You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 88 Next »

https://help.myob.com/wiki/x/_Qqc

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Make sure you've completed the tasks outlined in the Things to do before your first upload page

A contribution file contains information required to make super contributions for your employees. You create a contribution file in the Pay Superannuation window of your MYOB software. For help creating the contribution file, see your MYOB software's help:

Once you have a contribution file, you can process it using MYOB's super portal.

To process a contribution file

- Log in to the MYOB super portal and go to the Dashboard (the home page). You can access the dashboard by clicking the navigation button at the top-right of the portal's page, and selecting Home (or Dashboard).

In the Contributions panel, click Contribute today and then select Upload a new file.

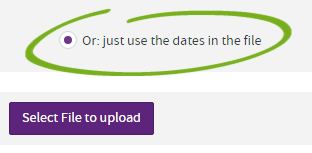

Ensure the Or: just use the dates in the file option is selected, and then click Select File to upload.

Find and select the contribution file you want to upload. The default name of the file that's saved from your MYOB software is SuperContribution.csv.

Ensure you select the correct file. You won't get a warning if you try uploading a file that has already been uploaded.

Click Next. The contribution file is uploaded and some checks are done on the data contained in the file.

If there are any employer, member or validation exceptions (issues), you'll need to fix them, as described below.

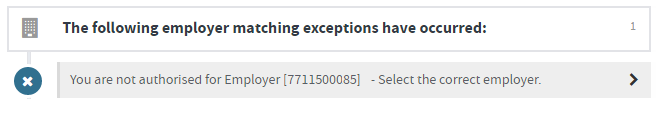

Employer matching exceptionsIf at the Employer Matching Exceptions step, you're prompted to select the correct employer, it means your business' ABN is not in the file you've uploaded, or is different to the one that's already set up in the super portal.

Click the > arrow to display the list of employers who are linked to your super portal account (in most cases there will be only one employer to choose from).

IMPORTANT: Ensure that the file you've selected actually is for the employer you select here. If you upload a file for the wrong employer, the employees will still be added in the super portal, but later you won't be able to delete those employees for that employer.

To avoid this issue again, enter your ABN in your MYOB software. In AccountRight you can add the ABN in the Setup menu > Company Information window.

Make sure that the employer you select is correct and then click Apply to All.

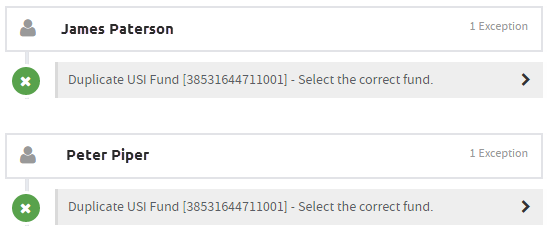

Member matching exceptionsAt the Member Matching Exceptions step, you might need to provide additional fund details for your employees.

If you haven't specified an employee's super fund, or the fund details were incomplete or incorrect in your MYOB software, you'll need to specify the fund to make the payment to.

Self-managed super funds (SMSFs) can't be paid using MYOB's super portal. Although a few SMSFs may appear in the portal's list of funds, you should not try to make payments to these funds using MYOB's super portal.

Click the > arrow to make the required change, or to enter the missing information, and then click Save once you've selected the correct fund for the employee.

The employee is removed from the list of exceptions when the issue is fixed.

When all employee details have been entered, you'll be taken to the next step automatically.

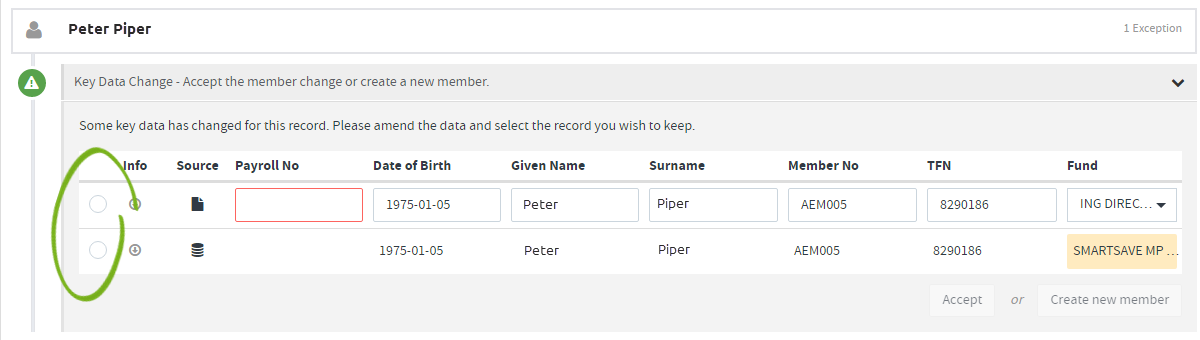

If the employee already existed, and their details have changed, you'll need to choose whether to add a new employee with the new details, or update the existing record with the new data.

Click the appropriate radio button (circled below) for the record you want to use. Depending on the record you choose, you'll need to click the Accept or Create new member button.

Validation issues

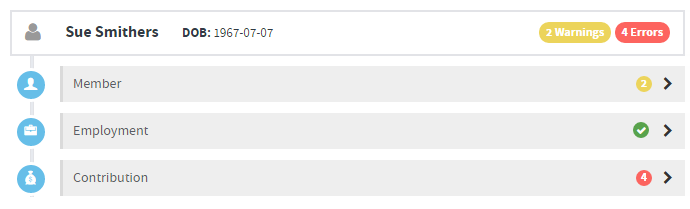

Validation issuesAt the Validation Issues step, if other required information is missing or incorrect for an employee, you'll see a red or yellow indicator for the section that needs your attention.

Click the > arrow for the section that has the issue and fill in any information that's missing or that's formatted incorrectly.

To avoid these issues again, update the contact records in your MYOB software with any of the changes you make in the super portal for the employee.

If you want to change other employee details, you can do this when you reach the Review step below. Click the member icon

to access and change the employee's details.

to access and change the employee's details.Click Next when you've finished entering the employee details.

Review contributions and other issuesAt the Review step you can see all contributions that you're about to process.

If there's still a problem with the contribution information, you'll see an alert icon in the Action column and the fields that need your attention have a red border. Click in these fields to see a description of what the issue is.

in the Action column and the fields that need your attention have a red border. Click in these fields to see a description of what the issue is.

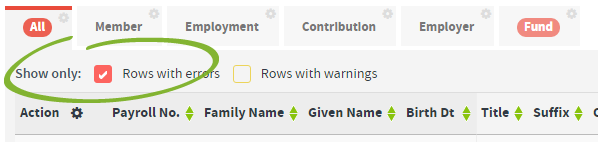

If a field is highlighted in yellow, it means there might be an issue, but you can still submit the details. However, you should review this information too.If you have lots of contributions, use the Show only filters to show only rows that have errors or warnings.

If you want to review or edit an employee's contact or fund information, click the member icon

in the Action column to view or make changes.

in the Action column to view or make changes.If you've accidentally deleted an employee contribution in the super portal, you can manually add the contribution details by clicking Add Member. You'll need to manually complete their contribution details in the Review window's grid. You shouldn't use this feature to add additional contributions that were not saved in a contribution file from your MYOB software.

Do the "Pay Period Start Dt" and "Pay Period End Dt" columns show different dates for some employees?

If these dates differ, the payroll period that will be reported to the funds might be incorrect for some employees. When creating a super contribution file, you should only include contributions for employees who were paid for the exact same payroll period.

For example, assume you’re making super payments for July. All your employees were paid fortnightly (14/7, 28/7), except for two who were paid monthly (15/7). You should save a separate contribution file for the two monthly employees. This will ensure that the correct payroll period is reported to all employee funds. The payroll period for the fortnightly employees would be reported as 1 July – 28 July, while for the monthly employees it would be 16 June – 15 July.

Once all contribution details are correct, click Next.

In the Summary and Submit step you can see the contributions that will be made to each fund. Ensure that you're sending the contributions to the correct fund (some funds have very similar names).

Note that the Payment Reference is what you'll see on your bank statement to identify the payment that's being made. You can change it if you want.- If the Confirm and Send button is available and you want to make the payment now, click it and you're done. If the file is submitted before 3:30pm AEST, the payment will be processed on the same business day, otherwise it will happen on the next business day.

If you're not ready to make the payment, or aren't authorised to submit the payment, click Save and Hold. Note that changes can't be made once you click this button.

FAQs

No, spouse contributions aren't supported. If the super contribution file you upload has a spouse contribution, you'll need to reallocate the amount at the Review step.

To change your bank account details after you've signed up, complete the change request form and return it to superportal@myob.com. We'll make the changes and let you know when it's done.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.