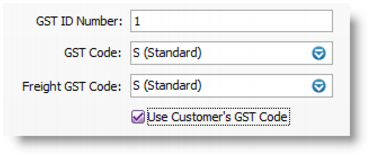

To assign GST codes to cardsYou can define a default GST code for a customer or supplier (Not Basics). You would only need to select a default GST code if the customer’s or supplier’s GST status takes precedence over that of the item or service being sold or purchased.For example, if a customer is one to whom you only ever make zero-rated export sales, you should assign the zero-rated GST code (Z) to that customer’s card. When you create a quote, order or invoice, the GST code assigned to the customer will be used as the default. This GST code will override the item’s GST code in an item sale, and the allocation account’s GST code in a non-item sale. GST codes are assigned to customers in the Selling Details tab of their Card Information window (Card File > Cards List > Customer tab > open the card > Selling Details tab > GST Code). Make sure you select the Use Customer’s GST Code option. (If this is not selected, the customer’s GST code will not be used, even if one has been assigned.)

Similarly, in AccountRight Standard, Plus and Premier, when you create a purchase quote, order or bill, the GST code assigned to the supplier will be used as the default. GST codes are assigned to suppliers in the Buying Details tab of their Card Information window. Make sure you select the Use Supplier’s GST Code option. (If this option is not selected, the supplier’s GST code will not be used, even if one has been assigned.)

|