You might notice some forms in your compliance list with a status of Non-lodgable. This includes the following form types: - Form N — annual PAYG instalment notice

- Form R — quarterly PAYG instalment notice

- Form S — quarterly GST Instalment notice

- Form T — quarterly PAYG and GST instalment notice.

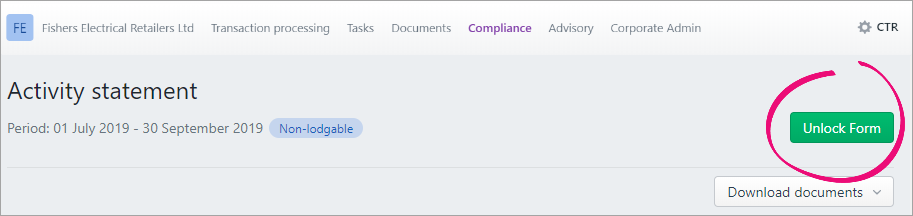

By default, non-lodgable forms are locked in the Compliance list, so they can't be edited. If your client is paying the amount advised by the ATO, then these forms don't need to be completed and lodged. If you're varying the ATO's instalment amount, you'll need to unlock the form to edit and lodge. | UI Expand |

|---|

| expanded | true |

|---|

| title | To unlock a non-lodgable form |

|---|

| | UI Text Box |

|---|

| Once the form is unlocked, you won't be able to re-lock it if you decide not to lodge the form. But you can delete the form and re-create it. |

- Click the non-lodgable form in your Compliance list.

- Click Unlock. The form status changes to In progress.

|

|