In this section, you can manage Fund Employer Numbers (FEN) and SMSF details.

Manage FENs: If you’re notified that a payment didn’t go through due to a missing or incorrect FEN, you can enter the details here:

- Click Add/Remove Funds.

- Type the name of the fund in the Available Funds text field. When the fund you need appears, select it and then click the > button.

- Click Update.

- Click Add FEN to enter the number for the fund.

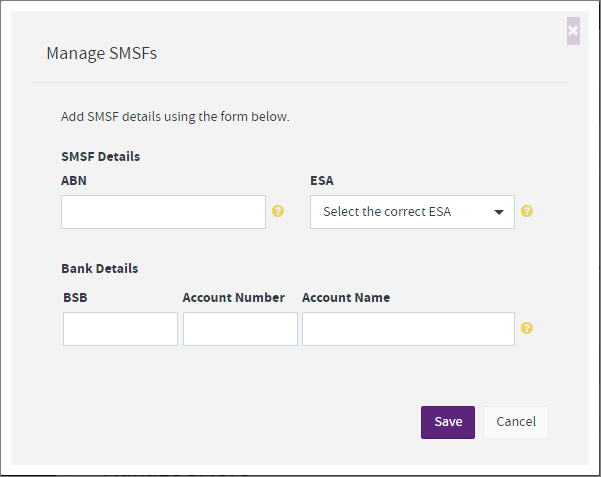

Manage SMSFs: You can add an SMSF fund here. Click Add SMSF and enter the fund’s ABN, ESA and bank account details.

| UI Text Box |

|---|

|

What's the ESA? The trustee of the SMSF will need to register with an SMSF messaging provider to obtain an Electronic Service Address (ESA). This is a quick process and only needs to be done once. The ATO has a list of messaging providers to register with. |

If you need to edit or delete an SMSF fund you've already set up, click the edit  or delete

or delete  icons.

icons.

Note: You can only submit contributions to the SMSF once it has been verified as compliant. If the fund is taking a while to be verified, try deleting the fund then adding it again.

| UI Text Box |

|---|

|

The first time you make a payment for a particular SMSF that isn't already set up in the super portal, you’ll be prompted to enter the fund’s details, such as the ABN and ESA. That fund will then appear in the Manage SMSFs list. |