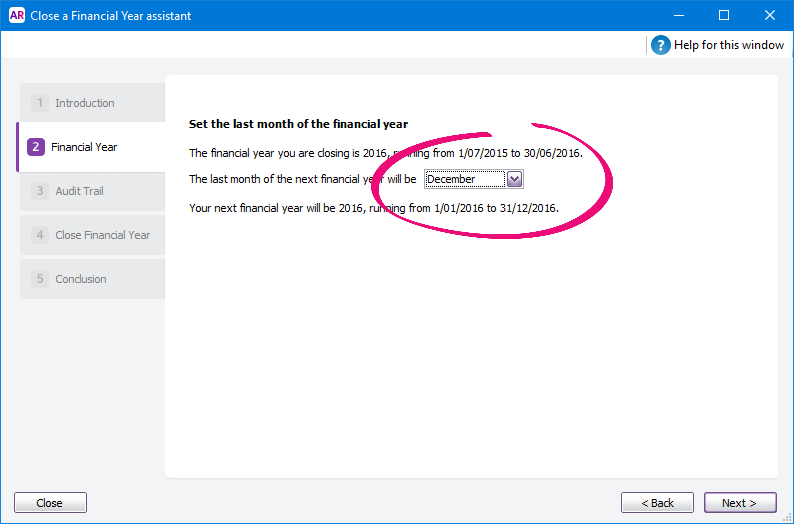

How do I change the last month of a financial year?You can change the last month of your financial year when you close a financial year. Changing your last month will result in a shorter or longer current financial year (it depends on the month you're moving from and to). Check with your accountant about reporting requirements for a short or long financial year. When to change your last monthWhen you change your last month, you shift your 12-month financial year period. As such, you'll need to consider when you can enter transactions in your new financial year. When changing your last month, you'll see a proposed new financial year. Check that you can enter transactions in this year. In the following example, changing the last month to December shifts the 12-month financial year from 1 July 2015—30 June 2016, to 1 January 2016—31 December 2016. As transactions can only be entered from 1 January 2016, you would only change the last month after all transactions have been entered for December 2015.

How to change your last monthBefore changing your last month, enter all transactions for your previous financial year and complete your end of financial year tasks. You can change the last month of your financial year in step 2 of the Close a Financial Year assistant. After changing the last month, check the proposed financial year as it shows you when you can record the first transaction in the new financial year. And don't forget to make a backup before you make this change. |