| UI Text Box |

|---|

Don't have this feature? Talk to your Account Manager about upgrading Tax for your practice. |

New Zealand only You can send a tax statement (previously called tax summary) to your client using the client portal, or manually by downloading a copy of the tax statement or tax return and sending via email, post, or other means. You'll need to send tax statements and tax returns to each client individually, but you can upload and send multiple documents to a client at one time, using the portal. For example, if you want to send a set of financial reports with the tax statement, save the reports to your computer, then attach them to the task when you send the tax statement. | UI Text Box |

|---|

| To send a tax statement via the portal, you'll need to have a portal for your client first. If you haven't created a portal for your client yet, see Create client portals to learn how. |

| UI Expand |

|---|

| title | To send a tax statement to a client via the portal |

|---|

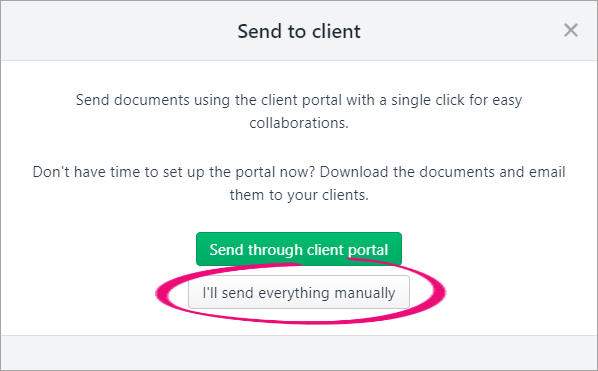

| - In the client's Tax return page, click Send to client.

- Click Send through client portal.

The Send to the client portal window appears. - Fill in the details and click Send to client. A task is created with the tax statement attached. This task is assigned to your client in their portal. The status of the tax return updates to Pending client signature.

|

| UI Expand |

|---|

| title | To send a tax return to a client manually |

|---|

| In the client's Tax return page, click Send to client. | UI Text Box |

|---|

| Can't see this button? Make sure the status of the return is Ready for client. See To review and approve the tax return above. |

Click I'll send everything manually.

The status of the tax return changes to Pending client signature.

Download a copy of the tax return or tax statement. In the Tax return page, click Download documents. Select Tax statement or Tax return & schedules. A PDF copy of the tax statement or tax return downloads and saves to a location on your computer. | UI Text Box |

|---|

| Not sure where it went? Check your Downloads folder. |

- Attach the PDF to an email or print and mail the tax return to your client.

- Once your client signs and approves the tax return or tax statement, click Client approved and signed. The tax return status changes to Ready to file. You can now file the tax return.

|

|