When it's time to pay super contributions, use the Pay superannuation page to download a file containing all of the contribution data. You can then upload this file to MYOB's super portal to make the contribution payments. First, make sure you've set up all the required information and signed up to use MYOB's super portal. See Set up Pay superannuation. | UI Expand |

|---|

| expanded | true |

|---|

| title | 1. Download a super contribution file |

|---|

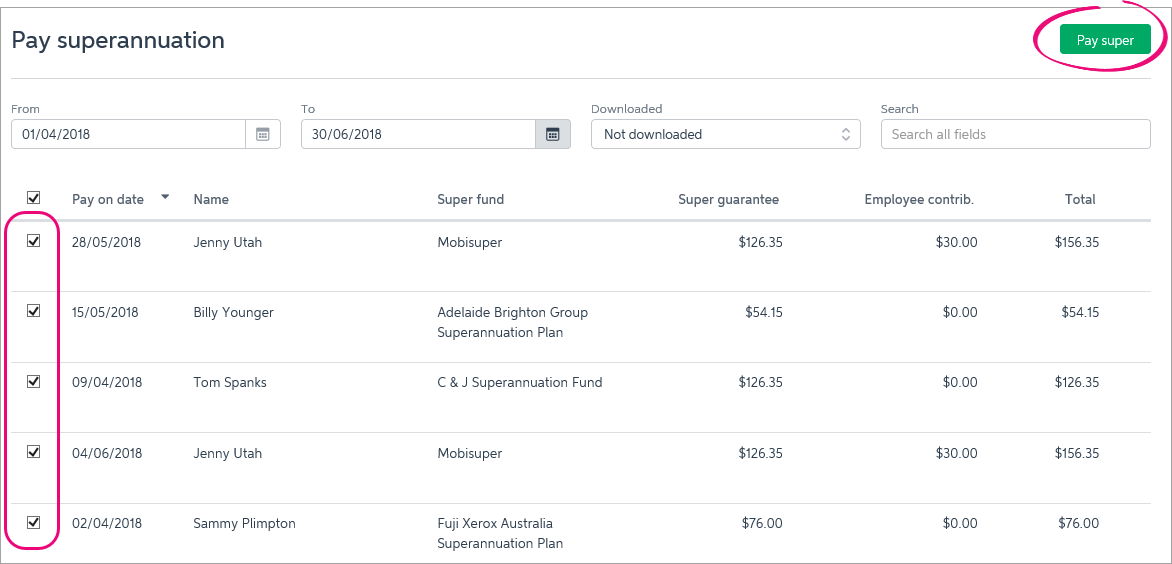

| 1. Download a super contribution file- From the Payroll menu, choose Pay superannuation. The Pay superannuation page appears.

- In the From and To fields, choose the dates you want to pay super contributions for.

- Click to select each super contribution you want to pay.

- Click Pay super.

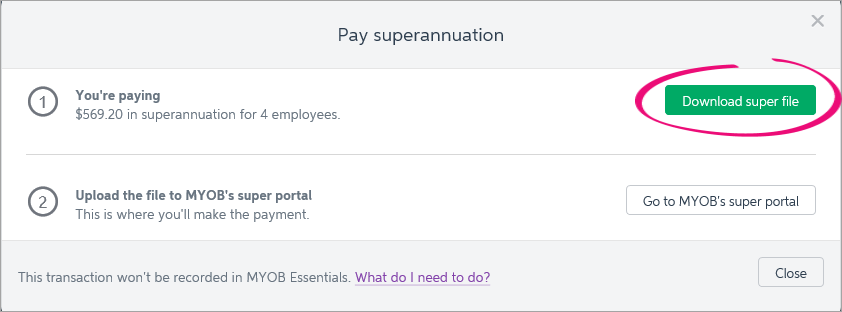

In the popup window, click Download super file.

Choose where to save the downloaded super file. Remember where you save it as you'll need to find it when you upload it to MYOB's super portal.

| UI Text Box |

|---|

| Don't open the downloaded file as this will interfere with the file format. |

|

| UI Expand |

|---|

| expanded | true |

|---|

| title | 2. Pay super through MYOB's super portal |

|---|

| 2. Pay super through MYOB's super portalOnce you've downloaded your super contribution file from MYOB Essentials (see above), you can upload it to MYOB's super portal. You'll see the option to go to the super portal after you've clicked Pay Super on the Pay Superannuation page.

| UI Text Box |

|---|

| Can't click Pay super?

If you've closed the Pay superannuation popup window (which has the button to go to MYOB's super portal), you can re-open it by displaying All downloaded files, selecting any contribution then clicking Pay super.

|

Once you're in the MYOB Super Portal, learn how to process your super contribution file. Note that any payments you make through MYOB's super portal won't be automatically recorded in MYOB Essentials. For details on how to do this, see Recording super payments made through MYOB's super portal. |

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | What if a super contribution has been returned because of incorrect details? |

|---|

| What if a super contribution has been returned because of incorrect details?If a super contribution was returned because of incorrect employee or super fund details, correct these details in MYOB Essentials. You might need to confirm some details with the employee or their superannuation fund. See Set up employees for paying super for help updating these details. After updating the incorrect details: - Enter a transaction in MYOB Essentials for the returned super payment.

If you have bank feeds on this bank account, allocate the deposit transaction (the returned super payment) to your Superannuation Payable liability account. If you don't have bank feeds on this bank account, create a Receive Money transaction for the returned super payment. Allocate it to your Superannuation Payable liability account.

- Download a new super contribution file containing for the payment to be re-submitted. See Download a super contribution file above for instructions.

- Pay the contribution through MYOB's super portal. See Pay super through MYOB's super portal above for instructions.

- Enter the transaction in MYOB Essentials for the resubmitted super payment.

If you have bank feeds on this bank account, allocate the withdrawal transaction to your Superannuation Payable liability account. If you don't have bank feeds on this bank account, create a Spend Money transaction for the resubmitted payment. See Recording super payments made through MYOB's super portal for details.

|

| UI Expand |

|---|

| title | What if I've forgotten my super portal password? |

|---|

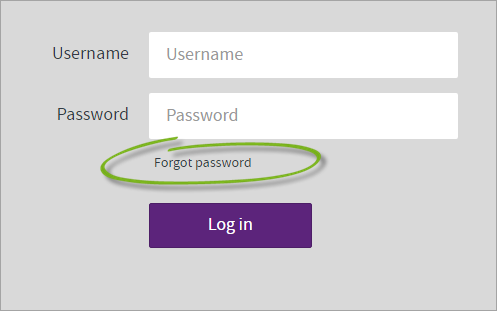

| What if I've forgotten my super portal password?If you forget your password, click Forgot password on the login screen. You will be emailed a temporary password, and will be prompted to change it the next time you log in to the super portal.

|

| UI Expand |

|---|

| title | Where can I find help for the super portal? |

|---|

| Where can I find help for the super portal?If you need help for the super portal, see MYOB's super portal help . |

| UI Expand |

|---|

| title | Why can't I click the Pay super button in MYOB Essentials? |

|---|

| If the Pay super button isn't clickable and has a red circle with a line through it when you hover over it, make sure you've set up all the required information and signed up to use MYOB's super portal.

Once you've completed all setup steps, select each employee and pay run you want to include in the payment on the Pay superannuation page (see Download a super contribution file above). The Pay super button will then be active. If there are no contributions listed on the Pay superannuation page but you need to access MYOB's super portal: - Select All in the Downloaded field.

- Select any contribution.

- Click Pay super.

- Click Go to MYOB's super portal.

|

| UI Expand |

|---|

| title | Can I log in to the super portal directly? |

|---|

| Can I log in to the super portal directly?When you access the super portal from MYOB Essentials, a check is done to verify you're entitled to access the super portal. This is a security precaution to protect your payroll information from unauthorised access. This means you can't access the super portal directly. |

| UI Expand |

|---|

| title | Can I change my bank details? |

|---|

| Can I change my bank details?| HTML |

|---|

<p>The bank account details can't be changed with the super portal. If you'd like to make changes to your bank account, please call MYOB on <a href="tel:1300-555-123">1300 555 123</a> | Monday to Friday <b>7am</b> to <b>7pm</b>, Saturday to Sunday <b>9am</b> to <b>5pm</b> (Melbourne time).</p>To change your bank account details after you've signed up, complete the change request form and return it to superportal@myob.com. We'll make the changes and let you know when it's done. |

| UI Expand |

|---|

| title | Can I pay my super contributions through a 3rd party clearing house? |

|---|

| Can I pay my super contributions through a 3rd party clearing house?| UI Text Box |

|---|

| We'd recommend paying super through MYOB's super portal as it seamlessly integrates with MYOB Essentials. Also, the contribution file generated by MYOB Essentials is formatted specifically to be uploaded to the MYOB super portal. It's unlikely to be supported by any other super clearing provider. |

If you're paying super through a 3rd party, make sure you're complying with the ATO's SuperStream requirements. You'll also need to update MYOB Essentials each time you make a super payment by completing the following: - Take note of the super contributions to be processed on the Pay superannuation page in MYOB Essentials (see above for details). You'll need these details, such as the employees' names and contribution amounts, to be able to make their super payments.

- Select the super payments to be paid on the Pay superannuation page and click Pay super (see above for details), then click Download super file. This clears those payments from the page and helps you keep track of payments yet to be paid, i.e. those payments remaining on the Pay superannuation page. It's up to you where you save the downloaded file and what you do with it. Check with your super clearing house about how to provide them your super payment info.

- Enter the transaction in MYOB Essentials for the super payments.

If you have bank feeds on the bank account your super payments are paid from, allocate the withdrawal transaction to your Superannuation Payable liability account. If you don't have bank feeds on this bank account, create a spend money transaction for the total payment. See Recording super payments made through MYOB's super portal for details.

|

|