If an employee wants super paid into multiple funds, they'll need multiple employee cards. This is because you can only assign one super fund to an employee's card. Here's how it works: The employee will have one primary card for their payroll information, and this card is linked to one super fund. For each additional super fund, a new employee card is needed to store the fund information. When the employee is paid, the fund linked to their primary card is paid as normal. The payments for the additional funds are temporarily held in a "clearing" account, then distributed to the other employee cards and their associated super funds. OK, let's step you through the setup. We'll use the example of an employee who wants their Superannuation Guarantee payments to go to one fund, and a salary sacrificed amount to go to another. Your scenario might be different, but the same approach can be used. | ui-expand |

|---|

| title | 1. Set up the employee's cards |

|---|

| Set up the employee's cardsIf you've already set up a card for the employee, consider this their primary card. For our example, we need an additional employee card which we'll refer to as the secondary card. Before setting up employee cards, make sure you've set up your employee's super funds. When setting up the employee's cards, here's what you need to record in each: | In the... | record this info... |

|---|

| Primary card | | | Secondary card | - Enter the employee's name. To differentiate from the name in their primary card, add a middle name or initial.

- Assign one super fund.

- Enter the employee's membership number for that fund.

| ui-| text-box |

|---|

| If you're using Pay Super, check super fund and employee details to make sure all mandatory information is recorded. |

| UI Expand |

|---|

| title | 2. Create a holding account |

|---|

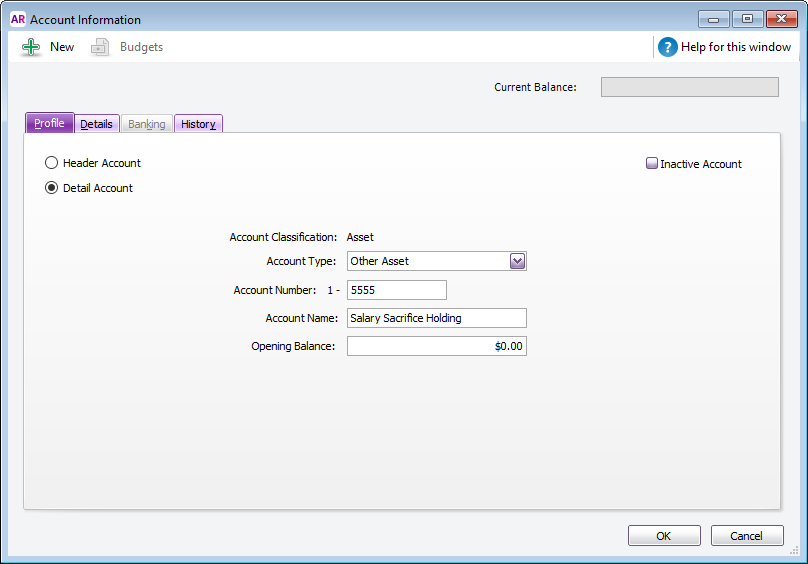

| Create a holding accountCreate an asset account which will be used to temporarily hold the super funds deducted from the employee's pay. This type of account is often referred to as a "clearing" account. When creating this account, set the Account Type to Other Asset as shown in our example:  Image Removed Image Removed

|

| UI Expand |

|---|

| title | 3. Set up the payroll categories |

|---|

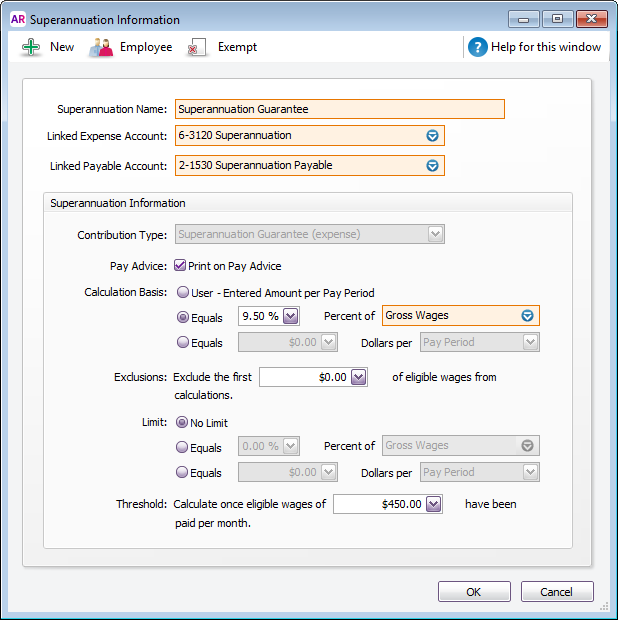

| Set up the payroll categoriesAmong other things, payroll categories are used to work out how much super to pay, and where to pay it. For our example where 2 super funds are being paid, we need to set up 4 payroll categories. - Set up a superannuation category to cater for the employee's mandatory (employer-paid) super payments. This super category might already exist in your company file - just make sure it's assigned to the employee.

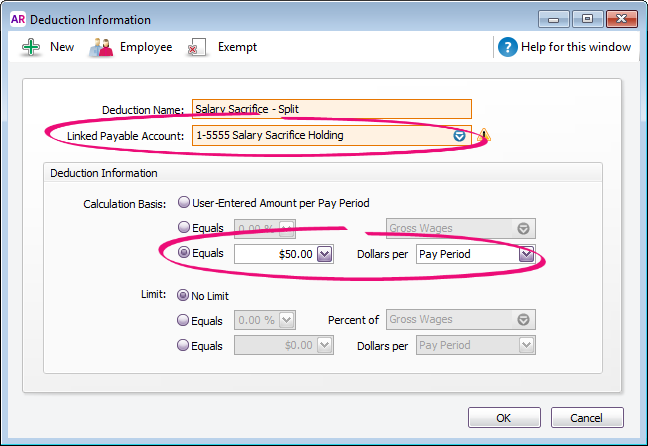

Image Removed Image Removed - Set up a deduction category to deduct payments for the employee's second super fund.

For this category: - Select the salary sacrifice "holding" asset account (created earlier) as the Linked Payable Account. Ignore the warning about the type of account you've selected.

- Enter the dollars per pay period to be deducted.

- Click Employee to assign this category to the employee's primary card.

- Click Exempt and select PAYG Withholding so the deduction will not be subject to PAYG and the PAYG will be the appropriate amount.

Image Removed Image Removed

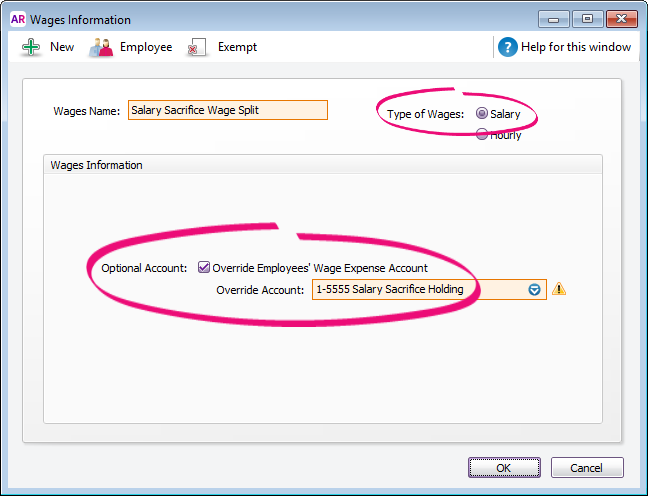

- Set up a wages category to pay the salary sacrifice super payments to the secondary card.

For this category: - Select Salary for the Type of Wages.

- Select the Optional Account option and select the salary sacrifice "holding" asset account created earlier. Ignore the warning about the type of account you've selected.

- Click Employee to assign this category to the employee's secondary card.

Image Removed Image Removed

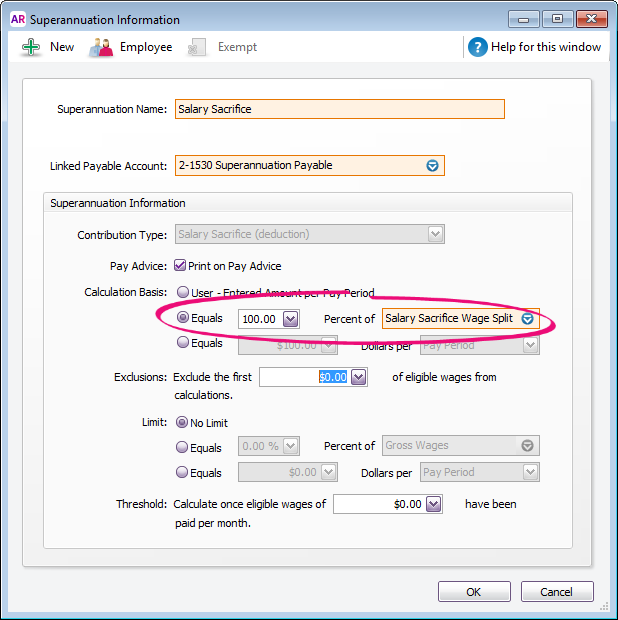

- Set up a superannuation category to pay the salary sacrifice super payments to the applicable fund.

For this category: - Select your superannuation payable account for the Linked Payable Account.

- Select Salary Sacrifice (deduction) for the Contribution Type.

- Select Equals 100% and select the wages payroll category (created at step 3).

- Click Employee to assign this category to the employee's secondary card.

Image Removed Image Removed

| UI Text Box |

|---|

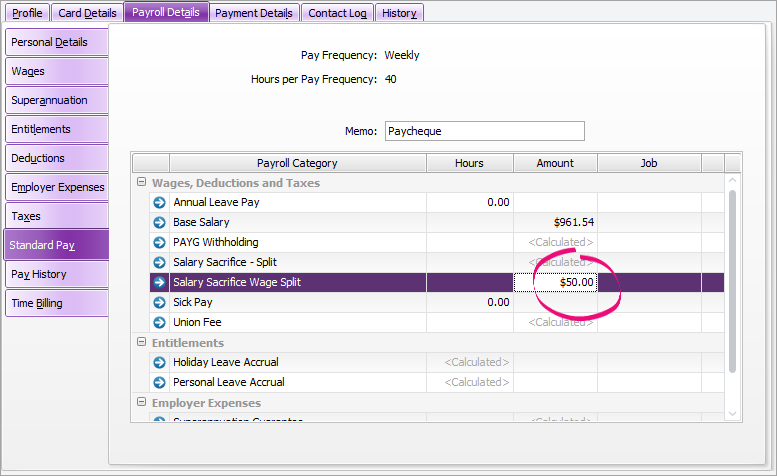

| Salary sacrificing the same amount each pay? Enter this amount against the salary sacrifice wages category in the standard pay details of the employee's secondary card.  Image Removed Image Removed

|

|

| UI Expand |

|---|

| title | 4. Process the employee's pay |

|---|

| Process the employee's payWhat's going to happen?When you process the employee's pay: - the Superannuation Guarantee payment will be allocated to the applicable fund, awaiting payment

- the salary sacrifice will be deducted and temporarily held in the clearing account, and

- the salary sacrifice payment will be transferred from the clearing account and allocated to the second super fund, awaiting payment.

Here's how to do itWhen you process your payroll, do this: - Choose the option Process all employees paid to ensure each of the employee's cards is used in the pay run.

- Click the zoom arrow next to the employee's primary card to view its details.

- If required, change the salary sacrifice deduction amount (if the amount varies each pay).

Image Removed Image Removed - Click the zoom arrow next to the employee's secondary card to view its details.

- Enter or change the salary sacrifice amount against the Salary Sacrifice wage split category.

Image Removed Image Removed - Click OK to the warning about a $0.00 Net Pay.

- Finalise the pay run as normal.

|

| HTML |

|---|

<h2><i class="fa fa-comments"></i> Multiple super fund FAQs</h2><br> |

| UI Expand |

|---|

| title | How can I see how much superannuation has accrued for each fund? |

|---|

| How can I see how much superannuation has accrued for each fund?To see how much super has accrued for each fund, run the Accrual by Fund Summary report (Reports > Index to Reports > Payroll > Superannuation). You can filter the report for the applicable funds and specify the required date range. |

| UI Expand |

|---|

| title | How do I report the employee's super on their payment summary? |

|---|

| How do I report the employee's super on their payment summary?At the Payment Summary Fields step of the Payment Summary Assistant, select the Salary Sacrifice - Split deduction category but NOT the Salary Sacrifice wage category. This will ensure only the employee's primary card will be included in the payment summary and EMPDUPE file. |

This content is obsolete, so we’ve retired the page. You can remove any bookmarks to this page. If there’s something else you need, try searching our help centre. To meet the ATO's super requirements, you'll only be able to pay super from AccountRight into a single super fund for an employee. If an employee requires their super to be paid into an additional super fund, you'll need to work with your accounting advisor to consider using the ATO's Small Business Superannuation Clearing House for payments to the additional fund. |

|