To finish an employee all you need to do is process a termination pay. This pay should include any unpaid amounts for time worked, plus any leave they are owed.

Finishing dates Do not enter a finishing date for the employee – once the final pay has been filed, Ace Payroll automatically enters a finishing date. In some situation, entering a finishing date can cause problems. If you enter a finishing date after you calculate pays but before you file your pays, then the payment for the finished employee will be deleted from your reports and from the records you will send to Inland Revenue. If this has happened, you can fix the situation by entering a One Off payment by following the instructions below.

To process a termination pay as a regular payment| UI Expand |

|---|

| title | To process a termination pay as a regular payment |

|---|

| - From the front screen click Calculate Pays and select the employee from the drop down list.

- Calculate their pay for the period as normal.

- Click Options > Termination Pay and follow the prompts.

Process the rest of your pay as normal. | UI Text Box |

|---|

| Do not manually enter a finishing date for this employee. Ace Payroll will do this automatically because you have paid a termination pay. |

|

To process a termination pay as a one off payment| UI Expand |

|---|

| title | To process a termination pay as a one off payment |

|---|

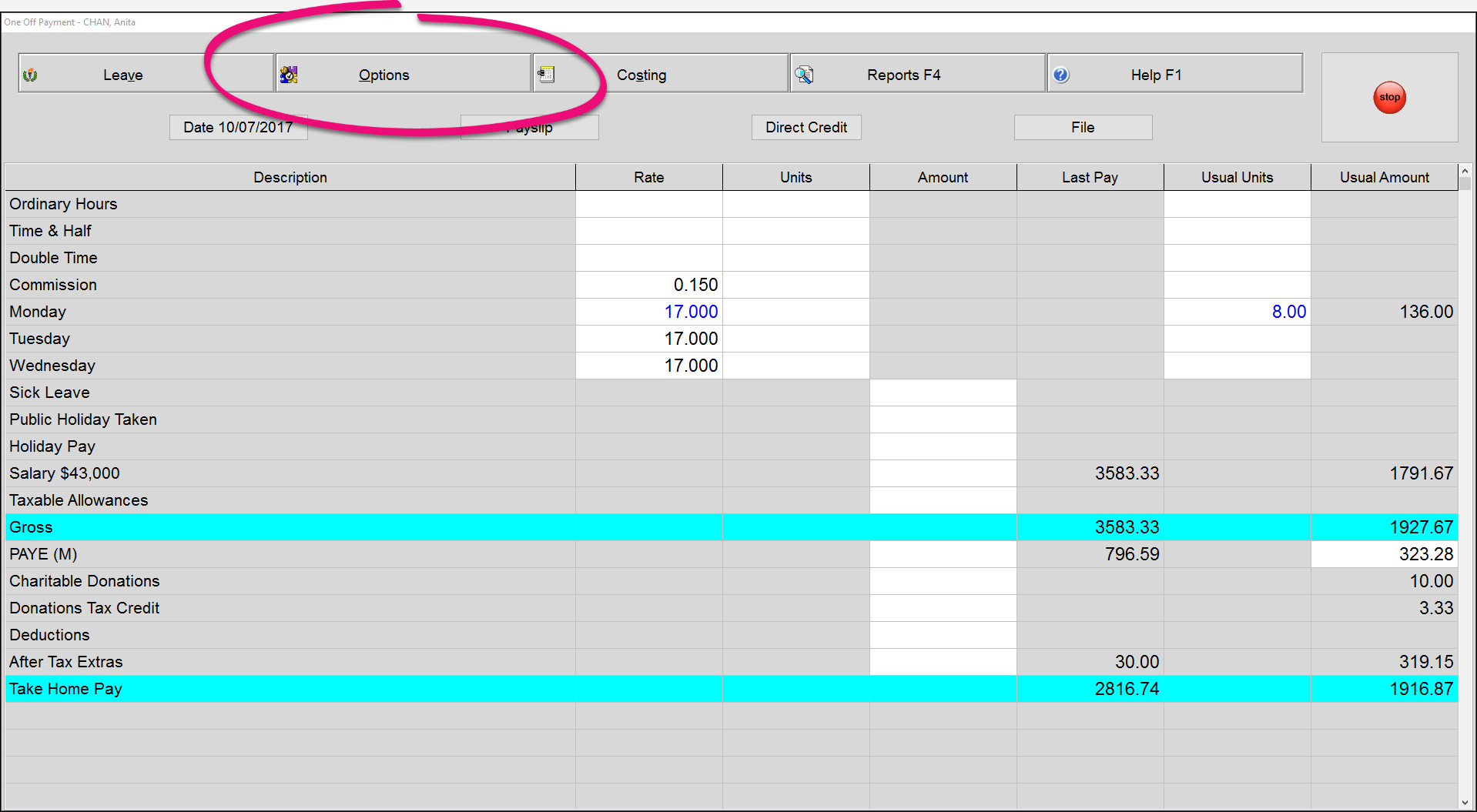

| From the front screen, click Employee, then click Make A One Off Payment.

Select the employee you want to pay and click the green tick.

Select the transaction date.

If you have not yet paid your PAYE nor lodged an Employer's Monthly Schedule for the period concerned, then enter the actual date of the transaction. If you have already accounted to the IRD for the transaction, then date it in such a way that it appears in the next return you make to the IRD.

Click Go.

The One Off Payment window opens. Click Options > termination pay.

Click Payslip to produce a payslip.

If you have already paid this employee their final pay you do not need to pay them again, only file the data for your records.

If you have not paid this employee their final pay click Direct Credit to make a direct credit payment.

Click File to file the payment, and you’re done.

|

|