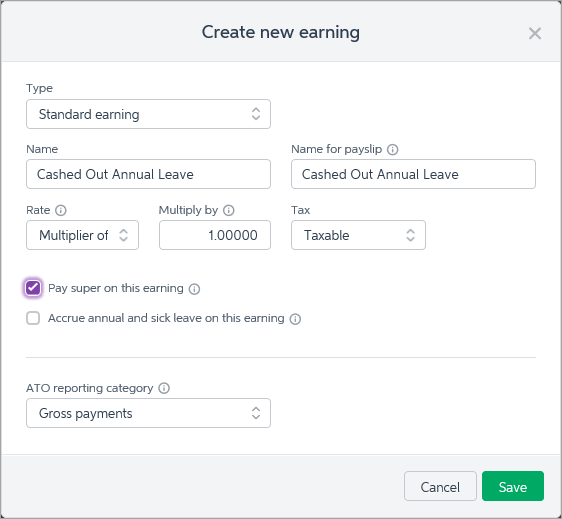

- For the Type, choose Standard earning

- Enter a Name for the earning such as "Cashed Out Annual Holidays" (or similar).

If you'd like a different, more personalised, name to show on payslips for this earning, enter a Name for payslip. Otherwise, this can be the same as the Name field. - For the Rate:

- In Australia, choose Multiplier of normal rate and leave the Multiply by field as 1.00000. This means the cashed out leave will be paid at the employee's regular hourly rate.

- In New Zealand, choose Per hour and leave the Amount field as 0.00. This lets you specify the amount in the employee's pay.

- For the Tax field, choose Taxable. If unsure, check with your accounting advisor or the ATO/IRD.

Select your country-specific options. Here are some guidelines: | Country | Option | Details |

|---|

| Australia | Pay super on this earning | Selecting this option means superannuation will be calculated on the cashed out leave payment. Annual holiday payments are typically considered part of ordinary time earnings (OTE) for super guarantee purposes, so you'd usually select this option. See the ATO guidelines for details about what should be included in super calculations. | | Accrue annual and sick leave on this earning | Selecting this option means annual holidays and sick leave will accrue on the cashed out holiday payment. But with cashed out holidays, because the leave isn't actually taken (it's just paid), typically no leave will accrue. So typically you'd deselect this option, but if unsure, check with the Fair Work Ombudsman or your accounting advisor. | | ATO reporting category | Select the applicable ATO reporting category. Annual leave is typically reported with Gross Payments, but if you're unsure, check with your accounting advisor or the ATO. Learn more about Assign ATO reporting categories for Single Touch Payroll. | | New Zealand | Exclude CEC | Selecting this option means compulsory employer contributions will be excluded from cashed out annual leave payments. If you're unsure about selecting this option, check with your accounting advisor or visit the IRD website. | | Exclude from gross earnings for leave calculations | Selecting this option excludes cashed out annual leave payments from leave calculations for Ordinary weekly pay or Average weekly earnings. However, the payments will still be included in the Use Ordinary weekly pay (OWP) formula. Learn more about Leave calculations. | | Don't accrue annual leave on this pay item | Select this option if you don't want employees to accrue pro-rata annual leave on this pay item. Note that employees with a fixed annual leave entitlement will never accrue leave on pay items. |

- Click Save. The pay item is saved for this employee and will now appear on their next pay. If you like, you can also assign this pay item to other employees who cash out annual holiday.

Here's an Australian example of the pay item setup:

Image Added Image Added |

| UI Expand |

|---|

| title | 2. Pay the cashed out leave |

|---|

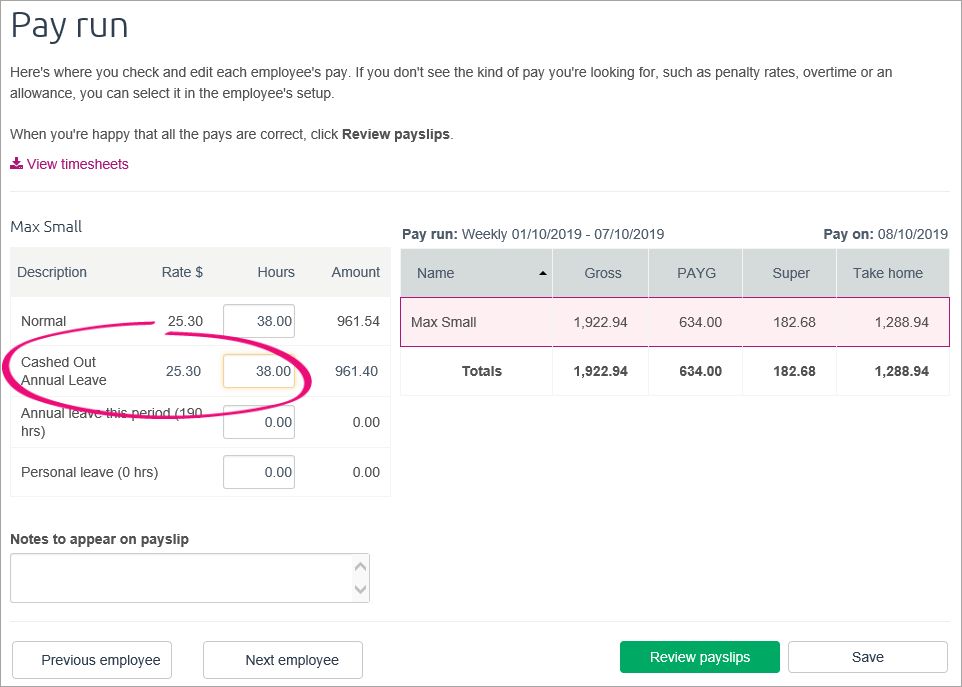

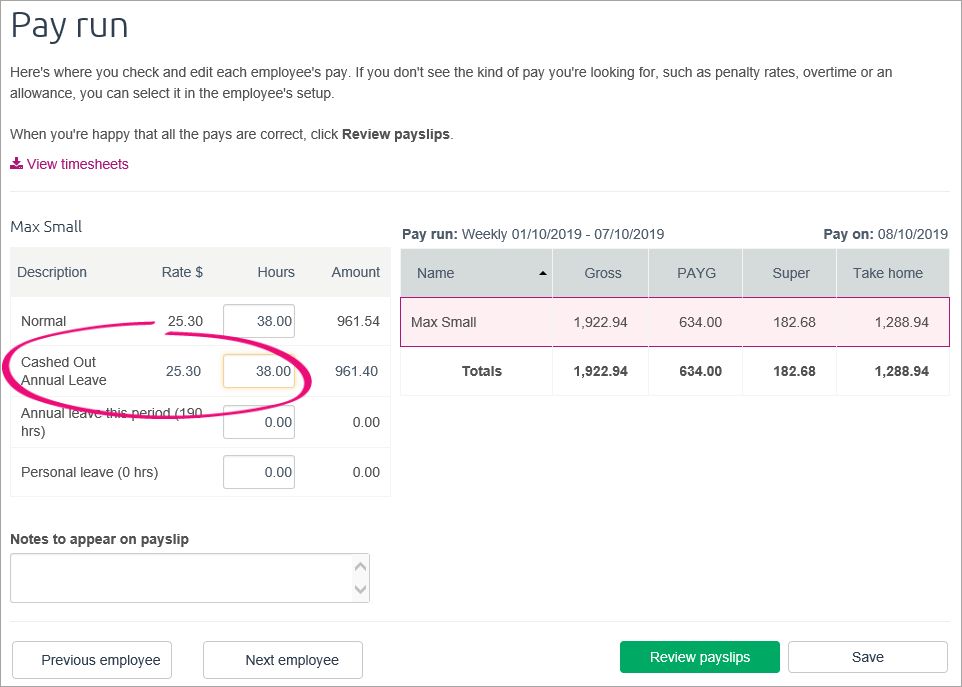

| You're now ready to pay the employee for their cashed out annual leave. - Go to the Payroll menu and choose Enter Pay.

- Choose the pay period and select the employee to be paid.

- Click Start Pay Run.

- (New Zealand only)

- Click Add Holidays or leave then click Annual leave. Take note of the hourly rate with the green tick beside it. Then click Cancel.

- Enter the noted rate in the Rate field for the Cashed Out Annual Leave pay item.

- Enter the Hours of annual holidays being cashed out. If the pay is only for the cashed out leave, remove all other hours and amounts from the pay.

Here's an Australian example of 38 hours of annual holidays being cashed out on top of a regular 38 hour weekly pay:

Image Added Image Added - Continue processing the pay as normal.

Now that you've paid the cashed out leave, you'll need to reduce the employee's leave balance. See below for instructions. |

| UI Expand |

|---|

| title | 3. Reduce the employee's leave balance |

|---|

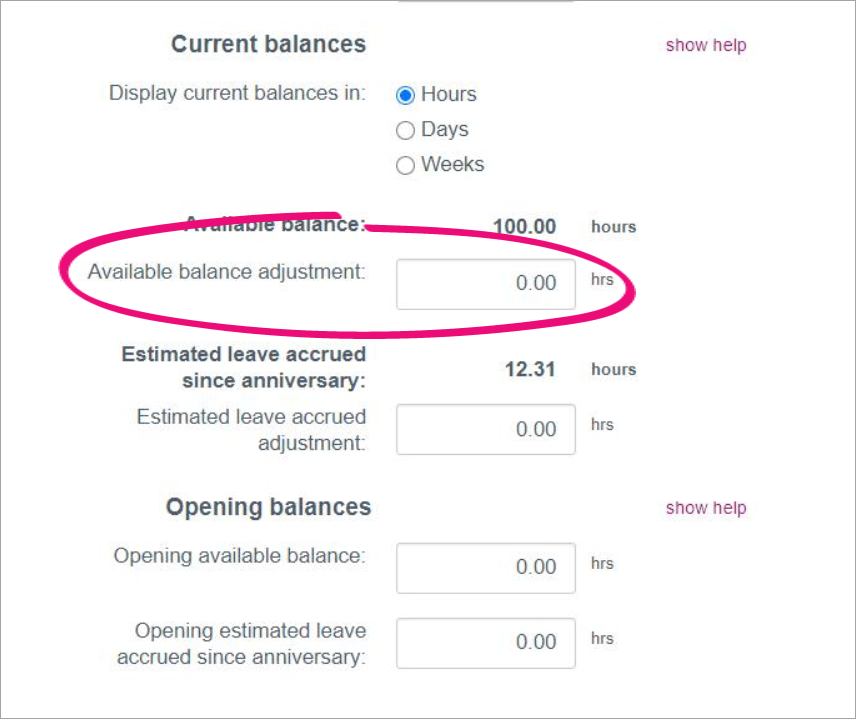

| Because of the way you've paid the employee's cashed out leave, their leave balance won't be reduced. Here's how to reduce their leave balance manually: - From the Payroll menu, choose Employees.

- Click the employee's name to open their record.

- Click the Leave tab.

- Reduce the employee's annual leave balance by the number of hours of cashed in leave.

- If you're in Australia, reduce the Opening balance.

Image Added Image Added

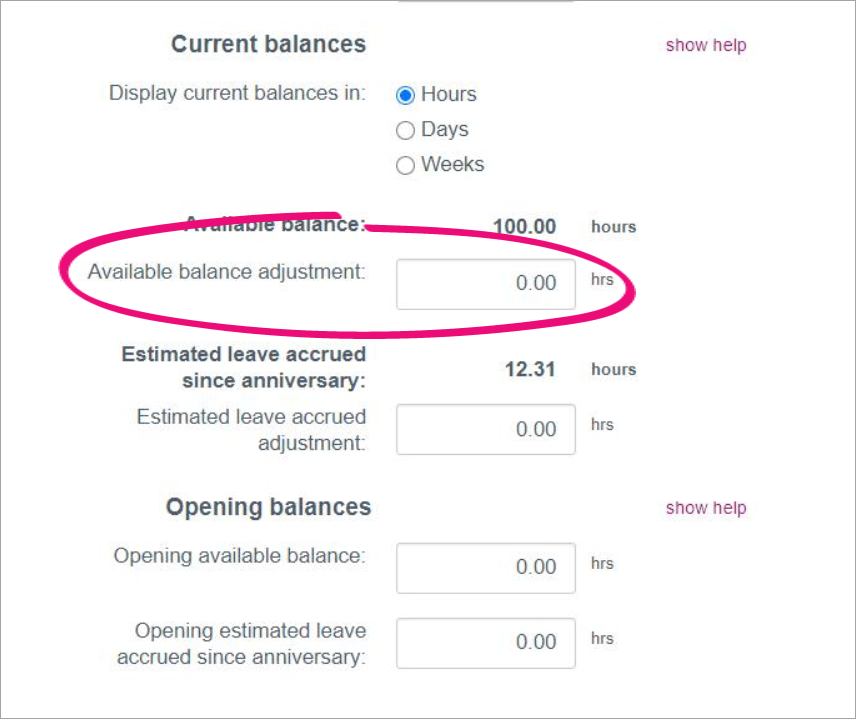

- If you're in New Zealand, enter the adjustment in the Available balance adjustment field.

Image Added Image Added

- Click Save.

The employee has been paid for their cashed in annual holidays and their leave balance has been reduced accordingly. |

| UI Expand |

|---|

| title | 4. Unlink the pay item from the employee |

|---|

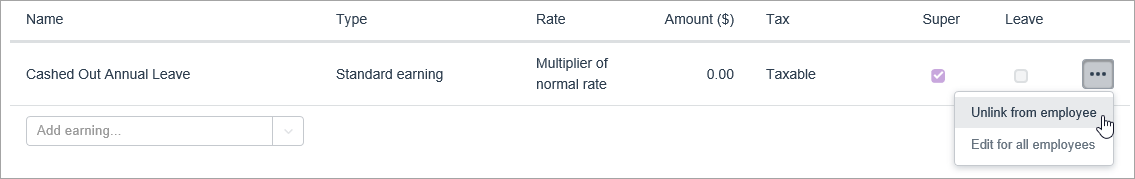

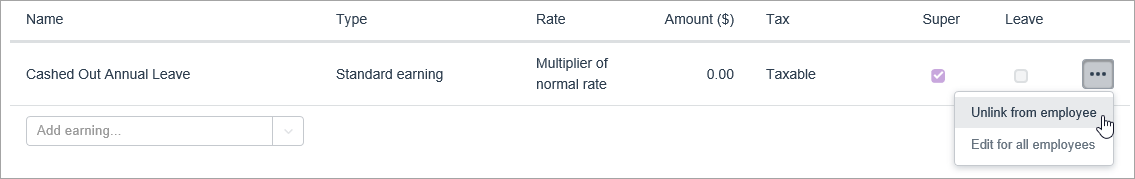

| Unless cashing out annual holidays will be a regular occurrence for the employee, you'll probably want to remove the Cashed Out Annual Leave pay item from appearing in their future pays. Here's how to unlink the pay item from the employee. - From the Payroll menu, choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

Click the ellipsis  Image Added button next to the Cashed Out Annual Leave pay item and choose Unlink from employee. Image Added button next to the Cashed Out Annual Leave pay item and choose Unlink from employee.

Image Added Image Added - Click Save.

If you need to re-assign the pay item to an employee, see Assigning pay items to employees. |

|

| HTML-wrap |

|---|

| width | 15% |

|---|

| class | col span_1_of_5 |

|---|

| | |

| HTML Wrap |

|---|

| float | left |

|---|

| class | col span_1_of_5 |

|---|

| | Panelbox |

|---|

| name | magenta |

|---|

| title | Related topics |

|---|

| |

|

|

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.