You can use MYOB to record the receipt of a loan and to record the repayments. Because there's lots of loan types, interest rates, terms and conditions, you might need help from your accounting advisor. They'll be able to help advise on your financing options, the tax implications, and how to handle the finance transactions in MYOB. Start by inviting your accounting advisor to your MYOB business. To accurately track a loan in MYOB, you'll need to know: - the initial loan amount

- the value of your repayments, and

- the repayment breakdown (how much of the repayment reduces the principal, and how much relates to interest charges)

Here's how to handle a basic loan, where you'll receive the loan amount then make repayments. | UI Text Box |

|---|

| Need help with business financing? MYOB has partnered with Valiant, the lending experts, to make it easy for your business to access the right finance solutions. Find out how to Find a business loan with Valiant. |

| UI Expand |

|---|

| title | 1. Create a liability account for the loan |

|---|

| You need a liability account to represent the loan. When the loan is received you'll allocate it to this account. - Go to the Accounting menu and choose Chart of accounts.

- Click Create account.

- Leave the Account category set to Detail account.

For the Account type, choose Other current liability. | UI Text Box |

|---|

| Will you be setting up a bank feed for the loan account? You'll need to set up this account with the Account type of Credit Card to be able to associate it with a bank feed. |

- Choose the applicable Parent header. This determines where the account will sit with your other liability accounts. If unsure, check with your accounting advisor.

- Specify an Account number that suits your account list.

Enter a suitable Account name. For the Tax code, choose N-T. Choose the applicable Classification for statements of cash flows. What is this?

Here's our example:

When you're done, click Save.

|

| UI Expand |

|---|

| title | 2. Record the receipt of the loan |

|---|

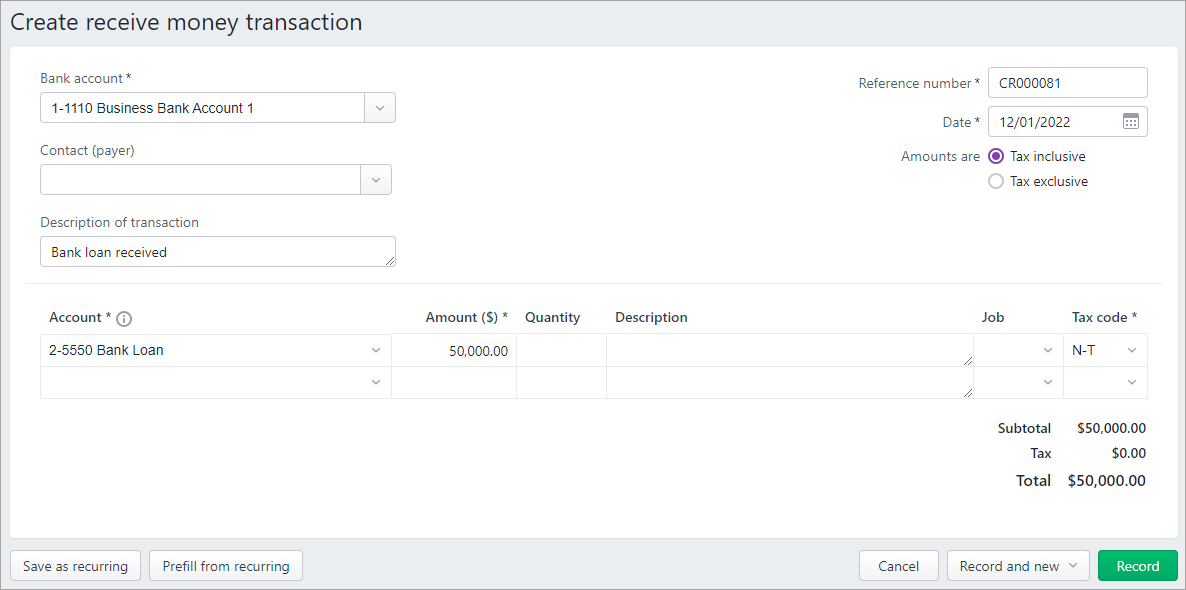

| When you receive the loan, use a Receive Money transaction to allocate it to the loan account created earlier. Here's how: - Go to the Banking menu and choose Receive money.

- In the Bank account field, choose the bank account that the loan money was deposited into.

- If you've set up a contact for the lender, select them in the Contact field.

- Enter a Description of transaction.

Make sure the Reference number is correct. If not, enter a new number. | UI Text Box |

|---|

| Changing the numbering If you change the reference number, you’ll change the automatic numbering. For example, if you change the number to 000081, the next time you enter a receive money transaction, the new reference number will be 000082. |

- Check that the correct date is selected in the Date field. If not, enter a new date or click the icon next to it to display the calendar and choose a date.

- Choose whether the transaction amounts are Tax inclusive or Tax exclusive.

- In the Account column, select the bank loan account created earlier. The tax code for the chosen account will appear in the Tax code column (but you can change this if needed).

- In the Amount column, enter the amount of the loan.

- In the Description column, add a short description about this line item.

- If required, change the Tax code. Here's our example:

- When you're done, click Save.

|

| UI Expand |

|---|

| title | 3. Record the loan repayments |

|---|

| | UI Text Box |

|---|

| Speed things up with bank feeds If you have bank feeds set up on the bank account your loan repayments come from, simply allocate the loan repayment to your loan account. This means you won't need to record a spend money transaction. |

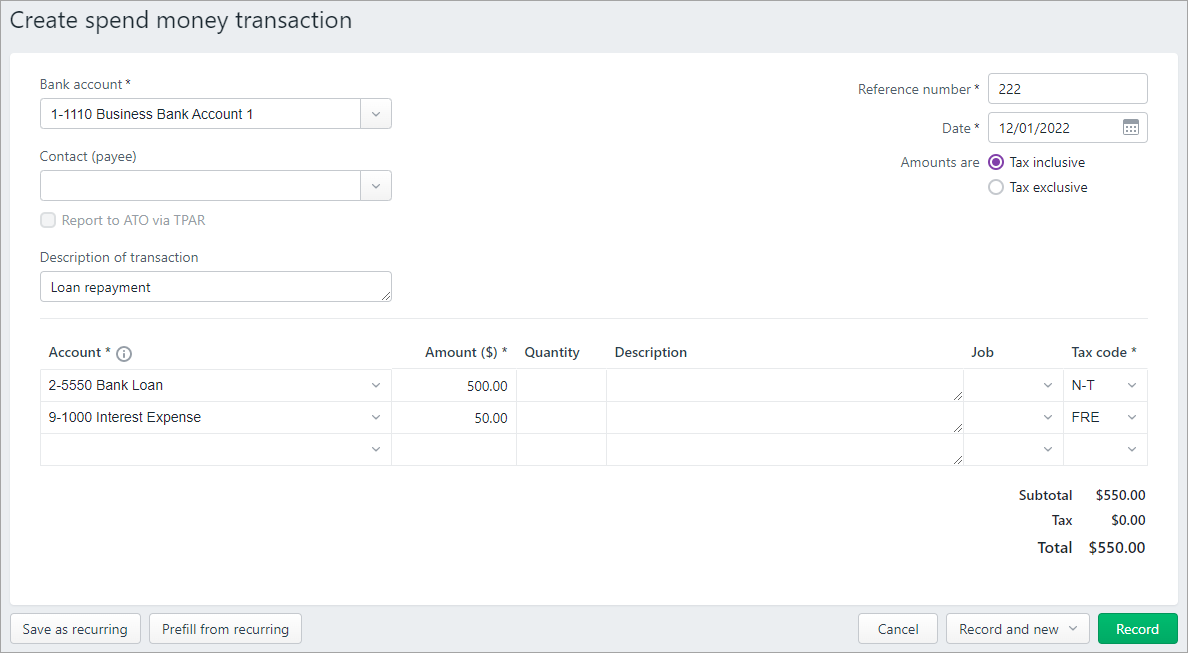

Loan repayments can be recorded using Spend Money transactions. Our example below is for a fixed repayment with the interest portion allocated to an expense account. This allows the loan interest to be tracked separately. For your loan, you might need to seek clarification from your accounting advisor about the best way to enter the repayments and which tax rates to apply. - From the Banking menu, choose Spend money.

- In the Bank account field, select the account you're making the repayment from.

- If you've set up a contact for the lender, select them in the Contact field.

- Enter a Description of transaction.

Make sure the Reference number is correct. If not, enter a new number. - Check that the correct date is selected in the Date field. If not, enter a new date or click the icon next to it to display the calendar and choose a date.

- Choose whether the transaction amounts are Tax inclusive or Tax exclusive.

- Enter the details of the transaction:

- In the Account column, select the loan account you created earlier. The tax code for the chosen account will appear in the Tax code column (but you can change this if needed).

- In the Amount column, enter the amount of the repayment

- In the Description column, add a short description about this line item.

- If required, change the Tax code.

- If entering the interest component separately, record the details on a separate line. Here's our example:

- When you're done, click Save.

As you record loan repayments, the balance of the liability account will be reduced to reflect a reduction in that liability. |

|