This page lists all of latest the features in MYOB Practice Tax (NZ). We're always adding more features. We'll keep this page updated with the latest changes, so make sure you bookmark this page and check back regularly! | UI Expand |

|---|

| expanded | true |

|---|

| title | February 2021 |

|---|

| 17 February 5 February - Easier navigation of Tax returns

Use the new Navigation options on the right of the Tax return page to jump straight to the section you want to view or update.

4 February - Filter by unreconciled transactions.

We've added an Unreconciled transaction alert filter to the Data reconciliation page, so you can quickly find clients who have MYOB or IR transactions to reconcile.

3 February - Enjoy an improved upgrade experience.

We've released a hotfix that corrects a couple of critical errors that you may see when you upgrade from MYOB AE/AO to MYOB Practice Tax. If you've installed MYOB AE/AO 5.4.36.144, it's important that you install this hotfix.

1 February - You can now delete tax returns in MYOB Practice Tax.

If you've made a mistake when adding a tax return for your client, you can now delete and recreate it with the right information. Learn more.

|

| UI Expand |

|---|

| 5 January More flexibility in how you send tax notices.

When you prepare a tax notice in MYOB Practice, you can now email the tax notice to your client directly from MYOB Practice! Learn more.

|

| UI Expand |

|---|

| 17 December - Prepare tax notices from MYOB Practice Tax.

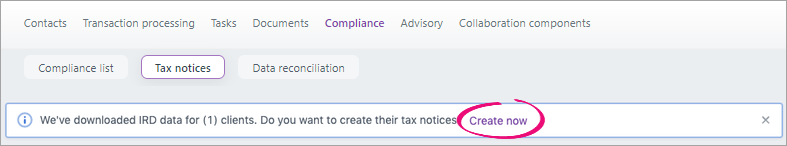

You can now prepare both provisional and terminal tax notices in MYOB Practice Tax. To get started, go to Compliance > Tax notices. You'll receive the message: We've downloaded IRD data for (X) clients. Do you want to create their tax notices? Click Create now to create tax notices for all your clients. See Preparing tax notices for information on how to get started.

|

| UI Expand |

|---|

| November 26 - Download tax statements for IR3, IR3NR, IR4, IR526, IR6 and IR7 returns.

You can now easily generate professional-looking tax statements for the above return types. You can download the tax statement from the Tax return page or send it to your clients digitally, via the client portal.

|

| UI Expand |

|---|

| - Allocate partnership income to partners in an IR7 return

|

| UI Expand |

|---|

| - Prepopulate data directly from Inland Revenue

Salary and wages data from Inland Revenue will soon pre-populate into IR3 and IR3NR returns, and schedular payments into all main tax return types. - Populate IR10 returns from MYOB AE MAS, AO Classic or MYOB Workpapers

Soon, you'll be able to import IR10 data from MYOB Workpapers, AE MAS or AO Classic into an IR10 form in MYOB Practice Tax.

|

|