- Created by StevenR, last modified by AdrianC on Mar 02, 2018

https://help.myob.com/wiki/x/jQuc

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

If a fund rejects a super contribution, perhaps due to incorrect information being supplied, they’ll return the funds to you. You might also receive an email from MYOB to let you know what went wrong, or you can contact the super fund for more details.

Once you’ve fixed the issue which caused the contribution to be returned, process the super payment again by following the steps for your MYOB software.

Let's step you through it:

A. Reverse the original superannuation transaction

- Find the superannuation payment transaction in AccountRight or AccountEdge that contains the contribution that was rejected.

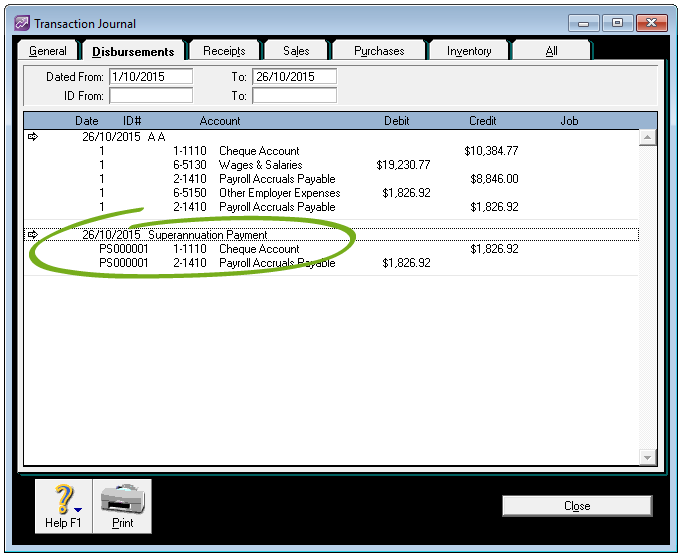

You can find it in the Disbursements tab of the Transaction Journal. The transaction usually has PS at the beginning of the ID.

- Open the transaction and then click Print to print a report showing what’s included in the transaction. You’ll need this information later.

Go to the Edit menu and choose Reverse Superannuation Payment Transaction.

If you only see the option to delete it, go to the Setup menu, choose Preferences, click the Security tab, and select the Transactions CAN’T be Changed… option.

- A message appears warning not to reverse the payment if it’s already been processed. In this case you do need to reverse it, so click OK.

- Enter the reversal date as the date the money was returned to your bank account, and then click Record Reversal.

B. Create a super contribution file for the amounts that were rejected

- Go to the Payroll command centre and click Pay Superannuation.

- Enter today’s date and select the contributions that were rejected.

- Click Save and choose where you want to save the contribution file.

- Upload the contribution file to MYOB’s super portal.

If the entire payment was rejected, (that is, no contributions were accepted by the funds), there’s nothing else you need to do. However, if some contributions had been processed successfully, follow the steps below.

C. Remove successful contributions from the Pay Superannuation window

After completing procedures A and B above, you'll need to clear any contributions that had been processed successfully from the Pay Superannuation window.

- Go to the Payroll command centre and click Pay Superannuation.

- Using the information you printed earlier, complete the window details:

- Enter the date range.

- Enter the original transaction date.

- Select all the contributions that were processed successfully.

Click Save and choose where you want to save the contribution file.

Important: Do not upload this contribution file to MYOB’s super portal. You should delete it, as this information was previously submitted to the portal, and it’s only created in order to clear the contributions from the Pay Superannuation window.

FAQs

Reconciling your bank account might seem tricky after completing the above tasks, because the resulting transactions on your bank statement won't appear to match the transactions in your MYOB software. However, the total credits and debits will balance.

Simply match all the Pay Superannuation transactions on your bank statement to the super contributions in your MYOB software, then mark them as reconciled. The reconciled transactions will equal the total of the original Pay Superannuation transaction.

The super payments you make through MYOB's super portal are manually recorded in MYOB Essentials using Spend Money transactions or via bank feeds (see Recording super payments made through MYOB's super portal).

If you haven't yet recorded the Spend Money transaction for the super payment that's been returned, you can simply recreate the super contribution file and upload it into MYOB's super portal.

If you have recorded the Spend Money transaction for the super payment that's been returned, you'll need to record a Receive Money transaction to reflect the super funds that have been returned. You can then recreate the super contribution file and upload it into MYOB's super portal.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.